FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

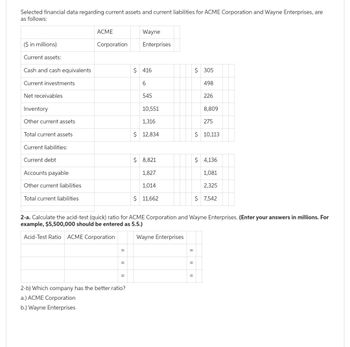

Transcribed Image Text:Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are

as follows:

($ in millions)

Current assets:

Cash and cash equivalents

Current investments

Net receivables

Inventory

Other current assets

Total current assets

Current liabilities:

Current debt

Accounts payable

Other current liabilities

Total current liabilities

ACME

Corporation

Wayne

Enterprises

2-b) Which company has the better ratio?

a.) ACME Corporation

b.) Wayne Enterprises

$ 416

6

545

10,551

1,316

$ 12,834

$8,821

1,827

1,014

$ 11,662

$ 305

=

498

226

8,809

275

$ 10,113

2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. For

example, $5,500,000 should be entered as 5.5.)

Acid-Test Ratio ACME Corporation

Wayne Enterprises

$ 4,136

1,081

2,325

$ 7,542

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- se the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $26,495 Accounts receivable 64,133 Accrued liabilities 6,993 Cash 21,465 Intangible assets 40,744 Inventory 89,481 Long-term investments 112,445 Long-term liabilities 70,738 Notes payable (short-term) 25,963 Property, plant, and equipment 664,167 Prepaid expenses 1,026 Temporary investments 30,035 Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)?arrow_forwardGiven the data in the following table, accounts receivable in 2023 was…arrow_forwardExamine the balance sheet of commercial banks in the following table. $ Billion % Total 201.2 28.9 230.1 Assets Real assets Equipment and premises Other real estate Total real assets Financial assets Cash Investment securities Loans and leases Other financial assets Total financial assets Other assets Intangible assets Other Total other assets Total $ Ratio of real assets to total assets $ $ 876.3 2,032.1 6,627.3 1,201.2 $10,736.9 $ 416.4 780.7 $ 1,197.1 $12,164.1 1.7% 0.2 1.9% 7.2% 16.7 54.5 9.9 88.3% 3.4% 6.4 9.8% 100.0% Liabilities Deposits Liabilities and Net Worth Debt and other borrowed funds Federal funds and repurchase agreements Other Total liabilities Net worth Balance sheet of FDIC-insured commercial banks and savings institutions Note: Column sums may differ from total because of rounding error. Source: Federal Deposit Insurance Corporation, www.fdic.gov, October 2018. a. What is the ratio of real assets to total assets? (Round your answer to 4 decimal places.) $ Billion %…arrow_forward

- Some recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forwardA6arrow_forwardPlease do not give solution in image format and show all calculation thankuarrow_forward

- Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, eg 13.5% or 13.5.) 2023 Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover Days to sell inventory Debt to equity Return on assets 2022 Return on equity % 2022 % % 2022 :1 :1 times days times days 56 2023 % % % 2023 times days times days 2024 Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, eg 15.1%) % 2024 % % % 2024arrow_forwardCompute and Interpret Liquidity, Solvency and Coverage Ratios Selected balance sheet and income statement information for Calpine Corporation for 2004 and 2006 follows. ($ millions) Cash 2004 2006 $1,376.73 $1,503.36 Accounts receivable Current assets Current liabilities Long-term debt Short-term debt Total liabilities Interest expense Capital expenditures Equity Cash from operations 1,097.16 735.30 3,563.56 3,168.33 3,285.39 6,057.95 16,940.81 3,351.63 1,033.96 4,568.83 22,628.42 25,743.17 1,516.90 1,288.29 1,545.48 211.50 4,587.67 (7,152.90) 9.89 Earnings before interest and taxes 1,589.84 155.98 1,877.84 (a) Compute the following liquidity, solvency and coverage ratios for both years. (Round your answers to two decimal places.) 2006 current ratio = 2004 current ratio= 2006 quick ratio= 2004 quick ratio= 2006 liabilities-to-equity= 2004 liabilities-to-equity= 2006 total debt-to-equity= 2004 total debt-to-equity= 2006 times interest earned = 2004 times interest earned = 2006 cash from…arrow_forwardWhat's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forward

- Some recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipment $336,695 Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Net income SMOLIRA GOLF CORPORATION 2021 Income Statement Earnings before interest and taxes Interest paid Dividends Retained earnings a. Current ratio b. Quick ratio c. Cash ratio Short-term solvency ratios: Asset utilization ratios: d. Total asset turnover e. Inventory tumover 1. Receivables turnover 2020 $23,066 $25,300 13,648 16,400 27,152 28,300 $63,866 $70,000 g. Total debt ratio h. Debt-equity ratio I. Equity multiplier Long-term solvency ratios: Times Interest emned K Cash coverage ratio Profitability ratios: SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 $ 400,561 $ 434,000 1. Profit margin m. Return on assels n. Return on equity $ 364,000 $ 22,000 19,891 Find the following financial ratios for Smolira Golf…arrow_forwardb. What is the ratio of real assets to total assets for nonfinancial firms in the following table? (Round your answer to 4 decimal places.) $ Billion Liabilities and Net Worth Liabilities Bonds and mortgages Bank loans $ 5,364 758 1,338 Other loans Trade debt 1,738 Other 4,608 $13,806 Assets Real assets Equipment and software Real estate Inventories Total real assets Financial assets Deposits and cash Marketable securities Trade and consumer credit Other Total financial assets Total $ Billion % Total $ 4,402 16.4% 36.3 9,749 1,734 6.5 $15,885 59.1% Ratio for nonfinancial firms $ 677 2.5% 1,056 3.9 2,282 8.5 6,968 25.9 $10,983 40.9% $26,868 100.0% Total liabilities Net worth $13,062 $26,868 % Total 20.0% 2.8 5.0 6.5 17.2 51.4% 48.6% 100.0% Balance sheet of U.S. nonfinancial corporations Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States, Board of Governors of the Federal Reserve System, September 2018.arrow_forwardThunder Corporation's balance sheet and income statement appear below: Assets: Cash and cash equivalents Accounts receivable Inventory Property, plant, and equipment Less accumulated depreciation Total assets Liabilities and stockholders' equity: Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Income taxes Net income Operating activities: Comparative Balance Sheet Income Statement @ 550 D RSA $ 891 Required: Prepare a statement of cash flows in good form using the indirect method. Note: List any deduction in cash and cash outflows as negative amounts. Thunder Corporation Statement of Cash Flows For This Year Ended December 31 334 $ 116 Santa Ending Balance 72 53 466 206 $ 425 53 $ 425 SER SIS The company did not dispose of any property, plant, and equipment, issue any bonds payable, or repurchase a stock during the year. The company…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education