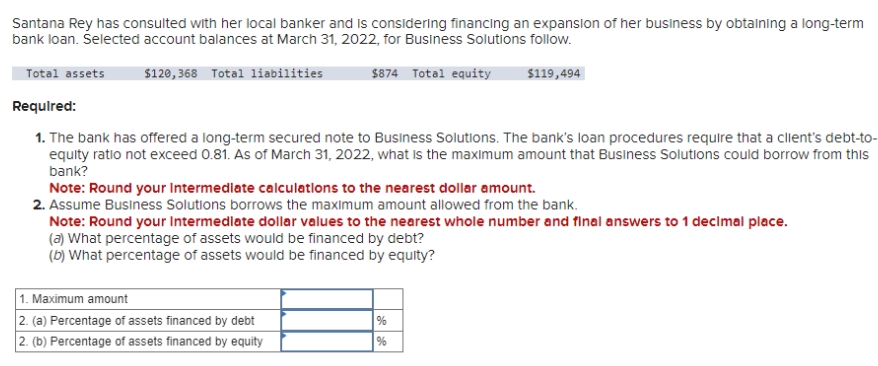

Santana Rey has consulted with her local banker and is considering financing an expansion of her business by obtaining a long-term bank loan. Selected account balances at March 31, 2022, for Business Solutions follow. Total assets Required: $120,368 Total liabilities $874 Total equity $119,494 1. The bank has offered a long-term secured note to Business Solutions. The bank's loan procedures require that a client's debt-to- equity ratio not exceed 0.81. As of March 31, 2022, what is the maximum amount that Business Solutions could borrow from this bank? Note: Round your Intermediate calculations to the nearest dollar amount. 2. Assume Business Solutions borrows the maximum amount allowed from the bank. Note: Round your Intermediate dollar values to the nearest whole number and final answers to 1 decimal place. (a) What percentage of assets would be financed by debt? (b) What percentage of assets would be financed by equity? 1. Maximum amount 2. (a) Percentage of assets financed by debt 2. (b) Percentage of assets financed by equity % %

Santana Rey has consulted with her local banker and is considering financing an expansion of her business by obtaining a long-term bank loan. Selected account balances at March 31, 2022, for Business Solutions follow. Total assets Required: $120,368 Total liabilities $874 Total equity $119,494 1. The bank has offered a long-term secured note to Business Solutions. The bank's loan procedures require that a client's debt-to- equity ratio not exceed 0.81. As of March 31, 2022, what is the maximum amount that Business Solutions could borrow from this bank? Note: Round your Intermediate calculations to the nearest dollar amount. 2. Assume Business Solutions borrows the maximum amount allowed from the bank. Note: Round your Intermediate dollar values to the nearest whole number and final answers to 1 decimal place. (a) What percentage of assets would be financed by debt? (b) What percentage of assets would be financed by equity? 1. Maximum amount 2. (a) Percentage of assets financed by debt 2. (b) Percentage of assets financed by equity % %

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 9PA: Mohammed LLC is a growing consulting firm. The following transactions take place during the current...

Related questions

Question

Am. 113.

Transcribed Image Text:Santana Rey has consulted with her local banker and is considering financing an expansion of her business by obtaining a long-term

bank loan. Selected account balances at March 31, 2022, for Business Solutions follow.

Total assets

Required:

$120,368 Total liabilities

$874 Total equity

$119,494

1. The bank has offered a long-term secured note to Business Solutions. The bank's loan procedures require that a client's debt-to-

equity ratio not exceed 0.81. As of March 31, 2022, what is the maximum amount that Business Solutions could borrow from this

bank?

Note: Round your Intermediate calculations to the nearest dollar amount.

2. Assume Business Solutions borrows the maximum amount allowed from the bank.

Note: Round your Intermediate dollar values to the nearest whole number and final answers to 1 decimal place.

(a) What percentage of assets would be financed by debt?

(b) What percentage of assets would be financed by equity?

1. Maximum amount

2. (a) Percentage of assets financed by debt

2. (b) Percentage of assets financed by equity

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT