Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Give answer

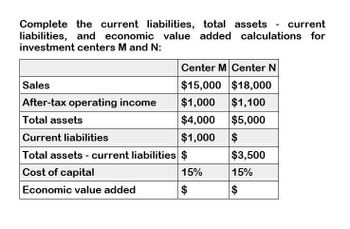

Transcribed Image Text:Complete the current liabilities, total assets - current

liabilities, and economic value added calculations for

investment centers M and N:

Center M Center N

Sales

$15,000 $18,000

After-tax operating income

$1,000

$1,100

Total assets

$4,000

$5,000

Current liabilities

$1,000

$

Total assets - current liabilities $

$3,500

Cost of capital

15%

15%

Economic value added

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give true calculation for this general accounting questionarrow_forwardGeneral Accounting Question Solutionarrow_forwardements What is the total Wealth Accumulation of the following investment assuming the available after tax reinvestment rate is 5%? IRR 10.70% O $4,690,000 O $4,821,078 O $4,848,844 $4,905.989 n 0 $ 1 S 2 $ 3 $ AS 5 $ Investment $ (3,000,000) 240,000 250,000 260,000 266,000 3,674,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you