FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

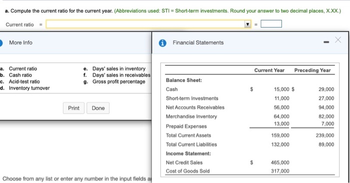

Transcribed Image Text:a. Compute the current ratio for the current year. (Abbreviations used: STI = Short-term investments. Round your answer to two decimal places, X.XX.)

Current ratio

More Info

a. Current ratio

b. Cash ratio

c. Acid-test ratio

d. Inventory turnover

e. Days' sales in inventory

f. Days' sales in receivables

g. Gross profit percentage

Print Done

Choose from any list or enter any number in the input fields a

Financial Statements

Balance Sheet:

Cash

Short-term Investments

Net Accounts Receivables

Merchandise Inventory

Prepaid Expenses

Total Current Assets

Total Current Liabilities

Income Statement:

Net Credit Sales

Cost of Goods Sold

$

Current Year Preceding Year

15,000 $

11,000

56,000

64,000

13,000

159,000

132,000

465,000

317,000

29,000

27,000

94,000

82,000

7,000

239,000

89,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer both a and b thxarrow_forwardfind assets, liabilities, and stockholders equityarrow_forward2) Ratios Based on the information given in picture #1, complete the following ratios for the last TWO years and indicate whether the trend is favorable or unfavorable. Note percentages and times should be to one decimal place (e.g. 14.8%; 5.8x) Liq./Solv. Ratios Current Yr. Prior Yr. Fav/Unfav. Current Ratio (X) {Total. Current Assets/ Total Current Liabilities} Quick Ratio (X) {Cash + Short term Investments + Current Receivables/ Current Liabilities} Day's Sales Uncollected (days) {Total Accounts Receivables / Sales x 365}arrow_forward

- a spreedsheet is needed to complete for this question. PR17-04b from Cegage accounting 2 (financial statement analysis)arrow_forward2) Ratios Based on the information given in picture #1, complete the following ratios for the last TWO years and indicate whether the trend is favorable or unfavorable. Note percentages and times should be to one decimal place (e.g. 14.8%; 5.8x) Liq./Solv. Ratios Current Yr. Prior Yr. Fav/Unfav. Current Ratio (X) {Total. Current Assets/ Total Current Liabilities} Quick Ratio (X) {Cash + Short term Investments + Current Receivables/ Current Liabilities} Day's Sales Uncollected (days) {Total Accounts Receivables / Sales x 365}arrow_forwardSuppose that you are doing a financial statement analysis. Assume you took a financial statement and divided every entry amount in the statement by the amount of total assets. The resulting statement is commonly called a? current ratio common base year income statement common size balance sheet common size income statement common base year balance sheet .DO NOT GIVE PLAGRIZED ANSWERarrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward! Required information Problem 12-6A (Algo) Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.] Income statements and balance sheets data for Virtual Gaming Systems are provided below. Net sales Cost of goods sold Gross profit Expenses: VIRTUAL GAMING SYSTEMS Income Statements For the Years Ended December 31 2025 $3,495,000 2,477,000 1,018,000 Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income 952,000 27,000 16,500 7,700 1,003, 200 14,800 2024 $3,021,000 1,947,000 1,074,000 855,000 25,500 7,700 13,500 46,500 948, 200 125,800arrow_forwardBalance Sheet Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. Note: Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (L.e., .2345 should be entered as 23.45). Assats Current assets Cash Income Statement Marketable securities Accounts receivable (net) Inventories Prepaid Items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other FANNING COMPANY Vertical Analysis of Balance Sheeta Year 4 Total noncurrent liabilales Total abilities Stockholders' equity Preferred stock (par value $10, 4% cumulative, nonparticipating: 6,600 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity…arrow_forward

- Which of the following ratios would a lender find most useful in monitoring a borrower's ability to make loan payments? () PE ratio Return on assets Total asset turnover Inventory turnover () Cash coverage ratio Previous Page Next Page Page 6arrow_forwardPrepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Lishilitinn WALTON COMPANY Vertical Analysis of Balance Sheets Year 4 $ Amount 17,800 21,300 55,100 136,900 25,700 256,800 27,600 270,600 30,300 328,500 585,300 Percentage of Total % $ $ Amount Year 3 13,700 6,800 47,500 144,700 10,500 223,200 21,100 256,000 24,900 302,000 525,200 Percentage of Total %arrow_forwardok D Int = Print Compute the annual dollar changes and percent changes for each of the following accounts. (Decreases should be indicated with a minus sign. Round percent change to one decimal place.) 0 ferences # Short-term investments Accounts receivable Notes payable Percent Change = Short-term investments Accounts receivable Notes payable Type here to search Esc fo F1 1 X F2 $ Current Year $ 378,252 100,583 @ 2 0 Horizontal Analysis - Calculation of Percent Change Numerator: 1 Current Year F3 20 #m Prior Year $ 236,897 104,503 91,702 3 378,252 $ 100,583 F4 0 S4 Prior Year $ 236,897 104,503 91,702 F5 $ % 5 Denominator: Dollar Change F6 111,355 (3,920) (91,702) DELL F7 A Percent Change 29.4 % (26.7) % (100.0) % 6 F8 & 7 0 F9 * a 8 F10 9arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education