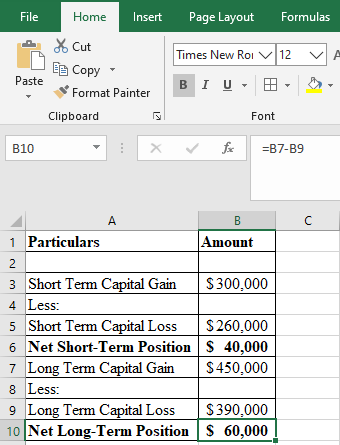

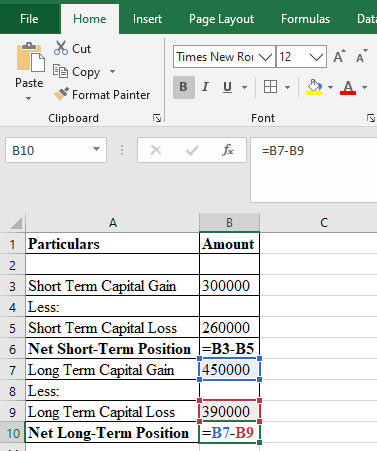

Tammy had the following aggregate results from her 2019 investing activity:

- STCG $300,000

- LTCG $450,000

- STCL -$260,000

- LTCL -$390,000

After the

1.Classify as short-term or long-term based on holding period:

•Short-termheld less than 12 months

•Long-term held longer than 12 months

2. Net short-term and long-term gains and losses to obtain a net short-term and a net long-term position for the year. Collectibles gains and losses, gains on qualified small businessstock, and unrecaptured Section 1250 gains are treated as long-term gains and losses inthe netting procedure.

Short-term capital gain $ XX

Short-term capital loss (XX)

Net short-term gain (loss) Short-term capital gain or loss

Long-term capital gain $ XX

Long-term capital loss (XX)

Net long-term gain (loss) Long-term capital gain or loss

3.If long-term and short-term positions are the same(both gains, both losses), no further netting is done.

4.If long-term and short-term positions are opposite(1 gain, 1 loss), net again to produce either a gain or loss.

When after disposing of a capital asset, either a gain or a loss is incurred, and to calculate a net effect of these gains or losses, the procedure of netting is performed. The procedure of netting is followed when the net positions of short and long terms are different, i.e. one is in loss and one is in gain.

The procedure of netting is followed as per the given equation:

As provided,

Short Term Losses or Gains occurs when the asset was held and sold within 12 months, and Long Term Losses or Gains occurs when the asset was held and sold after 12 months.

As per the given information, Net positions of the capital gains or losses will be calculated as below:

Formulation:

Step by stepSolved in 3 steps with 3 images

- South-Western Federal Taxation 2018 Determine the net effect on Tamara’s adjusted gross income with regard to these capital asset transactions that occurred this year (2018). Sold ABCCo stock, acquired 2 years ago, for a $1,500 loss. Sold collectible coins, held for 17 months, for a $2,000 gain. Sold XYZCo shares, acquired 6 months ago, for a $4,100 loss. Sold LMNCo stock, acquired 3 years ago, for a $500 gain.arrow_forwardActuarial gain or loss - plan assets Fair value of plan assets (1 July 2013) Plus: Return on plan assets (6% x $94 356 000) Contributions Minus: Benefits paid Actuarial Fair value of plan assets (30 June 2014) Required: Select a correct answer for each blank. $94 356 000 5 661 360 8 640 000 (15 552 000) $95 832 000arrow_forward1. No need to explain. Please answer all the questions correctly. Thank you in advancearrow_forward

- Tammy had the following aggregate results from her 2019 investing activity: STCG $300,000 LTCG $450,000 STCL $260,000*** LTCL $390,000*** *** These are negative numbers, obviously. After the “netting procedure” described in the textbook, what is / are Tammy’s net 2019 result(s)?arrow_forwardAccrued Expenses: Entity D acquired a piece of land on April 1, 20x1. The purchase price was reduced by a credit for the real property taxes accrued during the year. Entity D records real property taxes at each month-end by adjusting the prepaid tax or tax payable account as appropriate On May 1, 20x1 Entity D paid the first of two equal installments of P72,000 for real property taxes. Requirement: What is the entry to record the payment on May 1?arrow_forwardTrue/False 7. Interest paid or accrued during 2018 on aggregate acquisition indebtedness of $2 million or less ($1 million or less for married persons filing separate returns) is deductible as qualified residence interest.arrow_forward

- What are the after tax proceeds of the property sale? Answer is a three digit number with the correct symbol. Tax rate 30% Corporate net income - $200 Depreciated tax value of property sold - $150 Sale proceeds from sale of property - $450 Capital expenditures - $142.25arrow_forwardA taxpayer places a $50,000 5-year recovery period asset (not an auto) in service in 2021. This is the only asset placed in service in 2021. Assuming half-year convention, bonus depreciation, and taxable income before cost recovery of $5,000, what is the amount of cost recovery in 2021? a.$5,000 b.$25,000 c.$30,000 d.$0 e.$50,000arrow_forwardUse the formula FV = P(1 + R)N Rigoberto invests $8,000, at 6% interest, compounded semiannually for 1 year.How much interest will he earn on his investment?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education