FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

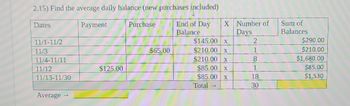

Transcribed Image Text:2.15) Find the average daily balance (new purchases included)

Payment

End of Day

Balance

Dates

11/1-11/2

11/3

11/4-11/11

11/12

11/13-11/30

Average

$125.00

Purchase

$65.00

X Number of

Days

$145.00 X

$210.00 X

$210.00 x

$85.00 x

$85.00 X

Total →

2

1

1

18

30

Sum of

Balances

$290.00

$210.00

$1,680.00

$85.00

$1,530

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise Al-9 Payment of payroll deductions LO3 Paradise Hills Berry Farm has 21 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. Gross Pay EI Premium Income Taxes 78,950.00 1,310.57 10,889.00 CPP 3,768.09 Medical Ins. United Way 1,475.00 1,644.00 Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) View transaction list Journal entry worksheet 1 Record the remittance to the Receiver General for Canada. Note: Enter debits before credits. Date April 15 General Journal + Debit Credit View general journal Record entry Clear entryarrow_forwardMarcus has a balance of $2,600 on his credit card. The credit card has an annual interest rate of 21%, compounded monthly (1.75% each month). Marcus uses his credit card for various expenses throughout month and, at the end of each month, makes a $275 payment. Use this information to complete the table below. Round to the nearest cent as needed. 1.75% Interest Month Prior Balance on Prior Balance 2 $2600 $ 4 $50.17 $2871.83 %24 %24 3.arrow_forward7. Weekly Osalary Cash Allowance $40.00 $75.00 $25.00 a. $1,225.00 b. $1,500.00 c. $ 425.00 d. $ 750.00 e. $1,180.00 $15.00 Tax Ben $3.80 $10.00 - $11.00 $25.00 Emp Ded СРР Emp Cont Emp Ded EI Emp Cont warrow_forward

- Calculate (a) the amount financed, (b) the total finance charge, and (c) APR by table lookup. (Use Table 14.1.) Purchase price of a used car $ Down payment 4,095 $ 95 Number of monthly payments 60 Amount financed Total of monthly payments $ 5,844 Total finance charge APRarrow_forwardQuestion 4 of 20 Beginning Cash Balance Add O O 10 O O O 10 O 0 0 O O O 0 10 $ -/7.5 E *** SUPPORarrow_forward#9 O Item Prior year Current year Accounts payable 8,193.00 7,858.00 Accounts receivable 6,044.00 6,592.00 Accruals 1,021.00 1,379.00 Cash ??? ??? Common Stock 11,724.00 12,455.00 COGS 12,775.00 18,196.00 Current portion long-term 4,957.00 5,018.00 debt Depreciation expense 2,500 2,754.00 Interest expense 733 417 Inventories 4,101.00 4,775.00 Long-term debt 14,725.00 14,635.00 Net fixed assets 50,550.00 54,207.00 Notes payable 4,377.00 9,925.00 Operating expenses (excl. 13,977 18,172 depr.) Retained earnings 28,729.00 29,950.00 Sales 35,119 47,942.00 Тахes 2,084 2,775 What is the firm's cash flow from investing? Submit Answer format: Number: Round to: 0 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forward

- #9 O Item Prior year Current year Accounts payable 8,113.00 7,909.00 Accounts receivable 6,029.00 6,555.00 Accruals 999.00 1,352.00 Cash ??? ??? Common Stock 11,096.00 12,144.00 COGS 12,698.00 18,074.00 Current portion long-term 4,971.00 4,959.00 debt Depreciation expense 2,500 2,836.00 Interest expense 733 417 Inventories 4,232.00 4,816.00 Long-term debt 14,899.00 14,036.00 Net fixed assets 50,114.00 54,819.00 Notes payable 4,323.00 9,810.00 Operating expenses (excl. 13,977 18,172 depr.) Retained earnings 28,849.00 29,434.00 Sales 35,119 46,806.00 Таxes 2,084 2,775 What is the firm's cash flow from investing? Submit Answer format: Number: Round to: 0 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forwardNonearrow_forwardDomingo Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 1,700 units. The costs and percentage completion of these units in beginning inventory were: Materials costs Conversion costs Cost $ 6,800 $ 3,000 Materials costs Conversion costs A total of 8,100 units were started and 7,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Percent Complete 50% 20% Cost $ 160,000 $ 121,700 The ending inventory was 85% complete with respect to materials and 75% complete with respect to conversion costs. The cost per equivalent unit for materials for the month in the first processing department is closest to:arrow_forward

- Safari 4:22 PM Tue Jan 30 < HW Set 1 (Ch 2 and 3) Template Calibri (Body) fx Enter text or formula here A 1 E 2.16 2 Information for Montgomery, Inc. 3 4 5 6 7 Cash 8 Accounts Receivable 9 Inventory 10 PP&E, net 11 Goodwill NOPAT for 2020 12 Other operating assets 13 A/P 14 Accrued Expenses and other 15 Unearned revenues 16 Long-term debt 17 Common stock 18 19 20 a. 21 NOA for 2019 22 NOA for 2020 23 24 b. 25 26 27 28 29 30 31 32 33 34 35 Retained earnings 2020 FCF E 2.16 E 2.17 E 3.15 11 B HE E 3.18 Home Insert $ BIU C 3,150 2019 3,590 5,650 10,240 21,840 13,160 3,450 10,400 10,350 3,120 7,680 18,840 7,540 + Draw Page Layout ABC 2020 4,260 8,340 11,460 26,110 14,310 4,720 13,310 13,740 4,770 8,350 18,930 10,100 ch LL F Formulas Data G Review View General H < E < H: AH L O M Σ ☎: 50% |||| Oarrow_forward2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 G1 INPUT Month Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 B X WAC Beginning Balance $ 150,000 ✓ fx 8.600% CPR% PASS_THRU RATE D SMM% WAM Mortgage PMT Expected 360 Interest$ paid to Investors G ASS_THRU RAT Scheduled Principal PMT H 8.000% Estimated Principal Pre-PMT POOL$ Total Principal paid to Investors $ 150,000 Total Cash Flow to Investors Pool Fees PSA M 100arrow_forwardExercise Al-9 Payment of payroll deductions LO3 Paradise Hills Berry Farm has 21 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. Gross Pay EI Premium Income Taxes 78,950.00 1,310.57 10,889.00 CPP 3,768.09 Medical Ins. United Way 1,475.00 1,644.00 Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) View transaction list Journal entry worksheet 1 Record the remittance to the Receiver General for Canada. Note: Enter debits before credits. Date April 15 General Journal + Debit Credit View general journal Record entry Clear entryarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education