FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:0.

R

%24

%23

不

0023

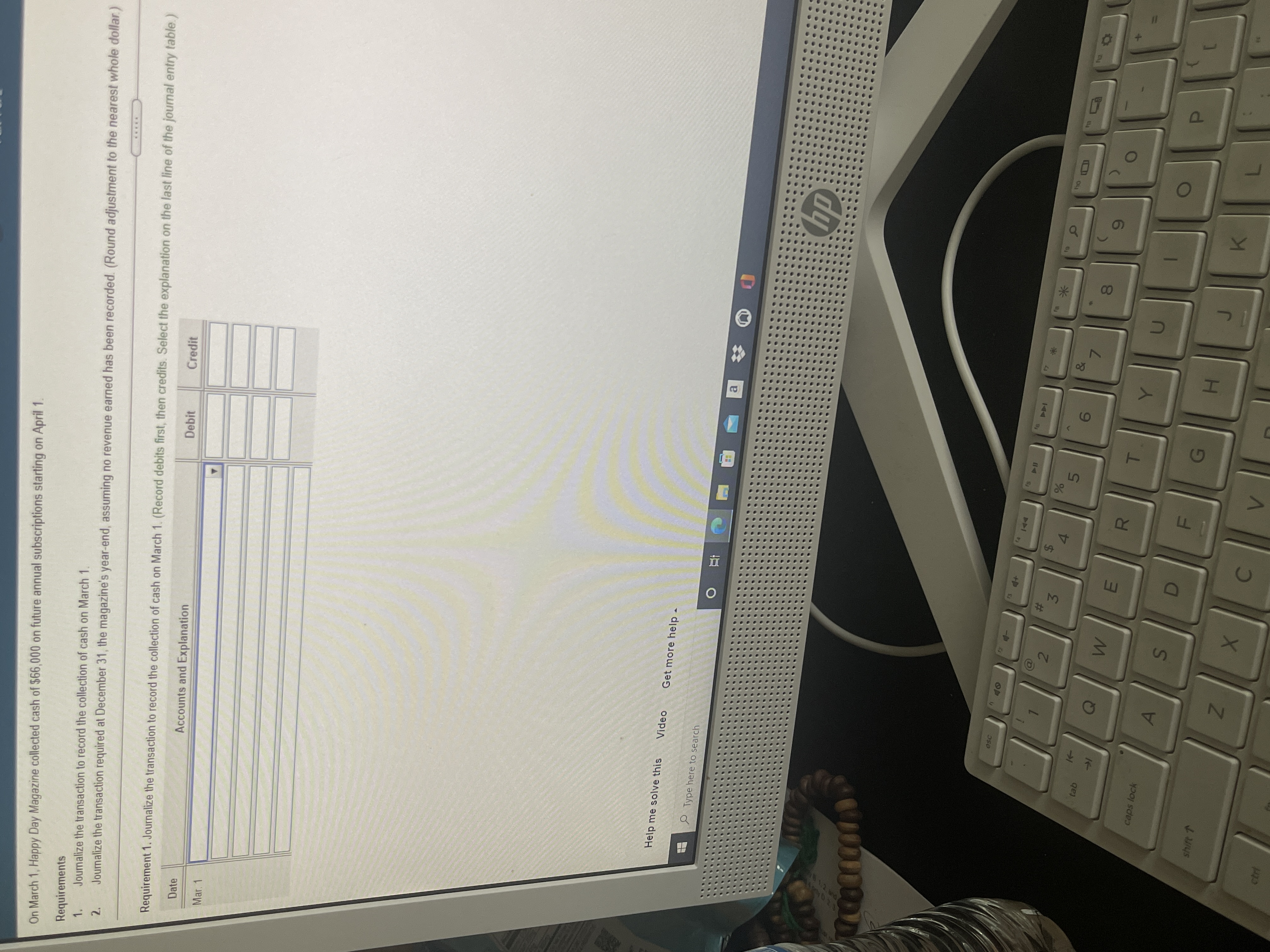

On March 1, Happy Day Magazine collected cash of $66,000 on future annual subscriptions starting on April 1.

Requirements

1.

Jounalize the transaction to record the collection of cash on March 1.

2.

Journalize the transaction required at December 31, the magazine's year-end, assuming no revenue earned has been recorded. (Round adjustment to the nearest whole dollar.)

Requirement 1. Journalize the transaction to record the collection of cash on March 1. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts and Explanation

Debit

Credit

Mar. 1

Help me solve this

Video

Get more help

P Type here to search

立 0

a

esc

94

31

61

4.

米

tab

5.

9.

7.

caps lock

shift 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Records show that $750 of cash receipts originally recorced as unearned admissions revenue had been earned as of December 31. Show calculations where necessary. Calculations: Date Debit Credit Db Crarrow_forwardJournalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Oct. 2: Received $2,730 from William Pruitt and wrote off the remainder owed of $5,650 as uncollectible. If an amount box does not reguire an entry, leave it blank. Oct. 2 Dec. 20: Reinstated the account of William Pruitt and received $5,650 cash in full payment. If an amount box does not require an entry, leave it blank. Dec. 20-Reinstate Dec. 20-Collectionarrow_forwardThe Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: QI $ 210 Sales 02 $ 270 Beginning receivables Sales Cash collections Ending receivables Q3 $ 330 a. Accounts receivable at the beginning of the year are $480. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Beginning receivables Sales Cash collections Ending receivables Q1 210 Q1 04 $480 210 Q2 Q2 270 b. Accounts receivable at the beginning of the year are $480. The company has a 60-day collection period. Calculate cash collections in each of the four quarters by completing the following: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. 270 Q3 Q3 330 330 Drair Q4 Q4 480 480 21.10 Harrow_forward

- R. Phometsi Ltd. Provides you with the following information.2019The imprest amount at the beginning of each is P600. However, on June 1, the pettycashier had P140 cash in hand. The main cashier re-imbursed the petty cashier to have acash float of P600.The following expenses were incurred as petty cash expenses for the month.June DIPLOMA AssignmentJanuary - June BPA612 Principles of Accounting ©BOU 2024 Page 4 of 93. Cleaning expenses P405. Taxi fare P127. Postage stamps P89. Printing expenses P2811. Pen, pencil and eraser P913. Cremora, margarine and peanut butter P42.14. Cleaning expenses P3815. Bus fare. P2417. Postage stamps P1419. Cleaning expenses P32.29. Staples P16.30. Tea, Coffee and sugar P39. Required:a) Prepare a petty cash book with analysis columns for the followings: Cleaningexpenses, General expenses, Postage, Travelling expenses and Stationery.arrow_forwardJournalize the following transactions, using the direct write-off method of accounting for uncollectible receivables. Mar. 17: Received $2,710 from Shawn McNeely and wrote off the remainder owed of $3,630 as uncollectible. If an amount box does not require an entry, leave it blank. Mar. 17 July 29: Reinstated the account of Shawn McNeely and received $3,630 cash in full payment. If an amount box does not require an entry, leave it blank. July 29 July 29arrow_forwardJournal Entries for Accounts and Notes ReceivablePittsburgh, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $33,000, 60 day, eight percent note on account from J. Albert. Aug.7 Received payment from J. Albert on her note (principal plus interest). Sep.1 Received an $39,000, 120 day, nine percent note from R.T. Matthews Company on account. Dec.16 Received a $31,800, 45 day, ten percent note from D. Leroy on account. Dec.30 R.T. Matthews Company failed to pay its note. Dec.31 Wrote off R.T. Matthews account as uncollectible. Pittsburgh, Inc. uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $48,200. An analysis of aged receivables indicates that the desired balance of the allowance account should be $43,000.…arrow_forward

- Journalize the following transactions: i. December 7. Wrote off Wilderness Park Accessories, Inc.'s past-due account as uncollectible. $247.60. M203. ii. iii. December 17. Received cash in full payment of Wilderness Park Accessories, Inc.'s account, previously written as uncollectible, $247.60. M215 and R461. December 23. Wrote off Bart's Landscaping's past-due account as uncollectible, $829.35. M229.arrow_forward16. Jim Havey receives an invoice amounting to $2916 with cash terms of 3/10 prox. and dated June 7. If a partial payment of $1666 is made on July 8, find (a) the credit given for the partial payment and (b) the balance due on the invoice. [7.4]arrow_forwardSubject:- accountingarrow_forward

- The LLYOD bank statement for the month of June shows that there is $13,300 difference with the cash balance per book. The difference occurs on the 12 of June as one of the customers’ outstanding check has been returned because of not sufficient fund. Record the required entries at the end of June.arrow_forwardRecord the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forwardb. The following selected transactions relate to 2 days' cash collections for a firm that maintains a $100 change fund at all times: a. Actual cash in cash register, $5,633; cash receipts per cash register tally, $5,724. b. Actual cash in cash register, $5,866; cash receipts per cash register tally, $5,782. Journalize the sales and cash receipts for each of the 2 days. If an amount box does not require an entry, leave it blank. a. 000 Previousarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education