Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

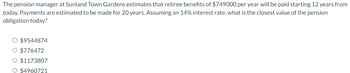

Transcribed Image Text:The pension manager at Sunland Town Gardens estimates that retiree benefits of $749000 per year will be paid starting 12 years from

today. Payments are estimated to be made for 20 years. Assuming an 14% interest rate, what is the closest value of the pension

obligation today?

O $9544874

O $776472

O $1173807

O $4960721

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You target to invest in a pension fund by making annual annuities due for 10 years. The annuity is Ksh 120,000 per year and earns annual interest at 15%. Required Compute the accumulated pension at end of 10th Develop a loan amortisation schedule for the first 10 yearsarrow_forwardFind the amount needed to deposit into an account today that will yield a typical pension payment of $20,000 at the end of each of the next 17 years for the given annual interest rate. (Round your answer to the nearest cent.) 5.9%arrow_forwardA pension plan must make total disbursements of $4.7 million, $6.7 million, $5.7, $3.0 and $1.0 million annually for the next five years, respectively. The fund makes these payments twice a year, paying half of each year's total amount six months into the year and the remaining half at the end of the year.Find the duration of the pension obligations if spot rates are flat at 8%. Group of answer choices 1.91 3.86 4.76 2.00 2.17arrow_forward

- To insure you, Assurances Nochance Ltd offers the following plan: you will pay 20 annual payments of $8,000 starting one year from today. Then, in year 21, you or your heirs will receive a pension for the following 15 years. The discount rate used by the company to calculate your pension is 6%. (a) What is the size of your annual pension? (b) Ifyoucouldtakeaone‐timelumpsumpayment25yearsfromtodayinsteadofthepension,how high would the equivalent lump sum payment have to be?.arrow_forwardProfessor’s Annuity Corp. offers a lifetime annuity to retiring professors. For a payment of $350,000 at age 65, the firm will pay the retiring professor $2,800 a month until death. If the professor’s remaining life expectancy is 30 years, what is the monthly rate on this annuity? What is the effective annual rate?arrow_forward1. Company has an plan to provide a pension plan for its one employee. They plan to start saving on 12/31/2020 and will save the same amount at the end of each year for 4 years ending at 12/31/2023. Once the money is accumulated on 12/31/2023. They will place in in an investment that will earn 9% annual interest. The company will pay $6,000 at the start of year year starting 1/1/2025 and continuing 4 more years to 1/1/2029 total of 5 payments. How much money will the company need to have collected at 1/1/2024 in order to start payming the annuity of $6,000 a year earning 9% annual interest rounded to the nearest full dollar? my answer was $30,000 or $66,6667. What am I doing wrong or how do I calculate this question? 2. If the amount of money the company sets aside is $25,000 at 12/31/2023 then if the amount the company needs to set aside every year is $5,887 starting 12/31/2020 then what interest does this account earn annually? my answer was 6% but I don't think that is correct how…arrow_forward

- Suppose that a life insurance company has guaranteed a payment of $14 million to a pension fund 4.5 years fromfund and can invest the entire premium for 4.5 years at an annual interest rate of 6.25%, how much will the life in$13.7 million$17.8 million$18.4 million$14.1 millionarrow_forwardYour employer contributes $500 per month, at the beginning of each month, to a retirement fund on your behalf. The contributions earn interest at a rate of 6% per year, compounded monthly. At the end of twenty years, what will be the balance of the fund? Group of answer choices $69,790 $232,175 $70,139 $220,713 $231,020arrow_forwardCalculate the present value of a retirement fund if you put $1,750 in your savings account at the end of each of each quarter for the next 35 years? Assume that your savings account pays 8% compounded quarterly. O $20,277.13 O$82,030.04 O $83,670.64 O None of the answers are correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education