FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

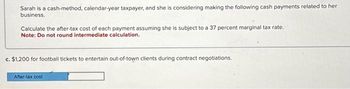

Transcribed Image Text:Sarah is a cash-method, calendar-year taxpayer, and she is considering making the following cash payments related to her

business.

Calculate the after-tax cost of each payment assuming she is subject to a 37 percent marginal tax rate.

Note: Do not round intermediate calculation.

c. $1,200 for football tickets to entertain out-of-town clients during contract negotiations.

After-tax cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- G, the Manager of ABC Co., was given a fringe benefit of a Household Expense account for the salary of his driver and other personal expenses in the amount of P20,000 per month for the current year. Compute the following: 1) Grossed Up Monetary of the Fringe Benefits 2) Fringe Benefits Tax Payable 3) If G is employed in an Offshore Banking unit, compute the fringe Benefits Tax. Upload your solutions in Spreadsheet Format.arrow_forwardHaru is a self-employed cash-method, calendar-year taxpayer, who made the following cash payments related to his business this year. Calculate the after-tax cost of each payment assuming Haru has a 37 percent marginal tax rate. b. $3,300 of interest on a short-term loan incurred in September and repaid in November. Half of the loan proceeds was used immediately to pay salaries and the other half was invested in municipal bonds until November.arrow_forwardHansabenarrow_forward

- The following information applies to the questions displayed below.] Haru is a self-employed cash-method, calendar-year taxpayer, who made the following cash payments related to his business this year. Calculate the after-tax cost of each payment assuming Haru has a 37 percent marginal tax rate. a. $500 fine for speeding while traveling to a client meeting. b. $800 of interest on a short-term loan incurred in September and repaid in November. Half of the loan proceeds was used immediately to pay salaries and the other half was invested in municipal bonds until November. c. $600 for office supplies in May of this year. Haru used half of the supplies this year, and he will use the remaining half by February of next year. d. $450 for several pairs of work boots. Haru expects to use the boots about 80 percent of the time in his business and the remainder of the time for hiking. Consider the boots to be a form of clothing.arrow_forwardMrs. Nunn, who has a 24 percent marginal tax rate on ordinary income, earned $3,670 interest on a debt instrument this year. Required: Compute her federal income tax on this interest assuming that the debt instrument was: Note: For all requirements, round your final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "0" wherever required. a. An unsecured note from her son, who borrowed money from his mother to finance the construction of his home. b. A certificate of deposit from a federal bank. c. A 30-year General Electric corporate bond. d. A U.S. Treasury note. e. A City of Memphis municipal bond. a. Federal income tax b. Federal income tax c. Federal income tax d. Federal income tax e. Federal income tax Amountarrow_forward1. Ms. Evelyn is tax compliance officer at the Bureau of internal revenue earning a monthly salary P35,196.00. How much is Ms. Evelyn's take home pay? 2. Allan S. Gala is a sales representative at a private pharmacy. He is given a monthly rice subsidy of P2,000.00. Over his monthly salary of P24,300.00. How much is his monthly net pay?arrow_forward

- Sarah is a cash-method, calendar-year taxpayer, and she is considering making the following cash payments related to her business. Calculate the after-tax cost of each payment assuming she is subject to a 37 percent marginal tax rate. Note: Do not round intermediate calculation. Problem 9-54 Part-b (Algo) b. $3,800 to reimburse the cost of meals at restaurants incurred by employees while traveling for the business. Answer is complete but not entirely correct. After-tax cost S 3,097arrow_forwardRoxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $2,800 dress. Lisa returns to Virginia a few weeks later to pick up the dress and drive it back to her Maryland residence, where she will use the dress. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 6 percent, what is Roxy's sales tax collection obligation? Multiple Choice $0 $140 to Virginia $140 sales tax to Virginia and $28 use tax to Maryland $168 to Marylandarrow_forwardWhich one of the following costs is most likely NOT fully deductible? Group of answer choices Jose, a local business owner, pays $30,000 in Self-Employment taxes. Sandra owns a mini golf course. She pays her employer portion of payroll taxes because of her employees, which totals to $12,000. Travis owns a CPA firm and pays his son Joe as an associate. Joe is a CPA and is paid the same salary as the other associates. X-Corp writes off a $12,000 business debt owed by Sam because he has not responded to their numerous requests for payment.arrow_forward

- A taxpayer would be required to pay Social Security and Medicare taxes for a domestic employee in all but one of the following situations. In which situation would this not be required? a.A cook who is paid $35,000 a year b.A nanny who earns $22,000 a year c.A baby-sitter who earns $1,300 a year d.A cleaning lady who is paid $8,000 a year e.The taxpayer would not have to pay Social Security and Medicare taxes in any of the above situations.arrow_forwardIndarrow_forwardFred Blake has agreed to work for the Cummings Foundation at a total annual salary of $ 55,000. He is uncertain whether he should be paid bi-weekly or semi - monthly and has asked for your assistance. Calculate the typical deductions for CPP and El that must be taken from Fred's salary under either alternative. Will the choice affect the total El or CPP Fred pays during the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education