Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

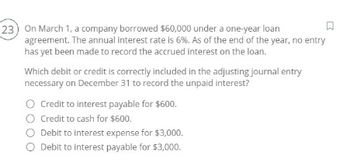

Transcribed Image Text:23) On March 1, a company borrowed $60,000 under a one-year loan

agreement. The annual interest rate is 6%. As of the end of the year, no entry

has yet been made to record the accrued interest on the loan.

Which debit or credit is correctly included in the adjusting journal entry

necessary on December 31 to record the unpaid interest?

○ Credit to interest payable for $600.

O Credit to cash for $600.

○ Debit to interest expense for $3,000.

◇ Debit to interest payable for $3,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardA company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forward

- On December 1, Gilman Corporation borrowed $20,000 on a 90-day, 6% note. Prepare the entries to record the issuance of the note, the accrual of interest at year end, and the payment of the note. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit $11arrow_forwardOn December 1, Cheyenne Furniture Corporation borrowed $8,800 on a 90-day, 15% note. Prepare the entries to record the issuance of the note, the accrual of interest at year end, and the payment of the note. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardSunland Company borrows $47,600 on July 1 from the bank by signing a $47,600, 13%, one-year note payable. (a) Prepare the journal entry to record the proceeds of the note. (b) Prepare the journal entry to record accrued interest at December 31, assuming adjusting entries are made only at the end of the year.arrow_forward

- On June 8, Alton Co. issued an $77,100, 7%, 120-day note payable to Seller Co. Assume that the fiscal year of Seller Co. ends June 30. Using a 360-day year in your calculations, what is the amount of interest revenue recognized by Seller in the following year? When required, round your answer to the nearest dollar. $450 $1,469 $900 $5,397arrow_forwardA business borrowed $59,037 on March 1 of the current year by signing a 30 day, 11% interest bearing note. Assuming a 360-day year, when the note is paid on March 31, the entry to record the payment should include a debit to Interest Payable for $541 debit to Interest Expense for $541 credit to Cash for $59,037 credit to Cash for $65,531arrow_forwardSheridan Company borrows $37,800 on July 1 from the bank by signing a $37,800, 8%, one-year note payable. (a) Prepare the journal entry to record the proceeds of the note.(b) Prepare the journal entry to record accrued interest at December 31, assuming adjusting entries are made only at the end of the year.arrow_forward

- Concord Company borrows $61,200 on July 1 from the bank by signing a $61,200, 10%, one-year note payable. (a) Prepare the journal entry to record the proceeds of the note.(b) Prepare the journal entry to record accrued interest at December 31, assuming adjusting entries are made only at the end of the yeararrow_forward32) On November 1, Bahama national bank lens $3.9 million and except a six month, 9% note receivable. Interest is due at maturity. Record the acceptance of the note and the appropriate adjustment for interest revenue add December 31, the end of the reporting period. (If no entry is required for a transaction/event, select “ no journal entry required” in the first account field. Enter your answer in dollars, not in millions (I.E. 5 should be entered as 5,000,000).)arrow_forwardPeralta Company borrows $53,400 on July 1 from the bank by signing a $53,400, 8%, one-year note payable. (a) Prepare the journal entry to record the proceeds of the note. (b) Prepare the journal entry to record accrued interest at December 31, assuming adjusting entries are made only at the end of the year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) No. Date Account Titles and Explanation Debit Credit (a) (b)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub