CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

General Accounting Question No.12

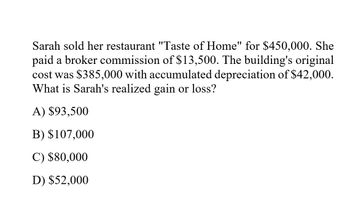

Transcribed Image Text:Sarah sold her restaurant "Taste of Home" for $450,000. She

paid a broker commission of $13,500. The building's original

cost was $385,000 with accumulated depreciation of $42,000.

What is Sarah's realized gain or loss?

A) $93,500

B) $107,000

C) $80,000

D) $52,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nicky receives a car from Sam as a gift. Sam paid 48,000 for the car. He had used it for business purposes and had deducted 10,000 for depreciation up to the time he gave the car to Nicky. The fair market value of the car is 33,000. a. Assuming that Nicky uses the car for business purposes, what is her basis for depreciation? b. Assume that Nicky deducts depreciation of 6,500 and then sells the car for 32,500. What is her recognized gain or loss? c. Assume that Nicky deducts depreciation of 6,500 and then sells the car for 20,000. What is her recognized gain or loss?arrow_forwardLO.3 Seojun acquired an activity several years ago, and in the current year, it generates a loss of 50,000. Seojun has AGI of 140,000 before considering the loss from the activity. If the activity is a bakery and Seojun is not a material participant, what is his AGI?arrow_forwardPlease Need Answer of this Questionarrow_forward

- Answer the questionarrow_forwardGain or Loss?arrow_forwardJane purchased an office building for the total acquisition price of $1,000,000.00. The value of the land was $250,000.00. The value of the personal property was $100,000.00. The value of the mortgage was $500,000.00. The value of the leasehold was $850,000.00. What is her depreciable basis for the real estate? Please don't provide solution in an image format thankuarrow_forward

- Jane operated a restaurant individually. Unfortunately, due to the current situation, he has to sell the restaurant for $5,000,000. He purchased the furniture, fixtures and equipment for $500,000 several years ago and the purchased price was allocated to them. The adjusted basis for these FF&E was $1000,000 and accumulated depreciation was $200,000. What's the effect for this transaction? A. Capital gain of $400,000 B. Ordinary income of $500,000 C. Ordinary income of $200,000, and capital gain of $200,000arrow_forwardLeonard London sold a building used in his business to Michelle Martinson. He had purchased the property several years previously for $340,000, $300,000 of which was the mortgage. Major improvements in the amount of $240,000 had been made. At the time of the sale, Leonard had taken $220,000 in straight-line depreciation. Leonard paid $104,000 in selling expenses. Michelle gave Leonard $400,000 in cash and unlike property with a fair market value of $240,000, assumed a delinquent real estate bill of $105,000 and assumed Leonard's mortgage on the property in the amount of $234,000. What is Leonard's gain on the sale? $191,000 $385,000 $410,000 $503,000 $515,000arrow_forwardSaharrow_forward

- Lee Simpson sold the building in which she operated her business. Lee had acquired the property many years ago for S$180,000 and over this period had made major improvements costing $210,000. Lee had claimed $$70,000 in straight-line depreciation at the time of the sale. The selling expenses paid by Lee amounted to $35,000. Jason purchased the property by (1) giving Lee $190,000 in cash; (2) giving Lee unlike property with a FMV of $170,000; (3) assuming Lee's mortgage on the property of $160,000; and (4) paying a delinquent real estate tax bill on the property of $65,000. What is Lee's realized amount? What was Lee's Adjusted Basis? What is Lee's gain on the sale?arrow_forwardHauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $65,000, and it has claimed $23,000 of depreciation expense against the building. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount.) Required: a. Assuming that Hauswirth receives $50,000 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. b. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $50,000, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. c. Assuming that Hauswirth receives $20,000 in cash in year O and a $50,000 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year O and in year 1.arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT