FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

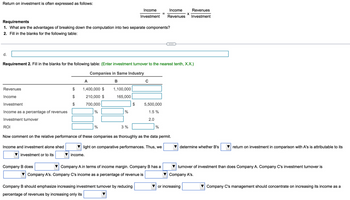

Transcribed Image Text:Return on investment is often expressed as follows:

d.

Requirements

1. What are the advantages of breaking down the computation into two separate components?

2. Fill in the blanks for the following table:

Revenues

Income

Investment

Income as a percentage of revenues

Investment turnover

ROI

Requirement 2. Fill in the blanks for the following table: (Enter investment turnover to the nearest tenth, X.X.)

Companies in Same Industry

B

Income and investment alone shed

investment or to its

A

1,400,000 $

210,000 $

700,000

%

Company B does

%

income.

1,100,000

165,000

%

Income

Income

Revenues

Investment Revenues Investment

3%

C

Now comment on the relative performance of these companies as thoroughly as the data permit.

light on comparative performances. Thus, we

Company B should emphasize increasing investment turnover by reducing

percentage of revenues by increasing only its

5,500,000

1.5%

2.0

=

%

Company A in terms of income margin. Company B has a

Company A's. Company C's income as a percentage of revenue is

X

determine whether B's

or increasing

return on investment in comparison with A's is attributable to its

turnover of investment than does Company A. Company C's investment turnover is

Company A's.

Company C's management should concentrate on increasing its income as a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- DONT GIVE ANSWER IN IMAGE FORMATarrow_forwardSPREADSHEET PROBLEMS 1. If a firm's net income (profits before taxes) is $120,000 and it has total assets of $1.5 million, what is its return on assets? 2. If a firm's total assets is $2.5 million and its return on assets is 12 percent, what is its net income? 3. If a firm is able to sustain the same level of operations in terms of sales and administrative expenses but reduces its materials cost by $50,000 through smarter purchases, what is the profit-leverage effect on gross profits? What is the profit- leverage effect on profits before taxes? 4. If a firm's cost of goods sold is $2.5 million and its average inventory is $500,000, what is the inventory turnover? 5. If a firm's cost of goods sold is $5 million and its inventory turnover is ten times, what is the average inventory? 6. If a firm's inventory turnover is eight times and its average inventory is $160,000, what is the cost of goods sold? 7. A retailer in Las Vegas has an ending inventory of $250,000 as of December 31, 2016,…arrow_forwardFinancial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity Joel de Paris, Incorporated Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 121,000 207,000 $4,416,000 3,665,280 750,720 328,000 $ 422,720 Beginning Balance $ 136,000 339,000 568,000 857,000 395,000 251,000 $ 2,546,000 Ending Balance $ 131,000 479,000 488,000 842,000 435,000 253,000 $ 2,628,000 $ 349,000 $ 374,000 983,000 1,189,000 983,000 1,296,000 $ 2,546,000 $ 2,628,000 The company paid dividends of $315,720 last year. The “Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The…arrow_forward

- Please help with 1-3 thank you!!!arrow_forwarda Rance 0ortotal tSpendingjJariance The Walnut Division of Benton core hurdle rate isug9o. Calculate the return on investment Calculate the profit, nmargin ÇalculateThe invest ment turnover (alculate the residual incomearrow_forwardThe Marine Division of Pacific Corporation has average invested assets of $110,000,000. Sales revenue of $50,280,000 results in net operating income of $9,972,000. The hurdle rate is 7%. Required a. Calculate the return on investment. b. Calculate the profit margin. c. Calculate the investment turnover. d. Calculate the residual income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the return on investment. Note: Round percentage to 2 decimals. Return on Investment Required D %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education