FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General Accounting

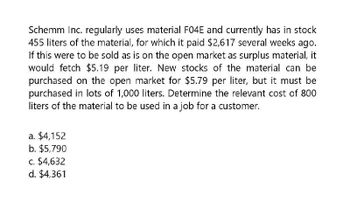

Transcribed Image Text:Schemm Inc. regularly uses material F04E and currently has in stock

455 liters of the material, for which it paid $2,617 several weeks ago.

If this were to be sold as is on the open market as surplus material, it

would fetch $5.19 per liter. New stocks of the material can be

purchased on the open market for $5.79 per liter, but it must be

purchased in lots of 1,000 liters. Determine the relevant cost of 800

liters of the material to be used in a job for a customer.

a. $4,152

b. $5,790

c. $4,632

d. $4,361

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If Lew's Steel Forms purchases $632,000 of new equipment, they can lower annual operating costs by $300,000. The equipment will be depreciated straight-line to a zero book value over its 3-year life. Ignore bonus depreciation. At the end of the three years, the equipment will be sold for an estimated $25,000. The equipment will require the company to hold an extra $65,000 of inventory over the 3-year period. What is the NPV if the discount rate is 13 percent and the tax rate is 21 percent? NPV = 36491.30 X Attempt # 1: 0/1 (Score: 0/1) Allowed attempts: 3 X Incorrect Check Answerarrow_forwardIf Lew's Steel Forms purchases $500,000 of new equipment, they can lower annual operating costs by $216,000. The equipment will be depreciated straight-line to a zero book value over its 5-year life. At the end of the three years, the equipment will be sold for an estimated $180,000. The equipment will no change in working capital. What is the NPV (in whole dollar) if the discount rate is 14 percent and the tax rate is 25 percent? {Hint: Use the method discussed in one of the special case.}arrow_forward(To record the sales) (To record premiums redeemed) (To record a liability for premiums) ||arrow_forward

- 10-9A (New proiect analysis) The Chung Ch..nical Corporation is considering the purchase o chemical analysis machine. Although the machine being considered will result in an increase earnings before interest and taxes of S35,000 per year, it has a purchase price of $100,000, and i would cost an additional $5,000 after tax to properly install this machineln sddiaon, to proper operate this machine, inventory must be increased by S5,000. This machine has an expected of 10 years, after which it will have no salvage value. Also, assume simplified straight-line dep ciation and that this machine is being depreciated down to zero, a 34 percent marginal tax rate. and a required rate of return of 15 percent. 2. What is the initial outlay associated with this project? b. What are the annual after-tax cash flows associated with this project for years I through c. What is the terminal cash flow in year 10 (what is the annual after-tar cash flow in 10 plus any additional cash flows associated with…arrow_forwardDo not do any interim rounding, state your answer rounded to the nearest dollar, for example, 35,498.67 would be 35499. Consider the following information regarding Ariadne Fiberworks and the planned acquisition of a new weaving loom. The loom will cost 269,000 and will be fully depreciated over 12 years using straight-line depreciation. Operating cash flows in year 1 are anticipated to be 30,910 and will grow at 3.6% per year thereafter, and the initial investment in net working capital of 17,350 will be maintained throughout the life of the project. Assuming a 12-year life, the anticipated incremental cash flows in year 12 at the end of the project are:arrow_forwardA warehouse building was purchased 10 years ago for P300,000. Since then, the effective annual interest rate has been 8%, inflation has been steady at 2.5%, and the building has no deterioration or decrease in utility. What should the warehouse sell for today? (Take note that inflation in commodity increases its value)arrow_forward

- Company Y acquired The Seoul Post in February 2021 for $315 million. Suppose the yearly margin per Seoul Post reader is $1 per year (coming from advertising), and the yearly retention rate is 70%, and assume a yearly discount rate of 10%. What is the difference between the price for which Company Y acquired the Seoul Post and the CLV of the 120 million unique visitors who will visit the Seoul Post this month?arrow_forwardMarigold Company includes one coupon in each box of soap powder that it packs, and 10 coupons are redeemable for a premium (a kitchen utensil). In 2020, Marigold Company purchased 9,100 premiums at 75 cents each and sold 101,000 boxes of soap powder at $ 3.60 per box; 40,800 coupons were presented for redemption in 2020. It is estimated that 60% of the coupons will eventually be presented for redemption.Prepare all the entries that would be made relative to sales of soap powder and to the premium plan in 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardThe D.J. Masson Corporation needs to raise $500,000 for 1 year to supplyworking capital to a new store. Masson buys from its suppliers on termsof 3/10, net 90, and it currently pays on the 10th day and takes discounts.However, it could forgo the discounts, pay on the 90th day, and therebyobtain the needed $500,000 in the form of costly trade credit. What is theeffective annual interest rate of this trade credit?arrow_forward

- You purchased equipment in 2017 for $120,000 plus it costs $20,000 to have it delivered and installed. You also traded yoour old computer worth $20,000. The old CCA half-year rule still applied. Based on past information, you believe that the equipment will have a salvage value of $19,000 in 6 years. The company's marginal tax rate is 40%. If the asset's CCA rate is 20% and the required return on this project is 10%, what is the present value of Salvage? Answer:arrow_forwardCompany Y acquired The Seoul Post in February 2021 for $315 million. Suppose the yearly margin per Seoul Post reader is $1 per year (coming from advertising), and the yearly retention rate is 70%, and assume a yearly discount rate of 10%. How many new readers should the Seoul Post acquire to close that gap, assuming an acquisition cost of $0.50 per reader? That is, how many new readers should it acquire to raise the CLV of its readers to $315 million, where the CLV of new readers is reduced by the acquisition cost?arrow_forwardDuring 2020, Tamarisk Furniture Company purchases a carload of wicker chairs. The manufacturer sells the chairs to Tamarisk for a lump sum or$71,820 because it is discontinuing manufacturing operations and wishes to dispose of its entire stock. Three types of chairs are included in the carload. The three types and the estimated selling price for each are listed below. Estimated Selling Туре No. of Chairs Price Each Lounge chairs 480 $90 Armchairs 360 80 Straight chairs 840 50 During 2020, Tamarisk sells 240 lounge chairs, 120 armchairs, and 144 straight chairs. What is the amount of gross profit realized during 2020? What is the amount of inventory of unsold straight chairs on December 31, 2020? (Do not round relative sales price. Round cost per chair to 2 decimal places, e.g. 78.25 and final answer to O decimal places, eg. 5,845.) Gross profit realized during 2020 %24 Amount of inventory of unsold straight chairs %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education