Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer the general accounting question do fast and step by step calculation

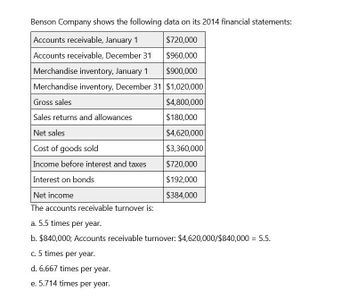

Transcribed Image Text:Benson Company shows the following data on its 2014 financial statements:

Accounts receivable, January 1

$720,000

Accounts receivable, December 31

$960,000

Merchandise inventory, January 1

$900,000

Merchandise inventory, December 31 $1,020,000

Gross sales

$4,800,000

Sales returns and allowances

$180,000

Net sales

$4,620,000

Cost of goods sold

$3,360,000

Income before interest and taxes

$720,000

Interest on bonds

$192,000

Net income

$384,000

The accounts receivable turnover is:

a. 5.5 times per year.

b. $840,000; Accounts receivable turnover: $4,620,000/$840,000 = 5.5.

c. 5 times per year.

d. 6.667 times per year.

e. 5.714 times per year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forwardOn January 1, Pope Enterprises inventory was 625,000. Pope made 950,000 of net purchases during the year. On its year-end income statement, Pope reported cost of goods sold of 1,025,000. Calculate Popes December 31 ending inventory.arrow_forwardCost of goods sold and related items The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 20Y8: Estimated returns of current year sales 11,600 Inventory, May 1, 20Y7 380,000 Inventory, April 30, 20Y8 415,000 Purchases 3,800,000 Purchases returns and allowances 150,000 Purchases discounts 80,000 Sales 5,850,000 Freight in 16,600 a. Prepare the Cost of goods sold section of the income statement for the year ended April 30, 20Y8, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 20Y8. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forward

- Reid Company uses the periodic inventory system. On January 1, it had an inventory balance of 250,000. During the year, it made 613,000 of net purchases. At the end of the year, a physical inventory showed it had ending inventory of 140,000. Calculate Reid Companys cost of goods sold for the year.arrow_forwardLangstons purchased $3,100 of merchandise during the month, and its monthly income statement shows a cost of goods sold of $3,000. What was the beginning inventory if the ending inventory was $1,250?arrow_forwardThe following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forward

- FINANCIAL RATIOS Based on the financial statements for Jackson Enterprises (income statement, statement of owners equity, and balance sheet) shown on pages 596597, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was 21,600. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventoryarrow_forwardWhat is the times interest earned ratio on these accounting question?arrow_forwardProvide correct answer the general accounting questionarrow_forward

- Solve these accounting questionarrow_forwardNeed General Accounting Question Solutionarrow_forwardCalculate activity measures The following information was available for the year ended December 31, 2016:Net sales $365,000Cost of goods sold 292,000Average accounts receivable for the year 14,600Accounts receivable at year-end 16,000Average inventory for the year 73,000Inventory at year-end 78,400Required:Calculate the inventory turnover for 2016.Calculate the number of days’ sales in inventory for 2016, using year-end inventories.Calculate the accounts receivable turnover for 2016.Calculate the number of days’ sales in accounts receivable for 2016, using year-end accounts receivable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning