FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

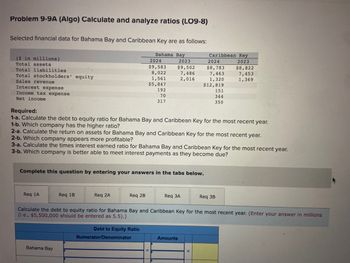

Transcribed Image Text:Problem 9-9A (Algo) Calculate and analyze ratios (LO9-8)

Selected financial data for Bahama Bay and Caribbean Key are as follows:

($ in millions)

Total assets

Total liabilities

Total stockholders' equity

Sales revenue

Interest expense

Income tax expense

Net income

Req 1A

Req 1B

Bahama Bay

Req 2A

Complete this question by entering your answers in the tabs below.

Req 2B

Bahama Bay

Required:

1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year.

1-b. Which company has the higher ratio?

2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year.

2024

$9,583

8,022

1,561

$5,847

2-b. Which company appears more profitable?

3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year.

3-b. Which company is better able to meet interest payments as they become due?

Debt to Equity Ratio

192

70

317

Numerator/Denominator

2023

$9,502

7,486

2,016

=

Caribbean Key

2023

2024

$8,783

7,463

1,320

$12,819

Req 3A

151

344

350

Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. (Enter your answer in millions

(i.e., $5,500,000 should be entered as 5.5).)

Amounts

$8,822

7,453

1,369

Req 3B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Examine the following selected financial information for Best Value Corporation and Modern Stores, Inc., as of the end of their fiscal years ending in 2018: Data table (In millions) Best Value Corporation Modern Stores, Inc. 1. Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . $15,256 $203,110 2. Total common stockholders' equity. . . . . $3,075 $71,460 3. Operating income. . . . . . . . . . . . . . . . . . . . $1,350 $26,820 4. Interest expense. . . . . . . . . . . . . . . . . . . . . . $88 $2,020 5. Leverage ratio. . . . . . . . . . . . . . . . . . . . . . . . 6. Total debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. Debt ratio. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. Times interest earned. . . . . . . . . . . . . . . . . Requirements…arrow_forwardCity A has the following financial data. What is the Net Asset Ratio? Cash: $ 4,650; Cash Equivalents: $12,350; Market Securities: $3,462; Receivables: $ 12,409; Current Liabilities: $45,690; Net Assets: $139,450; Total Assets: $2,458,360; Total Revenues: $1,367,809; Total Expenditures: $1,450,098; Population: 1,670.arrow_forwardPlease help mearrow_forward

- Given the following Balance Sheet and Income Statement information Balance Sheet $1,338,185 Total Liabilities: $549,219 Total Assets: Income Statement Earnings Before Income Tax: $211,636 Income Tax Expense: What is the Return on Equity? $42.717arrow_forwardGIVE THE COMPARATIVE BALANCE SHEET HORIZONTAL AND VERTICAL ANALYSIS FROM THE GIVEN BALANCE SHEET BELOW JOLLIBEE BALANCE SHEET ASSETS ITEM 2016 2017 2018 2019 2020 Cash & Short Term Investments 17.46B 22.52B 24.17B 23.02B 57.46B Cash & Short Term Investments Growth - 28.99% 7.32% -4.75% 149.59% Cash Only 16.73B 21.11B 23.29B 20.89B 21.36B Short-Term Investments 726M 1.41B 883.2M 2.13B 36.1B Cash & ST Investments / Total Assets 23.96% 25.08% 16.06% 12.28% 27.26% Total Accounts Receivable 3.59B 4.02B 4.86B 5.91B 7.05B Total Accounts Receivable Growth - 11.86% 21.04% 21.46% 19.36% Accounts Receivables, Net 3.03B 3.39B 4.41B 5.37B 5.8B Accounts Receivables, Gross 3.61B 4.08B 5.09B 5.76B 6.46B Bad Debt/Doubtful Accounts (579.79M) (690.12M) (676.91M) (392.36M) (658.63M) Other Receivable 562.75M 630.06M 451.73M…arrow_forwardCalculate the 2020 current ratio using the following information: Balance Sheet Cash and Cash Equivalents Marketable Securities Accounts Receivable Total Current Assets Total Assets Current Liabilities Long Term Debt Shareholders Equity Income Statement Interest Expense Net Income Before Income Taxes 1.17 0.60 1.40 0.80 2020 5,000 15,000 10,000 40,000 70,000 50,000 10,000 10,000 7,500 45,000arrow_forward

- (a) Calculate the asset tumover ratio, Asset tumover ratio________ 1) eTextbook 2) and Media List of Accountsarrow_forwardPlease input numbers in boxes below based on data provided for year 2018. Current assets - current liabilities = net working capitalarrow_forwardFILLING IN THE RATIOS .. THE LEFT SIDE IS 2019 THE RIGHT SIDE IS 2020 IN THE IMAGE. Jergan CorporationBalance SheetsDecember 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan CorporationIncome StatementFor the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales 698,900…arrow_forward

- The following summary financial statement information is provided for Denbury Industries: Cash and cash equivalents Short-term investments Accounts receivable Inventory Property, plant, and equipment Long-term investments Total assets Net income Interest expense Investment income Multiple Choice O 2024 2023 $ 239,850 $ 368,740 Calculate the return on investments ratio for 2024. 2.5% 25,640 18,740 658,930 690,760 345,920 415,380 859,710 735,480 83,670 65,300 2,213,720 2,294,400 $ 279,630 $ 199,850 39,540 25,670 5,750 3,170arrow_forwardMake comments on this tablearrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education