FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

3. Complete the below table to calculate the

|

see pictures

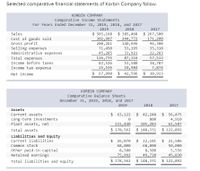

Transcribed Image Text:Selected comparative financial statements of Korbin Company follow.

KORBIN COMPANY

Comparative Income Statements

For Years Ended December 31, 2019, 2018, and 2017

2019

2018

2017

$ 267,500

171, 200

$ 503,168

302,907

200, 261

71,450

45, 285

$ 385,468

244,772

140,696

53,195

Sales

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

Total expenses

96,300

35,310

22,203

57,513

33,921

87,116

116,735

Income before taxes

83,526

53,580

10,984

$ 42,596

38,787

Income tax expense

15,536

7,874

Net income

$ 67,990

$ 30,913

KORBIN COMPANY

Comparative Balance Sheets

December 31, 2019, 2018, and 2017

2019

2018

2017

Assets

Current assets

$ 63,122

$ 42,248

$ 56,475

Long-term investments

Plant assets, net

800

4,910

115,440

105, 283

61,507

Total assets

$ 178,562

$ 148,331

$ 122,892

Liabilities and Equity

Current liabilities

$ 26,070

$ 22,101

$ 21,506

Common stock

68,000

8,500

68,000

8,500

50,000

5,556

other paid-in capital

Retained earnings

49,730

$ 148,331

75,992

45,830

Total liabilities and equity

$ 178,562

$ 122,892

Transcribed Image Text:3. Complete the below table to calculate the balance sheet data in trend percents with 2017 as base year. (Round your percentage

answers to 2 decimal places.)

KORBIN COMPANY

Balance Sheet Data in Trend Percents

December 31, 2019, 2018 and 2017

2019

2018

2017

Assets

Current assets

%

%

100.00 %

Long-term investments

100.00

Plant assets, net

100.00

Total assets

%

100.00 %

Liabilities and Equity

Current liabilities

%

%

100.00 %

Common stock

100.00

Other paid-in capital

100.00

Retained earnings

100.00

Total liabilities and equity

%

%

100.00 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose the Crane Ltd's 2020 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities NT$3,536.0 31,408.0 3,016.0 16,640.0 Compute the following values. Interest expense Income taxes Net income NT$520.0 (a) Debt to assets ratio. (Round to O decimal places, e.g. 62%.) 1,976.0 4,590.0 (b) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) % timesarrow_forwardCondensed financial data of Sweet Company for 2020 and 2019 are presented below. SWEET COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,800 $1,130 Receivables 1,770 1,320 Inventory 1,560 1,890 Plant assets 1,900 1,700 Accumulated depreciation (1,220 ) (1,180 ) Long-term investments (held-to-maturity) 1,300 1,430 $7,110 $6,290 Accounts payable $1,220 $890 Accrued liabilities 190 250 Bonds payable 1,410 1,520 Common stock 1,870 1,730 Retained earnings 2,420 1,900 $7,110 $6,290 SWEET COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,860 Cost of goods sold 4,710 Gross margin 2,150 Selling and administrative expenses 920 Income from operations…arrow_forwardCurrent Attempt in Progress Suppose the comparative balance sheats of Nike, Inc are presented here. Nike, Inc. Comparative Balance Sheets May 31 ($ in millions) 2020 2019 Assets Current assets $9,602 $9,400 Property, plant, and equipment (net) 2,125 1,700 Other assets 1,568 1,600 Tatal assets $13,375 $12,700 Liabilities and Stockholders' Equity Current liabilities $3,038 $3,100 Long-term liabilities 1.246 1,300 Stockholders' squity 9,089 8,300 Tatal liabilities and stockholders' equity $13,375 $12,700 (a) Prapare a horizontal analysis of the balance shest data for Niks, using 2019 as a base (Show the amount of increase or decreasas wall. (Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number eg. 45, -45% or parentheses eg. (45), (45%). Round percentages to 1 decimal place, eg. 12.3%) NIKE, INC. Condensed Balance Sheet ($ in millions) Increase Percentage Change from 2019 2020 2019 (Decrease) Assets Current assets $9,682…arrow_forward

- Condensed financial data of Waterway Company for 2020 and 2019 are presented below. WATERWAY COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,790 $1,150 Receivables 1,780 1,330 Inventory 1,620 1,890 Plant assets 1,930 1,700 Accumulated depreciation (1,200 ) (1,180 ) Long-term investments (held-to-maturity) 1,310 1,420 $7,230 $6,310 Accounts payable $1,210 $920 Accrued liabilities 210 240 Bonds payable 1,370 1,530 Common stock 1,860 1,670 Retained earnings 2,580 1,950 $7,230 $6,310 WATERWAY COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,970 Cost of goods sold 4,680 Gross margin 2,290 Selling and administrative expenses 940 Income from…arrow_forwardYou have been presented with the following selected information from the financial statements of one of Canada's largest dairy producers, Saputo Inc. (in $ millions): Statement of financial position 2021 2020 2019 Accounts receivable $1,217 $1,372 $1,248 Inventory 2,294 2,221 1,681 Total current assets 3,948 4,069 3,134 Total assets 13,123 13,793 9,886 Current liabilities 2,146 2,494 1,932 Total liabilities 6,679 7,234 4,465 Statement of income Sales $14,294 $14,944 $13,502 Cost of goods sold 9,575 10,181 9,179 Interest expense 79 96 67 Income tax expense 218 217 230 Net income 626 583 755arrow_forward8. Trend Ratios, Application of some Financial Ratios and their Interpretation Some of the balance sheet and income statement figures of Sapphire Mfg. CO. for 2016, 2017 and 20181 are as follows. 2018 P30,000 2016 2017 Quick assets P40,000 P48,000 65,000 25,000 80,000 50,000 Current assets 50,000 40,000 110,000 200,000 Investments 160,000 135,000 Plants, property and equipment, net Total assets 250,000 265,000 Current liabilities 45,000 50,000 100,000 75,000 Long Term debt Total stockholders' equity 40,000 50,000 105,000 125,000 125,000 Total liabilities and stockholders' Equity 200,000 400,000 240,000 250,000 265,000 Sales 375,000 500,000 Cost of goods sold Operating expenses (including Depreciation of P10,000) 255,000 290,000 110,000 95,000 105,000 Net income 50,000 50,000 130,000 a) Compute for the trend ratios based on the above given data and give your interpretation of the 2017 and 2018 figures.arrow_forward

- Computing rate of return on total assets Barot’s 2018 financial statements reported the following items—with 2017 figures given for comparison: Net income for 2018 was $3,910, and interest expense was $240. Compute Barot’s rate of return on total assets for 2018. (Round to the nearest percent.)arrow_forwardCrane Company has these comparative balance sheet data: CRANE COMPANYBalance SheetsDecember 31 2022 2021 Cash $ 27,105 $ 54,210 Accounts receivable (net) 126,490 108,420 Inventory 108,420 90,350 Plant assets (net) 361,400 325,260 $623,415 $578,240 Accounts payable $ 90,350 $ 108,420 Mortgage payable (15%) 180,700 180,700 Common stock, $10 par 252,980 216,840 Retained earnings 99,385 72,280 $623,415 $578,240 Additional information for 2022: 1. Net income was $27,900. 2. Sales on account were $382,300. Sales returns and allowances amounted to $29,000. 3. Cost of goods sold was $207,500. 4. Net cash provided by operating activities was $57,000. 5. Capital expenditures were $28,900, and cash dividends were $17,900. Compute the following ratios at December 31, 2022. (Round current ratio and inventory turnover to 2 decimal…arrow_forwardCullumber company has these comparative balance sheet data:arrow_forward

- N1. Account Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2021. (Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.)arrow_forward19. Using the following information, calculate the return on assets. Net income for November Total assets, November 1 5,000 76,000 Total assets, November 30 80,250 ... Identify the formula and then solve for return on assets (ROA). (Round the ROA to the nearest tenth percent, X.X%.) ÷ ROA %arrow_forwardPlease fill out vertical analysis of this balance sheet to determine component percentage of assets liabilities and stockholders equity based on data. Round percentages to the nearest hundredths percentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education