Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

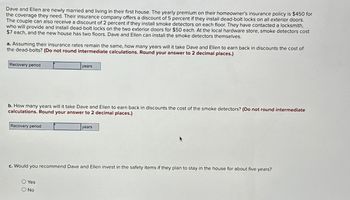

Transcribed Image Text:Dave and Ellen are newly married and living in their first house. The yearly premium on their homeowner's insurance policy is $450 for

the coverage they need. Their insurance company offers a discount of 5 percent if they install dead-bolt locks on all exterior doors.

The couple can also receive a discount of 2 percent if they install smoke detectors on each floor. They have contacted a locksmith,

who will provide and install dead-bolt locks on the two exterior doors for $50 each. At the local hardware store, smoke detectors cost

$7 each, and the new house has two floors. Dave and Ellen can install the smoke detectors themselves.

a. Assuming their insurance rates remain the same, how many years will it take Dave and Ellen to earn back in discounts the cost of

the dead-bolts? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Recovery period

b. How many years will it take Dave and Ellen to earn back in discounts the cost of the smoke detectors? (Do not round intermediate

calculations. Round your answer to 2 decimal places.)

Recovery period

years

O Yes

O No

years

c. Would you recommend Dave and Ellen invest in the safety items if they plan to stay in the house for about five years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Similar questions

- Using the accompanying Retirement Calculator spreadsheet model, Claire wants to use Scenario Manager to compare the following retirement saving scenarios: Click here for the Excel Data File Scenario 1 2 3 Starting salary $ 55,900 $ 70,900 $ 68,900 $ 72,900 Increase rate Saving rate Return rate 2% 2% 3% 3% 15% 10% 15% 10% Scenario generates the highest retirement savings Amount 水水水水 7% 7% 7% 7% a. Which scenario generates the highest retirement savings at the end of 10 years? What is the amount? Note: Round "Amount" to 2 decimal places.arrow_forwardcan someone help me pleasearrow_forward3arrow_forward

- Using the "Human Life Value" method, how much life insurance should you purchase if you have 45 years until retirement, an annual income of $65,100 received at the start of each years, and a time value of money of 9%? (Assume 80% income replacement, ignore taxes and inflation.)arrow_forwardFind the monthly house payment necessary to amortize the following loan. 9) In order to purchase a home, a family borrows $121,000 at 3.0% for 30 yr. What is their monthly payment? Round the answer to the nearest cent.arrow_forwardYour rich uncle dies, leaving you a life insurance policy worth $12 0,000. The insurance company also offers you an option to receive $8,225 per year for 25 years, with the first payment due today. You should choose the immediate payout if the interest rate is greater than a. 5.27% b. 5. 76% c. 7.75% d. 4.66%arrow_forward

- A yearly renewable term life insurance policy generally specifies that A) The policy owner may renew the policy only once B) Premiums shall increase every time the policy is renewed C) Evidence of insurability shall be required every renewal D) Cash values will increase for as long as the policy is in forcearrow_forwardAn insurance agent just offered you a new insurance product that will provide you with $1,959.20 13 years from now if you invest $400 today. What annual rate of interest would you earn if you invested in this product?arrow_forwardook ences Chris Seals has just given an insurance company $62,525. In return, she will receive an annuity of $7,458 for 12 years. a. At what rate of return must the insurance company invest this $62,525 to make the annual payments? (Use a Financial calculator to arrive at the answers. Round the final answer to 3 decimal places.) Rate of return b. What rate of return is required if the annuity is payable at the beginning of each year? (Use a Financial calculator to arrive at the answers. Round the final answer to 2 decimal places.) Rate of returnarrow_forward

- The Maybe Pay Life Insurance Company is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required return on this investment is 5.6 percent, how much will you pay for the policy? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardf. Insurance: You are still not done allocating your paycheck. Assume that you pay annually 0.5% of your home value in home insurance. You also pay $1,000/year in auto insurance, $2,500/year in medical and dental insurance, and $350 / year in life insurance. What is your monthly payment for these deductions?arrow_forwardAnswer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education