EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please Need Answer

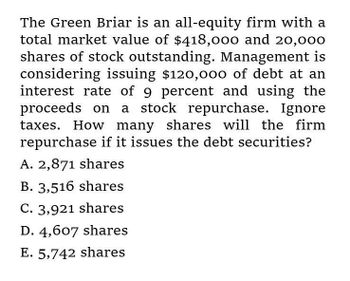

Transcribed Image Text:The Green Briar is an all-equity firm with a

total market value of $418,000 and 20,000

shares of stock outstanding. Management is

considering issuing $120,000 of debt at an

interest rate of 9 percent and using the

proceeds on a stock repurchase. Ignore

taxes. How many shares will the firm

repurchase if it issues the debt securities?

A. 2,871 shares

B. 3,516 shares

C. 3,921 shares

D. 4,607 shares

E. 5,742 shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need helparrow_forwardConsider this example: Shares of Ex Why Zee, Inc. (ticker symbol: XYZ) are currently trading at $6 per share. XYZ plans to issue $6M in short term debt and use the money they borrow to repurchase $6M worth of their own stock. What effect will the debt issuance and share repurchase have on the balance sheet? There isn't enough information to answer this question Assets will increase by $6M Liabilities will decrease by $6M Number of Shares Outstanding will increase by 1 million Equity will decrease by $6Marrow_forwardassume an analyst has valued a stock at $59.75 per share. What was the NPV of the firm if there are $ 3,500,000 shares outstanding and athe market value of the debt is $24,000,000arrow_forward

- The Sweet Melon Corp. has total 100 shares trading on the market at $20 each.The book value of the total equity is $3500.The total market value of debt issurance is $4000.The expected return on total assets is 15% and the expected return on debt is 10%.What is the estimated return on equity? A.17.5% B.25% C.None of the choices D.18.3arrow_forwardA company has the following balance sheet (market values): Liabilities + Equity Debt Equity Assets Cash Operating Assets 600 1000 400 1200 If the firm has 110. find the # of outstanding shares remaining after it repurchases 120 worth of shares: (round your answer to the nearest 0.01)arrow_forwardThe Greenbriar is an all-equity firm with a total market value of $551,000 and 21,700 shares of stock outstanding. Management is considering issuing $153,000 of debt at an interest rate of 9 percent and using the proceeds on a stock repurchase. Ignore taxes. How many shares will the firm repurchase if it issues the debt securities? Multiple Choice • 49,590 shares • 542 shares 6,026 shares 6,695 shares 7,304 sharesarrow_forward

- Give answerarrow_forwardAnswer want nowarrow_forwardAssume JUP has debt with a book value of $20 million, trading at 120% of par value. The firm has book equity of $26 million, and 2 million shares trading at $19 per share. What weights should JUP use in calculating its WACC? O A. 30.97% for debt, 69.03% for equity O B. 34.84% for debt, 65.16% for equity O C. 38.71% for debt, 61.29% for equity O D. 27.1% for debt, 72.9% for equityarrow_forward

- Please Solve this onearrow_forwardNote:- You are attempting question 2 out of 12 Using the following information calculate the WACC of Aqua Ltd. The company has 0.3 million shares outstanding at a price of $92 per share. The beta of common stock of is 1.2. The risk-free rate is 5% and the market risk premium is 7%. The company issued 11% preference shares with a total value of $ 25 million. The company issued 9% bonds of $33.6 million. The company pays corporate tax at 40 percent. A. 9.59% B. 9.89% С. 10.99% D. d.8.35% A Answer Darrow_forward1. What have been the trends in growth/decline of assets, liabilities and stockholders’equity? 2.Review the long-term liability section of the balance sheet and describe the types of debt financing. 3. How many shares of stock does the company have outstandiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT