FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

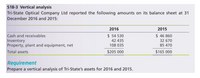

Transcribed Image Text:S18-3 Vertical analysis

Tri-State Optical Company Ltd reported the following amounts on its balance sheet at 31

December 2016 and 2015:

2016

2015

Cash and receivables

$ 54 530

$ 46 860

32 670

Inventory

Property, plant and equipment, net

42 435

108 035

85 470

Total assets

$205 000

$165 000

Requirement

Prepare a vertical analysis of Tri-State's assets for 2016 and 2015.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I determine the NNO for 2014? Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Operating Assets 1,447,869 1,513,139 Operating liabilities 1,094,173 1,158,007 Net operating assets (NOA) 353,696 355,132 $ 397,299.00 NNO $ 490,548 $ 473,323 Equity $ 844,244 $ 828,455 $ 726,328.00 NOA= NNO + Equity $ 1,334,792 $ 1,301,778arrow_forwardCurrent assets Cash Accounts receivable Inventory Total Net plant and equipment Total assets Current assets Cash Assets Fixed assets 2017 $ 10,200 30,200 74,600 $ 115,000 Accounts receivable Inventory Total $285,000 $400,000 Assets 2018 Net plant and equipment $ 13,200 38,640 87,120 $ 138,960 $ 341,040 $480,000 $ $ $ 2017 Current liabilities For each account on this company's balance sheet, show the change in the account during 2018 and note whether this change was a source or use of cash. (If there is no action select "None" from the dropdown options. Leave no cells blank - be certain to enter "0" wherever required. A negative answer should be indicated by a minus sign.) Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in Retained earnings surplus Liabilities and Owners' Equity 2017 Total 10,2003 30,200 74,600 115,000 Total liabilities and owners' equity 285,000 Sources/Uses $ $ $ $ 46,000 27,800 $ 73,800 $ 40,000 $ 60,000 226,200 $286,200…arrow_forward18 eppertree Company’s financial statements on December 31, 2021, showed the following: Net Sales $ 550,000 Fixed Assets, January 1 $ 146,000 Fixed Assets, December 31 $ 134,000 Total Assets, January 1 $ 194,000 Total Assets, December 31 $ 200,000 What is the fixed asset turnover for 2021? Multiple Choice 3.93 2.60 4.10 2.79arrow_forward

- Disaggregate Traditional DuPont ROE Graphical representations of the KLA-Tencor 2018 income statement and average balance sheet numbers (2017-2018) follow ($ thousands). KLA-Tencor Average Balance Sheet 2017-2018 $1,473,464 O $2,583,930 -$2,627,235.5 $1,518,3711 Operating assets Nonoperating assets Operating labilities Nonoperating Babies Equity + 0 수 $2.948.529 0 KLA-Tencor Income Statement 2018 $802,265 $653.666- ✪ 0 O $81,263 a. Compute return on equity (ROE). Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE. Numerator Denominator ROE Operating expenses Tax expense 수 0 b. Apply the DuPont disaggregation into return on assets (ROA) and financial leverage (FL). Note: 1. Select the appropriate numerator and denominator used to compute ROA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROA. Numerator Denominator ROA 수 0…arrow_forwardCompute and Compare ROE, ROA, and RNOA Graphical representations of the KLA-Tencor 2018 income statement and average balance sheet numbers (2017-2018) follow ($thousands). KLA-Tencor Average Balance Sheet 2017-2018 $1,473,464 $2.583,930 -$2,627,235.5 $1,518,371 Operating assets Nonoperating assets Operating labilities Nonoperating abis Equity + -$2,948,529 Check OS 05 KLA-Tencor Income Statement 2018 $802,265 ė $653,666- Note: Assume a statutory tax rate of 22%. a. Compute return on equity (ROE). Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE. Denominator Numerator ROE $81,263 05 Operating expenses Tax expense b. Compute return on assets (ROA). Note: 1. Select the appropriate numerator and denominator used to compute ROA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROA. Numerator Denominator ROA -$2.499.507 +…arrow_forwardKk. 251.arrow_forward

- Calculate Inventory Turnover Accounts Receivable Turnover PPE Turnover Asset Turnoverarrow_forwardOperating and Nonoperating Items in Boston Scientific's Income Statement EXHIBIT 3.6 For Year Ended December 31, S mllllons 2018 2017 2016 Net sale . Cost of products sold $9,823 $9,048 2,593 $8,386 2,424 2,813 Gross profit. Operating expenses Selllng, general and admlnIstratlve expenses. Research and development expenses Royalty expense Amortlzatlon expense Intanglble asset Impalrment charges ContIngent conslderatlon expense (beneflt) . RestructurIng charges. LItigatlon-related charges 7,010 6,455 5,962 3,569 1,113 3,294 3,099 997 920 70 68 79 599 565 545 35 4 11 (21) (80) 29 36 37 28 103 285 804 Operating expenses - 5,504 5,170 5,515 Operating income . Other expense (income) Interest expense 1,506 1,285 447 241 229 233 Other expense (income), net. (156) 124 37 Income before income taxes 1,422 932 177 Income tax expense (benefit) . (249) 828 (170) Net income. $1,671 $ 104 $ 347 Calculate the operating expense margin ratio for 2016arrow_forwardThe following information is from Lacy's Inc. $ millions Prior Fiscal Year Current Fiscal Year Net Year-End Assets Revenue Income $21,330 14,403 $18,955 $1,070 a. Compute the asset turnover ratio for the current fiscal year. b. Compute the return on assets ratio for the current fiscal year. Numerator a. Asset Turnover Ratio $ Check b. Return on Assets Ratio $ Numerator Denominator / $ Denominator / $ || Result Resultarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education