FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

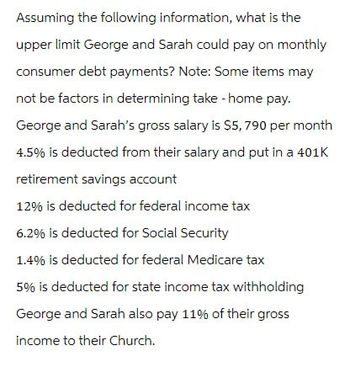

Transcribed Image Text:Assuming the following information, what is the

upper limit George and Sarah could pay on monthly

consumer debt payments? Note: Some items may

not be factors in determining take-home pay.

George and Sarah's gross salary is $5,790 per month

4.5% is deducted from their salary and put in a 401K

retirement savings account

12% is deducted for federal income tax

6.2% is deducted for Social Security

1.4% is deducted for federal Medicare tax

5% is deducted for state income tax withholding

George and Sarah also pay 11% of their gross

income to their Church.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much can the following single taxpayer contribute to a traditional IRA? The taxpayer earns $119,900 at a job in 2018. He is not covered by another qualified plan.arrow_forward1: Mortimer Klein earned gross pay of $1,340. Each period he makes a 401(k) contribution of 3% of gross pay. His current year taxable earnings for Social Security tax, to date, are $184,600. Total Social Security tax = $ × 2: Helena Smith earned gross pay of $2,000. She does not make any retirement plan contributions. Her current year taxable earnings for Social Security tax, to date, are $137,500. Total Social Security tax = $ 3: Kasey Wolfe earned gross pay of $1,140. Each period he contributes 1.5% of gross pay to a flexible spending account. His current year taxable earnings for Social Security tax, to date, are $71,900. Total Social Security tax = $ 4: Matthew Pugh earned gross pay of $840. Each period he designates 3% of gross pay for a dependent care flexible spending account. His current year taxable earnings for Social Security tax, to date, are $137,900. Total Social Security tax = $ ×arrow_forwardIndividual Retirement Accounts (LO 5.3) Phil and Linda are 25-year-old newlyweds and file a joint tax return. Linda is covered by a retirement plan at work, but Phil is not. If an amount is zero, enter "0". a. Assuming Phil's wages were $27,000 and Linda's wages were $18,500 for 2018 and they had no other income, what is the maximum amount of their deductible contributions to a traditional IRA for 2018? Phil $ Linda $ b. Assuming Phil's wages were $53,000 and Linda's wages were $70,000 for 2018 and they had no other income, what is the maximum amount of their deductible contributions to a traditional IRA for 2018? Phil $ Linda $arrow_forward

- Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. A single taxpayer’s base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. Suppose Eric is retiring this year at age 67. The following table shows his data. Part-time salary $30,500 Annual savings account interest $300 Annual dividends $2,750 Annual interest on Dallas municipal bonds $1,550 Based on the income calculated, Eric will have % of his Social Security benefits taxed.arrow_forwardLana Long, age 32, chief executive officer of News America borrows $100,000 from her employer as a bridge loan. Assume that the applicable federal rate for year one of the loan is 6 per cent, but that American only charges 2 percent. What are the likely tax consequences for Lana? Explain.arrow_forwardData: In 2020, Elaine paid $2,160 of tuition and $900 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband - AGI $165,500. Question: What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books ? Thx, Stephaniearrow_forward

- Please help me solve both questionsarrow_forwardSuppose Alexa has a weekly paycheck with gross earnings of $1,234.00 and is single with no dependents. Calculate her Federal Withholding Tax for the pay period using the percentage method.arrow_forwardLouise's monthly gross income is $2, 300. Her employer withholds $460 in federal, state, and local income taxes and $184 in Social Security taxes per month. Louise contributes $92 per month for her IRA. Her monthly credit payments for Visa, MasterCard, and Discover cards are $43, $33, and $20, respectively. Her monthly payment on an automobile loan is $353. What is Louise's debt payments to income ratio?arrow_forward

- Use the following federal tax table for biweekly earnings of a single person to help answer the question below. Emeril has gross biweekly earnings of $784.21. By claiming 1 more withholding allowance, Emeril would have $13 more in his take home pay. How many withholding allowances does Emeril currently claim? a. 3 b. 4 c. 5 d. 6arrow_forwardEarned Income Credit. Carolyn is unmarried and has one dependent child, age 6, who lives with her for the entire year. In 2015, she has income of $16,000 in wages and $6,000 in alimony. Her AGI is $22,000. a. What is Carolyn’s tentative earned income credit (before phase out)? b. what is Carolyn’s allowable earned income credit? c. If Carolyn has no income tax liability (before the earned income credit is subtracted), is she entitled to a refund in the current year? d. How will your answers to Part a and b change if Carolyn is married filing a joint returnarrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education