Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

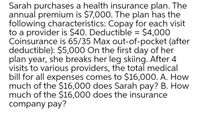

Transcribed Image Text:Sarah purchases a health insurance plan. The

annual premium is $7,000. The plan has the

following characteristics: Copay for each visit

to a provider is $40. Deductible = $4,000

Coinsurance is 65/35 Max out-of-pocket (after

deductible): $5,000 On the first day of her

plan year, she breaks her leg skiing. After 4

visits to various providers, the total medical

bill for all expenses comes to $16,000. A. How

much of the $16,000 does Sarah pay? B. How

much of the $16,000 does the insurance

company pay?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ashley took out a student loan for $12,544. The loan had annual interest of 6.9%. She graduated five years after getting the loan and began repaying the loan upon graduation. Ashley will make monthly payments for two years after graduation. During the five years she was in school not making payments the loan occurred simple interest. What was her subsidize loan monthly payment an unsubsidized loan monthly payment?arrow_forwardCheck my work Ariana's health Insurance policy includes a deductible of $1,050 and a coinsurance provision requiring her to pay 20 percent of all bils. Her total bill is $8,700. What is Ariana's total cost? (Do not round intermediate calculations.) Imsured's cotarrow_forwardJenna bought a new car for $39,000. She paid a 10% down payment and financed the remaining balance for 48 months with an APR of 4.5%. Determine the monthly payment that Jenna pays. Round your answer to the nearest cent, if necessary.arrow_forward

- Steven wants to buy a new couch priced at $591 and agrees to pay for it over two years with a finance charge of 4.3% simple annual interest. How much will his monthly payment be? State your answer in terms of dollars rounded to the nearest cent (hundredth). Carl purchased a $385 car stereo at Worst Buy. He paid $25 at the time of purchase and agreed to pay the balance in 12 equal monthly payments. The finance charge was 14% simple annual interest. What was the amount of each payment? State your answer in terms of dollars rounded to the nearest cent (hundredth). Sammy wants to buy a new stereo priced at $449. He enters into an agreement to pay $21 a month for 24 months. How much will the finance charge be for this purchase?arrow_forwardThe tucker family has health insurance coverage that pays 80 percent of out of hospital expenses after a 500 deductible per person. If one family member has doctor and prescription medication expenses of 1,100 what amount would the insurance pay?arrow_forwardLydia borrows $2000 from a credit card company at 23% annually for two years. Determine Lydia’s monthly payments.arrow_forward

- Janet borrows $3500 from a credit card company at 22.5% annually for 3 years. Determine Janet’s monthly payment. Show your work.arrow_forwardTo help pay for art school, Kareem borrowed money from his credit union. He took out a personal, amortized loan for $55,000 at an interest rate of 5.3% with monthly payments for a term of 20 years a) Find Kareem's monhly payment b) If Kareem pays the monthly payment for each month for the full term, find his total amount to repay the amount. c) If Kareem pays the monthly payement for each month for the full term, find the total amount of interest he will pay. .arrow_forwardMarisol finances a sports car for $27,700 by taking out an installment loan for 36 months. The payments were $998.61 per month and the total finance charge was $8,249.96. After 21 months, Marisol decided to pay off the loan. After calculating the finance charge rebate, find her loan payoff amount.arrow_forward

- The Baulding family has a basic health insurance plan that pays 80 percent of out-of-hospital expenses after a deductible of $250 per person. If three family members have doctor and prescription drug expenses of $425, $1,444, and $195, respectively, how much will the Baulding family and the insurance company each pay? How could they benefit from a flexible spending account established through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account? The Baulding family will pay $ (Round to the nearest dollar)arrow_forwardBritta has been accepted into a 2-year Medical Assistant program at a career school. She has been awarded a $6,000 unsubsidized 10-year federal loan at 4.29%. She knows she has the option of beginning repayment of the loan in 2.5 years. She also knows that during this non-payment time, interest will accrue at 4.29%. Britta made her last monthly interest-only payment on May 5. Her next payment is due on June 5. What will be the amount of that interest-only payment? Round your answer to the nearest cent. *arrow_forwardElaine borrows $1,000.00 from a credit card company at 19% annually for two years. Determine Elaine’s monthly payment. $50.41 $52.49 $100 $49.93arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education