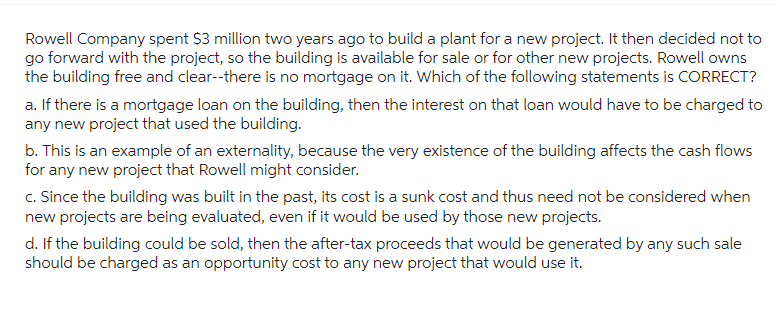

Rowell Company spent $3 million two years ago to build a plant for a new project. It then decided not to go forward with the project, so the building is available for sale or for other new projects. Rowell owns the building free and clear--there is no mortgage on it. Which of the following statements is CORRECT? a. If there is a mortgage loan on the building, then the interest on that loan would have to be charged to any new project that used the building. b. This is an example of an externality, because the very existence of the building affects the cash flows for any new project that Rowell might consider. c. Since the building was built in the past, its cost is a sunk cost and thus need not be considered when new projects are being evaluated, even if it would be used by those new projects. d. If the building could be sold, then the after-tax proceeds that would be generated by any such sale should be charged as an opportunity cost to any new project that would use it.

Rowell Company spent $3 million two years ago to build a plant for a new project. It then decided not to go forward with the project, so the building is available for sale or for other new projects. Rowell owns the building free and clear--there is no mortgage on it. Which of the following statements is CORRECT? a. If there is a mortgage loan on the building, then the interest on that loan would have to be charged to any new project that used the building. b. This is an example of an externality, because the very existence of the building affects the cash flows for any new project that Rowell might consider. c. Since the building was built in the past, its cost is a sunk cost and thus need not be considered when new projects are being evaluated, even if it would be used by those new projects. d. If the building could be sold, then the after-tax proceeds that would be generated by any such sale should be charged as an opportunity cost to any new project that would use it.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter12: Corporations: Organization, Capital Structure, And Operating Rules

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:Rowell Company spent $3 million two years ago to build a plant for a new project. It then decided not to

go forward with the project, so the building is available for sale or for other new projects. Rowell owns

the building free and clear--there is no mortgage on it. Which of the following statements is CORRECT?

a. If there is a mortgage loan on the building, then the interest on that loan would have to be charged to

any new project that used the building.

b. This is an example of an externality, because the very existence of the building affects the cash flows

for any new project that Rowell might consider.

c. Since the building was built in the past, its cost is a sunk cost and thus need not be considered when

new projects are being evaluated, even if it would be used by those new projects.

d. If the building could be sold, then the after-tax proceeds that would be generated by any such sale

should be charged as an opportunity cost to any new project that would use it.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage