FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

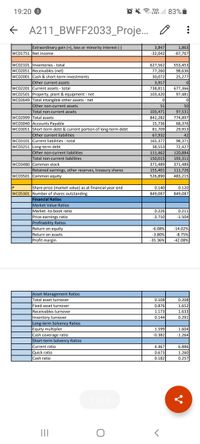

Calculate the asset efficiency - receivables, inventory, fixed asset and total asset turnover ratios

Transcribed Image Text:19:20 6

OX M l 83% i

LTE1

A211_BWFF2033_Proje.. O

Extraordinary gain (+), loss or minority interest (-)

3,847

1,863

wc01751 Net income

-32,042

-67,767

WC02101 |Inventories - total

wC02051 Receivables (net)

627,562

553,453

77,260

30,072

3,917

98,636

wc02001 Cash & short-term investments

Other current assets

WC02201 Current assets - total

wc02501 Property, plant & equipment - net

wc02649 Total intangible other assets - net

25,277

677,366

97,481

738,811

103,420

Other non-current assets

51

50

Total non-current assets

103,471

97,531

WC02999 Total assets

WC03040 Accounts Payable

wc03051 Short-term debt & current portion of long-term debt

842,282

774,897

15,736

81,709

68,376

29,953

Other current liabilities

wC03101 Current liabilities - total

WC03251 Long-term debt

67,932

165,377

42

98,371

38,553

72,427

Other non-current liabilities

111,462

150,015

120,884

193,311

Total non-current liabilities

WC03480 JCommon stock

371,489

155,401

371,489

Retained earnings, other reserves, treasury shares

111,726

WC03501 Common equity

526,890

483,215

IP

0.120

849,087

Share price (market value) as at financial year end

0.140

wC05301 Number of shares outstanding

Financial Ratios

Market Value Ratios

849,087

Market -to-book ratio

0.226

0.211

Price-earnings ratio

-3.710

-1.504

Profitability Ratios

-6.08%

-14.02%

-8.75%

Return on equity

Return on assets

Profit margin

-3.80%

-35.36%

-42.08%

Asset Management Ratios

Total asset turnover

0.108

0.208

Fixed asset turnover

0.876

1.652

Receivables turnover

1.173

1.633

0.144

Inventory turnover

Long-term Solvency Ratios

Equity multiplier

Cash coverage ratio

Short-term Solvency Ratios

Current ratio

Quick ratio

Cash ratio

0.291

1.599

1.604

-0.382

-1.264

6.886

1.260

4.467

0.673

0.182

0.257

1 of 2

II

Transcribed Image Text:103,420

lother non-current assets

677.366

774,897

19:20 6

OX l 83% i

Vol)

A211_BWFF2033_Proje.. O

Company name:

L:BEHB

Туре

Description

2019

2020

31/12/2019 31/12/2020

161,058

161,625

10.943

WC05.

W05350 Fiscal year end date

wC01001 |Net sales or revenues

90,611

wc01051 Cost of goods sold (excl depreciation)

Boous

58,030

WC01151 Depreciation, depletion & amortization

12,312

wC01100 Gross Income

20,200

20,268

-11,510

wc01101 ISelling, general and adminitrative expenses

lother operating expenses

72,888

41,098

wc01250 Operating income

-52,620

-52,608

6,568

Other incomes (+) or associated losses (-)

27,009

4,786

-20,825

wc01266 Non-operating interest income

WC18191 Earnings before interest & taxes

Lammgs beid

WC01251 Interest expense on debt

-46,040

27,773

-73,813

22,300

WC01401 Pretax income

-43,125

WC01451 Income taxes

-7,236

3,847

-32,042

-4,183

Extraordinary gain (+), loss or minority interest (-)

1,863

-67,767

WC01751 Net income

wC02101 Inventories - total

wC02051 Receivables (net)

wc02001 Cash & short-term investments

Other current assets

wC02201 Current assets - total

627,562

553,453

98,636

77,260

30,072

25,277

3,917

738,811

103,420

677,366

97,481

wc02501 Property, plant & equipment - net

wc02649 Total intangible other assets - net

totar itangibie

Other non-current assets

51

50

Total non-current assets

103,471

97,531

wc02999 Total assets

wC03040 Accounts Payable

wc03051 Short-term debt & current portion of long-term debt

842,282

774,897

15,736

81,709

68,376

29,953

Other current liabilities

wC03101 Current liabilities - total

WC03251 Long-term debt

67,932

165,377

42

98,371

38,553

72,427

120,884

Other non-current liabilities

Total non-current liabilities

111,462

150,015

371,489

155,401

526,890

193,311

371,489

111,726

wC03480 Common stock

Retained earnings, other reserves, treasury shares

WC03501 Common equity

483,215

IP

Share price (market value) as at financial year end

0.140

0.120

WC05301 Number of shares outstanding

849,087

849,087

Financial Ratios

Market Value Ratios

Market -to-book ratio

Price-earnings ratio

0.226

0.211

-3.710

-1.504

Profitability Ratios

Return on equity

-6.08%

-14.02%

-8.75%

Return on assets

Profit margin

-3.80%

35.36%

-42.08%

Asset Management Ratios

Total asset turnover

0.108

0.208

1 6521

IFived ascet turnover

O 8761

II

Expert Solution

arrow_forward

Step 1

Ratios refer to establishing the relationship between the two numbers. In accounting, the ratio is used to determine the companies performance in terms of asset usage and management, profitability, and efficiency.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Describe the important properties of fixed assets? Compare and contrast the straight-line, units-of-activity, and double-declining balance depreciation methods ? Describe the accounting for intangible assets, such as patents, copyrights, and goodwill ? Describe current liabilities, including those related to accounts payable, accruals, notes payable, and the current portion of long-term debt?arrow_forwardhow to Determine the total assetsarrow_forwardhow to calculate gain on the sale of equipmentarrow_forward

- What is asset specificity Identify three different types of asset specificity.arrow_forwardWhat costs are included when capitalizing an asset on the balance sheet?arrow_forwardPlease explain how the long-term and short-term classification of assets and liabilities is determined. In addition, please define “operating cycle.arrow_forward

- Brad's BBQ reported sales of $660,000 and net income of $41,000. Brad's also reported ending total assets of $491,000 and beginning total assets of $384,000. Required: Calculate the return on assets, the profit margin, and the asset turnover ratio for Brad's BBQ. Return on Assets Choose Numerator Choose Denominator Return on Assets Return on assets %3D Profit Margin Choose Numerator Choose Denominator Profit Margin Profit margin %3D II IIarrow_forwardAllied, Inc. bought a two-year insurance policy on August 1 for $3,600. What's the adjusting journal entry on December 31? make into a spreadsheetarrow_forwardHow can we determine the unit profit of operating an asset?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education