Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

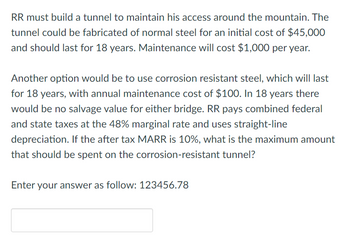

Transcribed Image Text:RR must build a tunnel to maintain his access around the mountain. The

tunnel could be fabricated of normal steel for an initial cost of $45,000

and should last for 18 years. Maintenance will cost $1,000 per year.

Another option would be to use corrosion resistant steel, which will last

for 18 years, with annual maintenance cost of $100. In 18 years there

would be no salvage value for either bridge. RR pays combined federal

and state taxes at the 48% marginal rate and uses straight-line

depreciation. If the after tax MARR is 10%, what is the maximum amount

that should be spent on the corrosion-resistant tunnel?

Enter your answer as follow: 123456.78

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Similar questions

- Celtic Inc. is considering a 16-year project that will generate before tax cash flow of $18,000 peryear for 16 years. The project requires a machine that costs $96,000. The CCA rate is 20% andthe salvage value is $9,600. Celtic has cash of $66,000 and needs to borrow the balance at 6%interest rate to purchase the machine. Celtic is required to repay $10,000 at year 4 and theremaining balance at year 16. The corporate tax rate is 30%.If the weighted average cost of capital is 11% and the machine is the only asset in the assetclass, calculate the NPV of the project using the WACC approach.arrow_forwardRare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The project falls under the government’s subsidy program for encouraging local agricultural products and is eligible for a one-time rebate of 25% on any initial equipment installed for the project. The initial equipment (IE) will cost $41,000,000. An additional equipment (AE) costing $3,500,000 will be needed at the end of year 3. At the end of seven (7) years, the original equipment, IE, will have no resale value but the supplementary equipment, AE, can be sold for $50,000. A working capital of $1,350,000 will be needed. The project is forecast to generate sales of agri-products over the seven years as follows: Year 1 Year 2 Years 3-5 Years 6-7 70,000 units 100,000 units 250,000 units 325,000 units A sale price of $150 per unit for the first two years is expected and then decline to $90 per unit thereafter as the newness of the product loses some sheen. The variable expenses will amount…arrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $157,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44 45 percent, 14 81 percent, and 7.41 percent, respectively. The project will have annual sales of $98,000, variable costs of $27,400, and fixed costs of $12,000. The project will also require net working capital of $2,600 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 10 percent. What is the net present value of this project? Multiple Choice $3112 $3.395 $16.360 56718 $4.645arrow_forward

- A proposed project requires an investment of $250,000 and will require an additional $60,000 for upgrades in year five. The income from the project is expected to be $65,000 in years one through four and $50,000 in years six through seven. In year five, revenue to be in ye of the $60,000 spent for upgrades). There is not salvage value. If the external reinvestment rate of 8% is available, what is the rate of return for this project using the ERR method? $250,000 $65,000 $65,000 $65,000 $65,000 TITT $60,000 $50,000 $50,000arrow_forwardPenn Medical Center, a for-profit entity, is considering the purchase of a 64-slice CT scanner. The cost of the scanner is $5 million. The scanner would be depreciatied over 10 years on a straight line basis to a zero salvage value. The tax rate is 40%. The financing options include either borrowing for the full cost of the scanner or leasing a scanner. The lease option is a 5-year lease with equal before-tax lease payments of $999,000 per year. The borrowing alternative is a 5-year loan covering the entire cost of the scanner at an interest rate of 5% which is also the implied lease rate. The after-tax cost of debt is 3%. a. Calculate the total cost to purchase the CT scanner over 5 years. b. Calculate the total cost to lease the CT sanner over 5 years. c. Should Penn Medical purchase or lease the CT scanner?. You will enter PURCHASE or LEASE for your answer.arrow_forwardCeltic Inc. is considering a 16-year project that will generate before tax cash flow of $18,000 peryear for 16 years. The project requires a machine that costs $96,000. The CCA rate is 20% andthe salvage value is $9,600. Celtic has cash of $66,000 and needs to borrow the balance at 6%interest rate to purchase the machine. Celtic is required to repay $10,000 at year 4 and theremaining balance at year 16. The corporate tax rate is 30%. (a) If the cost of unlevered equity is 12%, the asset class remains open with a positive UCCafter the project ends, and flotation cost is 2% of the amount borrowed, calculate the NPV ofthe project using the APV approach.(b) If the cost of equity is 14% and the asset class remains open with a positive UCC after theproject ends, calculate the NPV of the project using the FTE approach.(c) If the weighted average cost of capital is 11% and the machine is the only asset in the assetclass, calculate the NPV of the project using the WACC approach.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education