Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Tag. General Account

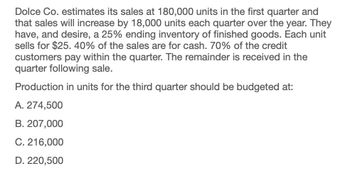

Transcribed Image Text:Dolce Co. estimates its sales at 180,000 units in the first quarter and

that sales will increase by 18,000 units each quarter over the year. They

have, and desire, a 25% ending inventory of finished goods. Each unit

sells for $25. 40% of the sales are for cash. 70% of the credit

customers pay within the quarter. The remainder is received in the

quarter following sale.

Production in units for the third quarter should be budgeted at:

A. 274,500

B. 207,000

C. 216,000

D. 220,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Earthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardIf the sales forecast estimates that 50,000 units of product will be sold during the following year, should the factory plan on manufacturing 50,000 units in the coming year? Explain.arrow_forwardNegus Enterprises has an inventory conversion period of 50 days, an average collection period of 35 days, and a payables deferral period of 25 days. Assume that cost of goods sold is 80% of sales. What is the length of the firm’s cash conversion cycle? If annual sales are $4,380,000 and all sales are on credit, what is the firm’s investment in accounts receivable? How many times per year does Negus Enterprises turn over its inventory?arrow_forward

- Ranger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forwardSunland Company estimates its sales at 400000 units in the first quarter and that sales will increase by 15000 units for each subsequent quarter during the year. The company has, and desires, an ending finished goods inventory to 25% of the next quarter's sales. Each unit sells for $25.40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is collected in the quarter following the sale. Cash collections for the third quarter are budgeted at O $10682500. O $8815000. O $6167500. $11314375.arrow_forwardplease help mearrow_forward

- Dolce Co. estimates its sales at 180,000 units in the first quarter and that sales will increase by 18,000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $25. 30% of the sales are for cash. 65% of the credit customers pay within the quarter and 5% will not be collected from the succorers.. The remainder is received in the quarter following sale. Cash collections for the third quarter are budgeted at O a. $3,051,000. O b. $4,428,000. O c. $5,319,000. O d. $5,156,000. e. None of the answers is correct Clear my choicearrow_forwardBear, Inc. estimates its sales at 200,000 units in the first quarter and that sales will increase by 20,000 units each quarter over the year. Bear calculates a 25% ending inventory of finished goods based on next month's sales. Each unit sells for $35. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Production in units for the third quarter should be budgeted atarrow_forwardSunland Company estimates its sales at 180000 units in the first quarter and that sales will increase by 17000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $25. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Cash collections for the third quarter are budgeted at O $5273500. O $3026500. O $4387000. O $6057389.arrow_forward

- jagdisharrow_forwardJoAnn Manufacturing has projected the following sales for the coming year: Sales $25,847.50 C$25,182.50 $22,604.17 Q1 $23,560.83 Q2 $ 54,750 $ 61,850 Q3 The company places orders each quarter that are 35 percent of the following quarter's sales and has a 30-day payables period. What is the payment of accounts for the third quarter? $70,050 Q4 $75,750arrow_forwardSwifty Corporation estimates its sales at 210000 units in the first quarter and that sales will increase by 21000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $25.40% of the sales are for cash, 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Cash collections for the third quarter are budgeted at O $7182000 O $3559500. O $6205500. O $5166000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning