FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

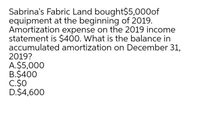

Transcribed Image Text:Sabrina's Fabric Land bought$5,000of

equipment at the beginning of 2019.

Amortization expense on the 2019 income

statement is $400. What is the balance in

accumulated amortization on December 31,

2019?

A.$5,000

B.$400

C.$0

D.$4,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carla Vista Company purchases a patent for $147,200 cash on January 2, 2021. Its legal life is 20 years and its estimated useful life is 8 years. Record amortization expense for the year ended December 31, 2021 Blossom Company purchased real estate for $1,165,000, which included $6,200 in legal fees. It paid $256,000 cash and incurred a mortgage payable for the balance. The real estate included land that was appraised at $476,700, a building appraised at $762,720, and fences and other land improvements appraised at $122,580. The building has an estimated useful life of 60 years and a $56,000 residual value. Land improvements have an estimated 15-year useful life and no residual value. Calculate the annual depreciation expense for the building and land improvements assuming Blossom Company uses straight-line depreciation.arrow_forwardFinance Assume that Tim Corporation has 2020 taxable income of $240,000 for purposes of computing the $179 expense. It acquired the following assets in 2020: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) ASSET PURCHASE DATE BASIS Furniture (7-year) December 1$ 450,000 Computer equipment (5-year) February 28 $90,000 Copier (5-year) July 15 $30,000 Machinery (7-year) May 22 480,000 Total $ 1,050,000 c. What would Tim's maximum depreciation expense deduction be for 2020 if the machinery cost $3,500,000 instead of 480,000 and assuming no bonus depreciation?arrow_forwardSalem Company buys a building for $1,000,000 on 1st January 2019. Its estimated useful life in the business is 20 years, after which it will be sold for an estimated residual value of $200,000. Under the Straight-line method of depreciation, Accumulated depreciation at December 31, 2020 will be Multiple Choice O $40,000 $80,000 $200,000arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] AMP Corporation (calendar-year-end) has 2019 taxable income of $1,900,000 for purposes of computing the §179 expense. During 2019, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Placed in Service September $1,550,000 Asset Basis Machinery 12 Computer equipment Office building Total February 10 365,000 480,000 $2,395,000 a. What is the maximum amount of §179 April 2 expense AMP may deduct for 2019?arrow_forwardSwifty Company purchased machinery for $939000 on January 1, 2019. Accumulated Depreciation was $846000 on December 31, 2025. The machinery was sold on January 1, 2026 for $70000. What gain or loss did Swifty record from the sale of the machinery? O $70000 loss O $23000 gain O $70000 gain O $23000 lossarrow_forwardPlease answer, round off final answers to two decimal placesarrow_forward

- N1.arrow_forwardDanzerarrow_forwardAMP Corporation (calendar year-end) has 2022 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2022, AMP acquired the following assets: (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5) Asset Machinery Computer equipment Office building Total Placed in Service September 12 Basis $ 1,390,000 February 101 April 2 415,000 $ 2,335,000 530,000 b. What is the maximum total depreciation, Including $179 expense, that AMP may deduct in 2022 on the assets it placed in service in 2022, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Maximum total depreciation (including $170 expense), $ 1,315,000arrow_forward

- 9. Amazing Inc. purchased Class 8 furniture for $4,000 in 2022. In 2023, this furniture was sold for $1,000. Class 8 UCC was $10,300 at the beginning of 2022 and no Class 8 property was purchased during the year. What is the UCC of this class at the end of 2023? A. $1,860 B. $7,440 C. $9,300 D. $8,240 10. Mary carries on business as a sole proprietor that generated $100,000 in net accounting income. Included in this amount are: • $7,000 of amortization expense; •$4,000 for bad debt expense; • $112,000 cost of goods sold; and • $12,000 meals and entertainment with clients. Mary's maximum CCA has been calculated at $10,000 for the year. What is Mary's business income for income tax purposes? A. $113,000 B. $109,000 A) C. $107,000 $103,000 11. Tomas began carrying on a home-based business as a sole proprietor on January 1, 2023. In 2023, he received $40,000 cash for services rendered and paid $33,000 in business expenses. On December 31, 2023 there was an outstanding accounts receivable…arrow_forwardPrepare the complete Depreciation and Amortisation Form 4562.arrow_forwardHypothetical Corporation incurred the following expenses: 2019 2020Research and Development 619,000 703,000 The new product will be available for sale July 1, 2021. Calculate the deduction for R&D expenses for 2019, 2020, and 2021 under the following independent assumptions:a. Armando Corporation elects to expense the R&D expenses. b. Armando Corporation elects to amortize the R&D expenses over 60 months.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education