FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

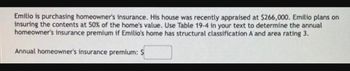

Transcribed Image Text:Emilio is purchasing homeowner's insurance. His house was recently appraised at $266,000. Emilio plans on

insuring the contents at 50% of the home's value. Use Table 19-4 in your text to determine the annual

homeowner's insurance premium if Emilio's home has structural classification A and area rating 3.

Annual homeowner's insurance premium: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A couple buys a $190,000 home, making down payment of 16%. The couple finances the purchase with a 15 year mortgage at an annual rate of 2.88%. Find the monthly payment.arrow_forward9. The annual insurance premium on Julie’s home is $2,074 and the annual property tax is $1,403. If her monthly principal and interest payment is $1,603, find the adjusted monthly payment including principal, interest taxes and insurance (PITI).arrow_forwardJanet receives a $ 10,000 life insurance benefit. If she uses the proceeds to buy an n-year annuity immediate, the annual payout will be 1534.86. If a 2n-year annuity due is purchased, the annual payout will be 994.13. Both calculations are based on an effective annual interest rate of i. Calculate i.arrow_forward

- Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 4 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $90; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $300; and attorney's fees, $500. Find the closing costs (in $).arrow_forwardKari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $30,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $90; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (in $).arrow_forwardCheck my work Ariana's health Insurance policy includes a deductible of $1,050 and a coinsurance provision requiring her to pay 20 percent of all bils. Her total bill is $8,700. What is Ariana's total cost? (Do not round intermediate calculations.) Imsured's cotarrow_forward

- Find her monthly cost for all the expenses.arrow_forwardFully furnished accommodation with monthly rent of $5,000. Ms Tan contributed a total rent of $6,000 in the year 2019, with the rest paid for by the company. Calculate the accommodation benefit.arrow_forward1. Alex owns a home with a replacement value of $320,000. The homeowners policy has an 80% coinsurance clause and a face value of $240,000. Damage caused by a fire costs $125,280 to repair. What compensation will the insurance company pay? 2. Using Table 19-5 and 19-6, find the annual premium for an automobile insurance policy for Sandra who has a good credit rating. She lives in Territory 1 and buys 50/100/50 coverage for her liability protection. Sandra's vehicle is Model Class 2 and is five years old. In addition to the liability coverage, she purchased comprehensive and collision insurance with a $250 deductible on comprehensive and a $500 deductible on collision. TABLE 19-5 Annual Automobile Liability Insurance Premiums Territory 1 Territory 2 Liability Limits BAD GOOD ОСС GOOD ОСС BAD 50/100/50 385 600 846 354 552 778 100/300/100 425 682 961 391 627 884 250/500/250 460 750 1036 423 690 953 500/1000/500 530 843 1208 488 776 1111 GOOD = good credit; OCC = occasional payments past…arrow_forward

- Assume you are looking to share an apartment with another person, Joe. The rent for a 2-bedroom/2 bath apartment is $1,000 per month. Joe wants to split the rent 50/50. Prior to agreeing to this, you find out the following information: Joe’s bedroom is 20’ x 24’ or 480 square feet with an on suite bath. Your bedroom is 12’ x 10’ or 120 square feet and the bath will be used by visitors too. You think that the rent should be allocated between you and Joe based upon the relative square feet of your rooms. 2. Using your method of allocating rental costs based upon the square feet of your rooms, how much rent will each of you pay?arrow_forwardCalculate the annual premium for a 20 year old male seeking 5 year term insurance valued at $120,000.arrow_forwardYou are the wage earner in a "typical family," with $28,000 gross annual income. Use the easy method to determine how much life insurance you should carry. (Do not round intermediate calculations.) Life insurance needarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education