FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

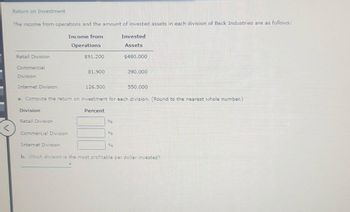

Transcribed Image Text:Return on Investment

The income from operations and the amount of invested assets in each division of Beck Industries are as follows:

Income from

Operations

Retail Division

Commercial

Division

Internet Division

Division

Retail Division

Commercial Division

$91,200

126,500

a. Compute the return on investment for each division. (Round to the nearest whole number.)

Percent

Internet Division

81,900

%

Invested

Assets

%

$480,000

390,000

550,000

b. Which division is the most profitable per dollar invested?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Return on Investment The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Income from Operations Invested Assets Retail Division $52,500 $250,000 Commercial Division 93,600 390,000 Internet Division 91,800 540,000 a. Compute the return on investment for each division. (Round to the nearest whole number.) Division Percent Retail Division fill in the blank 1% Commercial Division fill in the blank 2% Internet Division fill in the blank 3% b. Which division is the most profitable per dollar invested?arrow_forwardResidual Income The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Income from Operations Invested Assets Retail Division $74,100 $390,000 Commercial Division 159,600 760,000 Internet Division 84,000 560,000 Assume that management has established a 12% minimum acceptable return for invested assets. a. Determine the residual income for each division. Retail Division Commercial Division Internet Division Income from operations $74,100 $159,600 $84,000 Minimum acceptable income from operations as a percent of invested assets fill in the blank 1 fill in the blank 2 fill in the blank 3 Residual income $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 b. Which division has the most residual income?arrow_forward4. The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Division Income from Operations Invested Assets Retail Division $5,500,000 $30,000,000 Commercial Division 6,750,000 23,000,000 Internet Division 1,500,000 12,000,000 a. Compute the return on investment for each division. b. Which division is the most profitable per dollar invested?arrow_forward

- Profit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $1,476,000 Cost of goods sold 664,200 Gross profit $811,800 Administrative expenses 295,200 Income from operations $516,600 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $2,460,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Rate of return on investment fill in the blank 3 % b. If expenses could be reduced by $73,800 without decreasing sales, what would be the impact on the…arrow_forwardHelparrow_forwardProfit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $1,980,000 Cost of goods sold (891,000) Gross profit $1,089,000 Administrative expenses (594,000) Operating income $495,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $3,300,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Return on investment fill in the blank 3 % b. If expenses could be reduced by $99,000 without decreasing sales, what would be the impact on…arrow_forward

- Return on investment The operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating Income Invested Assets Retail Division $72,600 $330,000 Commercial Division 117,600 490,000 Internet Division 224,100 830,000 a. Compute the return on investment for each division. (Round to the nearest whole percentage.) Division Percent Retail Division % Commercial Division % Internet Division b. Which division is the most profitable per dollar invested?arrow_forwardReturn on investment The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Income from Operations Invested Assets Retail Division $156,200 $710,000 Commercial Division 56,000 280,000 Internet Division 194,400 720,000 a. Compute the return on investment for each division. (Round to the nearest whole number.) Division Percent Retail Division fill in the blank 1 % Commercial Division fill in the blank 2 % Internet Division fill in the blank 3 % b. Which division is the most profitable per dollar invested?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education