Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Typed plz and asap thanks

One more thing I have posted 3 questions before this one but I did not get any answer of any one of them i want my questions back

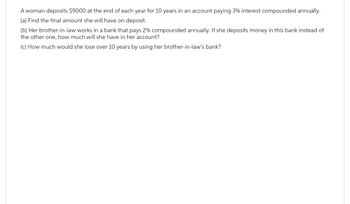

Transcribed Image Text:A woman deposits $9000 at the end of each year for 10 years in an account paying 3% interest compounded annually.

(a) Find the final amount she will have on deposit.

(b) Her brother-in-law works in a bank that pays 2% compounded annually. If she deposits money in this bank instead of

the other one, how much will she have in her account?

(c) How much would she lose over 10 years by using her brother-in-law's bank?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- u Online Cour X (78) Whats x M Your AccoL X M Inbox (2,74 X SP2021-AC X Answered: Ek My Home * CengageN X Bartleby Q x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10. M Gmail > YouTube Fourth Homework O eBook Patents 6. MC.12.06 Instructions Chart Of Accounts General Journal 7. MC.12.07 Instructions 8. MCС.12.08 Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, $72,000. The patent has a remaining legal life of 9 years. 9. МC.12.09 Required: 10. MC.12.10 Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the 11. RE.12.01.BLANKSHEET straight-line method over the life of the asset. 12. RE.12.02 13. RE.12.03.BLANKSHEET 14. RE.12.04.BLANKSHEET 15. RE.12.05.BLANKSHEET 16. RE.12.06.BLANKSHEET 17. RE.12.07.BLANKSHEET 18. RE.12.08 O V I 12:52arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward* My Home x : CengageNOWv2 | Online teachin x b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false M Gmail YouTube Maps Blackboard HW #10 - Chpt 22 1 eBook E Print Item Schedule of Cash Payments for a Service Company Oakwood Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $124,500 April 115,800 Мay 105,400 Depreciation, insurance, and property taxes represent $26,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 60% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Oakwood Financial Inc.…arrow_forward

- 1 ← → C M Gmail of 4 Book rences Assignments: ACC 211 A F Prin X esc ! YouTube Maps M Question 7 - Chapter 5, Assign X M Connect ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252F... January 1 April 1 October 1 O Porter's Five Forc... Required information [The following information applies to the questions displayed below.] The following information pertains to the inventory of Parvin Company during Year 2. Beginning Inventory Purchased Purchased Parvin Company Cash Flows from Operating Activities FIFO Cash flows from operating activities: Cash inflow from customers Cash outflow for inventory Cash outflow for operating expenses Cash outflow for income tax expense Net cash flow from operating activities During Year 2, Parvin sold 3,500 units of inventory at $80 per unit and incurred $46,000 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All…arrow_forwardhow do I do thisarrow_forward7:27 f t < Session[1].docx - Word ✓ Qo 138 - 21 Paragraph O References Mailings Review View Help BLUEBEAM One day you're going to miss my boring texts ## TO Accessibility: Investigate Search Costs to date Estimated costs to complete Progress billings during the year Cash collected during the year hoher webb ng Normal ||| No Spacing Styles Acrobat 2021 $ 980,000 3,020,000 1,000,000 648,000 Go to website O Heading 1 √ Calculate the amount will be reported for accounts receivable on the statement of financial position at December 31, 2022. 3. Accounts Receivable on the Statement of Financial Position at December 31, 2022 for Newton Corp.: Accounts Receivable is calculated as the cumulative billings to date minus the cumulative cash collected: Accounts Receivable at December 31, 2022 = Cumulative Billings- Cumulative Cash Collected Accounts Receivable at December 31, 2022 = ($1,000,000+ $1,000,000) - ($648,000+ $1,280,000) = $2,000,000 - $1,928,000 = $72,000 Therefore, the amount reported…arrow_forward

- - Homework A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co... E User Management,.. H https://outlook.offi.. O FES Protection Plan System 7- North C.. 用Re mework Exercises i Soved Help Save & Exit Submit Check my work Required: Record the following transactions of Fashion Park in a general journal, Fashion Park must charge 6 percent sales tax on all sales. The company uses the perpetual inventory system. (Round your intermediate calculations and final answers to the nearest whole dollar value.) DATE TRANSACTIONS 20X1 Sold merchandise for cash, $2,540 plus sales tax. The cost of merchandise sold was $1,540. The customer purchasing merchandise for cash on April 2 returhed $270 of the merchandise; provided a cash refund to the customer. The cost of returned merchandise was $170. Sold merchandise on credit to Jordan Clark; issued Sales Slip 908 for $1,090 plus tax, terms n/30. The cost of the merchandise sold was…arrow_forward同 Mail - Edjouline X Bb Content- ACG2 X CengageNOWv X (58) YouTube + Microsoft Office X PowerPoint from Towards a A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%=Dassignments&takeAssignmentSessionLocator=assignment-take&inpro. of mail YouTube Maps eBook Show Me How apter Nine Determine Due Date and Interest on Notes .09-03.BLANKSHEET Determine the due date and the amount of interest due at maturity on the following notes: L09-04.BLANKSHEET Date of Note Face Amount Interest Rate Term of Note 09-03.ALGO January 10* $40,000 90 days a. b. March 19 180 days 000 8. 09-04.ALGO June 5 30 days 000'06 d. September 8 90 days 90-60 3. 000'9E e. November 20 60 days 9-11 4. 000' *Assume that February has 28 days. 9-12 Assume 360-days in a year when computing the interest. -19 Note Due Date Interest > -20 (2) (b) 9-22 -24 (p) (a) 890- 8/12 items Check My Work ( Previous Next LE V O 10: Narrow_forwardBookmarks People Tab Window Help 192.168.1.229 60 83% Wed 12:20 PM Chapter 10 Homework (Applice X CengageNOWv2 | Online teach x lim/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ☆ 青N Login Common A... A Common Black Co... *No Fear Shakespe... b Hamlet, Prince of... E 12th Grade PVA H.. O Paraphrasing Tool.. eBook Labor Variances. Verde Company produces wheels for bicycles. During the year, 656,000 wheels were produced. The actual labor used was 364,000 hours at $9.20 per hour. Verde has the following labor standards: 1) $10.40 per hour; 2) 0.48 hour per wheel. Required: 1. Compute the labor rate variance. 2. Compute the labor efficiency variance. Previous Next Check My Workarrow_forward

- * CengageNOWv2 | Online teachin X b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * D 9 : M Gmail O YouTube Maps Blackboard HW #9 - Chpt 21 O eBook Show Me How E Print Item 1. TMM.21.01 Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): 2. TMM.21.02 Sales $14,100 3. TMM.21.03 Food and packaging $5,994 Рayroll 3,600 4. TMM.21.04 Occupancy (rent, depreciation, etc.) 1,986 5. EX.21,01 General, selling, and administrative expenses 2,100 $13,680 6. EX.21.02 Income from operations $420 7. EX.21.03 Assume that the variable costs consist of food and packaging; payroll; and 40% of the general, selling, and administrative expenses. 8. EX.21.06.ALGO a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million 9. EX.21.09.ALGO b. What is Wicker…arrow_forwarde Chrome File Edit View History Gbjs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Siç x Window Help M Question 5- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 3 Homework Saved 。 Help Save LO 5 9.25 points eBook Hint Ask Print References Exercise 3-8 (Algo) Adjusting and paying accrued expenses LO P3 a. On April 1, the company hired an attorney for April for a flat fee of $2,000. Payment for April legal services was made by the company on May 12. b. As of April 30, $2,102 of interest expense has accrued on a note payable. The full interest payment of $6,307 on the note is due on May 20. c. Total weekly salaries expense for all employees is $11,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. The above…arrow_forwardFile Edit View History Bookmarks Profiles estion 4 - Proctoring Enable X getproctorio.com/secured #lockdown ctoring Enabled: Chapter 6 Homework Assignm... i 4 kipped ic raw 511 F CUNY Login 2 Req 1 Req 2 to 4 #3 Complete this question by entering your answers in the tabs below. с Tab How many performance obligations are in this contract? Number of performance obligations $ Window Help st X 4 Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada. On March 1, 2024, Barrick Gold receives $150,000 from Citizen Bank and promises to deliver 95 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Barrick Gold delivers the products to Brink's, a third-party carrier. In addition, Barrick Gold has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education