Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Give me true calculation of this accounting question

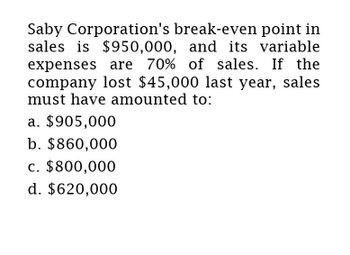

Transcribed Image Text:Saby Corporation's break-even point in

sales is $950,000, and its variable

expenses are 70% of sales. If the

company lost $45,000 last year, sales

must have amounted to:

a. $905,000

b. $860,000

c. $800,000

d. $620,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 67) Sabv Corporation's break-even-point in salesis $675,000, and its variable expen ses are 75% of sales. If the company lost $24,000 last year, sales must have amounted to: A) $651,000 B) $579,000 C) $603,000 D) $471,000 Answer: Barrow_forwardSabv Corporation's break-even-point in sales is $800,000, and its variable expenses are 70% of sales. If the company lost $30,000 last year, sales must have amounted to: Multiple Choice $770,000 $740,000 $700,000 $530,000arrow_forwardKR Corporation's break-even-point in sales is Rs. 900,000, and its variable expenses are 75% of sales. If the company lost Rs. 32,000 last year, sales must have amounted to:arrow_forward

- Solen Corporation's break-even-point in sales is $850,000, and its variable expenses are 80% of sales. If the company lost $35,000 last year, sales must have amounted to: $815,000 S780,000 $675,000 $645,000arrow_forwardThe Spector Company has sales of $830,000, and the break-even point in sales dollars is $547,800. Determine the Spector company's margin of safety as a percent of current sales.fill in the blank 1 of 1 %arrow_forwardLast year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product variable expense $67.00 per unit with a fixed price expense of $835,500 per year. a. What is the product's net income or loss last year? b. What is the product break-even point in unit sales and dollar sales? c. Assume the company has conducted a market study that estimates it can increase sales by 5,000 units for each $2.00 reduction in its selling price. If the company would only consider increments of $2.00(e.g. $68,$66, etc) What is the maximum annual profit that can be earned on this product? What sales volume and selling price per unit generate the maximum profit? d. What would be the break-even point in unit sales and dollar sales using the selling price that was determined in the required letter c above? Thank you,arrow_forward

- Company X's break-even-point in sales is $675,000, and its variable expense ratio is 75%. Last month, the company made a loss of $24,000, How much was the sales ($)? a. 603,000 O b. 651,000 Oc. None of the given answers O d. 471,000 O e. 579,000arrow_forwardBoss, Inc. has consistently generated these operating results for the past several years:arrow_forwardStark Industries reports that its average operating assets are $511,000,000 and its net operating income is $147,000,000 on sales of $1,645,000,000 What is the residual income if the required rate of return is 0.11? Round your answer to the nearest dollar.arrow_forward

- Margin of Safety Quick Inc. has sales of $36,400,000, and the break-even point in sales dollars is $24,024,000. Determine the company's margin of safety as a percent of current sales. Enter your answer as a whole number. %arrow_forwardLast year, Ezra Company reported sales of P640,000, a contribution margin of P160,000, and a net loss of P40,000. Based on this information, the break-even point was: P640,000 P480,000 P800,000 P960,000arrow_forwardLast year Minden Company introduced a new product and sold 25, 300 units of it at aprice of $99 per unit. The product's variable expenses are $69 per unit and its fixedexpenses are $837,300 per year. Required: 1. What was this product's net operatingincome (loss) last year? 2. What is the product's break - even point in unit sales anddollar sales? 3. Assume the company has conducted a marketing study that estimates itcan increase annual sales of this product by 5.000 units for each $2 reduction in itsselling price. If the company will only consider price reductions in increments of $2 (e.g$68, $66, etc.), what is the maximum annual profit that it can earn on this product?What sales volume and selling price per unit generate the maximum profit? 4. Whatwould be the break - even point in unit sales and in dollar sales using the selling pricethat you determined in requirement 3?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning