FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:## Cash Flow from Investing Activities - Educational Overview

### Net Cash Provided by (Used for) Operating Activities

Net Cash Provided by (Used for) Operating Activities represents the cash inflows and outflows from a company's core business operations. This section of the cash flow statement is crucial for understanding the liquidity and long-term solvency of a company.

### Cash Flows from Investing Activities:

Investing activities primarily involve changes in the investments and capital expenditures of a company. Here, you would record transactions such as the purchase and sale of physical assets, investments in securities, or acquisitions of other businesses.

1. **Cash Payment for Acquisition of Plant Assets**

- This line item represents cash outflows for purchasing property, plant, and equipment (PP&E). These expenditures are considered capital investments that are necessary for maintaining or expanding productive capacity. However, they represent a use of cash that might limit liquidity in the short term.

### Net Cash Provided by (Used for) Investing Activities

This field shows the aggregate of all cash inflows and outflows from investing activities. A positive number indicates that more cash was brought in through investing activities than was spent, while a negative number indicates otherwise.

### Additional Resources

- **Help me solve this:** A link or button that likely directs users to resources or tools that assist with solving related problems or completing this section of the cash flow statement.

- **Demodocs example:** This may link to documentation or an example that provides a practical demonstration of how to fill out or interpret the cash flow statement related to investing activities.

- **Get more help:** A general help link that provides additional assistance, FAQs, or contact information for further support.

This page is designed to help users comprehend and complete the section of a cash flow statement concerned with investing activities, ensuring they properly account for cash transactions related to investments and capital expenditures.

### Interface Layout

The image shows a user interface likely designed for entering financial data. Visible is a portion of a form where users can input values specific to cash payments for the acquisition of plant assets. Additionally, links for further help and examples are present at the bottom of the screen for user assistance.

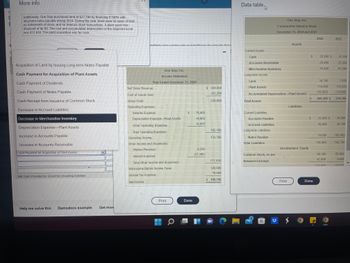

Transcribed Image Text:### Financial Analysis Scenario

#### Narrative

One Stop, Inc. made a series of financial decisions that impacted its financial statements for the year ending December 31, 2024. These decisions include the acquisition of land financed entirely through long-term notes payable, disposal of a plant asset, and various transactions involving cash payments and receipts. The implications of these decisions are reflected in the comparative balance sheet and income statement for the years 2023 and 2024.

---

#### Balance Sheet Breakdown (One Stop, Inc.)

**Comparative Balance Sheet**

*(As of December 31, 2024, and 2023)*

**Assets:**

- **Current Assets:**

- **Cash:**

- 2024: $26,800

- 2023: $15,100

- **Accounts Receivable:**

- 2024: $20,200

- 2023: $16,500

- **Merchandise Inventory:**

- 2024: $79,500

- 2023: $91,200

- **Long-term Assets:**

- **Land:**

- 2024: $34,700

- 2023: $7,000

- **Plant Assets:**

- 2024: $118,450

- 2023: $120,000

- **Accumulated Depreciation (Plant Assets):**

- 2024: $(16,950)

- 2023: $(14,680)

- **Total Assets:**

- 2024: $269,300

- 2023: $234,300

**Liabilities and Stockholders' Equity:**

- **Current Liabilities:**

- **Accounts Payable:**

- 2024: $35,800

- 2023: $30,000

- **Accrued Liabilities:**

- 2024: $28,600

- 2023: $30,700

- **Long-term Liabilities:**

- **Notes Payable:**

- 2024: $74,000

- 2023: $105,000

- **Total Liabilities:**

- 2024: $138,400

- 2023: $165,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The purchase of a long-term asset is classified in the statement of cash flows as a(n) a. Operating activity. b. Investing activity. c. Financing activity. d. Noncash activity.arrow_forward(Appendix) When preparing a schedule for the calculation of cash generated from operating activities under the direct method, an increase in Depreciation Expense is a.subtracted from operating expenses. b.subtracted from net income. c.added to net income. d.added to operating expenses.arrow_forward18. When using the indirect method to prepare the operating section of a statement of cash flows, which of the following is deducted from net income to compute cash provided by/used by operating activities? Decrease in accounts receivable. Gain on sale of land. Amortization of patent. All of these are deducted from net income to arrive at cash flow from operating activities.arrow_forward

- Which of the following represents an investing activity in the statement of cash flows? a) Sale of plant assets at a loss b) Depreciation of plant assets c) Stock dividend d) Purchase of inventoryarrow_forwardDepreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in a. the Cash flows from financing activities section b. a separate schedule c. the Cash flows from investing activities section d. the Cash flows from operating activities sectionarrow_forwardabout the cash flow problem, confusing.arrow_forward

- Decrease in Accrued Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Plant Assets Net Cash Provided by (Used for) Investing Activities Help me solve this Demodocs example esc Get more help -arrow_forwardWhich of the following will be reflected in the "Cash flows from operating activities" of a Statement of Cash Flows? A) Adjustment for depreciation B) Purchase of equipment C) Increase or decrease in loans D) Purchase of inventoryarrow_forwardWhich of the following statements is true when computing the net cash provided by (used in) operating activities using the Indirect method? Multiple Cholce If the property, plant, and equlpment balance Increases during the perlod, the amount of the Increase is added to net Income. If the prepald expenses balance Increases during the perlod, the amount of the Increase is added to net Income. If the property, plant, and equipment balance Increases during the perlod, the amount of the Increase is subtracted from net Income. If the prepald expenses balance Increases during the perlod, the amount of the Increase is subtracted from net Income.arrow_forward

- Exercises: 1. Indicate under which activity (operating, financing, investing) the following accounts belong in the statement of cash flows: Activity Land Mortgage payable Profit for the year Trade and other payables Depreciation/amortization Inventories Prepaid expenses Buildings Accrued expenses Current taxes payable Equipment Long-term borTowings Purchase of a company Dividendsarrow_forwardThe net income reported on an income statement for the current year was $63,000. Depreciation recorded on fixed assets for the year was $24,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the Cash Flows from Operating Activities section of the statement of cash flows using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. End Beginning Cash $65,000 $70,000 Accounts receivable (net) 70,000 57,000 Inventories 86,000 102,000 Prepaid expenses 4,000 4,500 Accounts payable (merchandise creditors) 51,000 58,000 Cash dividends payable 4,500 6,500 Salaries payable 6,000 7,500arrow_forwardRECONCILIATION OF NET INCOME TO NET CASH FLOWS FROM OPERATING ACTIVITIES Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: Net cash flows from operating activitiesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education