FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General Accounting

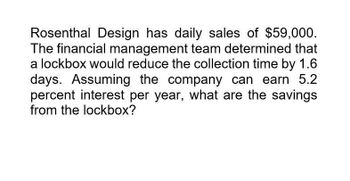

Transcribed Image Text:Rosenthal Design has daily sales of $59,000.

The financial management team determined that

a lockbox would reduce the collection time by 1.6

days. Assuming the company can earn 5.2

percent interest per year, what are the savings

from the lockbox?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Carla Vista Design has daily sales of $54,000. The financial management team has determined that a lockbox would reduce the collection time by 1.7 days. Assuming the company can earn 4.1 percent interest per year, what are the savings from the lockbox? (Round answer to 2 decimal places, e.g. 12.25.) what is the Savings from the lockbox per year?arrow_forwardACE Design has daily sales of $52,000. The financial management team has determined that a lockbox would reduce the collection time by 2.9 days. Assuming the company can earn 6.8 percent interest per year, what are the savings from the lockbox? (Round answer to 2 decimal places, e.g. 12.25.) Savings from the lockbox $__________ per yeararrow_forwardMacy's Design has daily sales of $42,000. The financial management team has determined that a lockbox would reduce the collection time by 1.2 days. Assuming the company can earn 7.9 percent interest per year, what are the savings from the lockbox? (Round answer to 2 decimal places, e.g. 12.25.)arrow_forward

- Rosenthal design. ...accounting questionsarrow_forwardIvanhoe Traders has annual sales of $1,600,000. The firm's financial manager has determined that using a lockbox will reduce collection time by 2.1 days. If the firm's opportunity cost on savings is 4.90 percent, what are the savings from using the lockbox? (Do not round itermediate calculations. Use 365 days for calculation. Round answer to 2 decimal places, e.g. 12.25.) what is the Savings from using the lockbox?arrow_forwardA new delivery van costs $20,000 and can be financed for 60 months with a $4,000 down payment. I.M.’s bank will finance the van at 5.5 percent compounded monthly, and you calculated his weighted average cost of capital at 8 percent. How do you figure out the monthly payment for the van?arrow_forward

- Company XYZ has annual credit sales of $2,500,000. Collection of the credit sales are evenly spread out over the 250 working days per year. The company’s annual cost of borrowing is 7%. How much would XYZ save each year by improving its receivables process by one day?arrow_forwardA store plans on investing on a new grill oven that costs P100,000. It will generate revenues of P2,500 per day and expenses of P800 per day. Suppose the store will be operating 320days in a year. Evaluate the acceptability of this investment if the grill oven will have a life span of six years and MARR is 10% per year. Use PW method. WhatisIRR?arrow_forwardA company has just sold a product with the following payment plan: $75, 000 today, $50, 000 at the end of year 1. and $25, 000 at the end of year two. If the payments are deposited into an account earning 4.5% per year, calculate the present value for the cash flow. Show steps using ONLY a financial calculator. The answer should be 145,740.arrow_forward

- Your firm spends $5,000 every month on printing and mailing costs, sending statements to customers. If the interest rate is 0.5% per month, what is the present value of eliminating this cost by sending the statements electronically?arrow_forwardLeyton Lumber Company has sales of $12 million per year, all oncredit terms calling for payment within 30 days, and its accounts receivable are $1.5 million.What is Leyton’s DSO, what would it be if all customers paid on time, and how much capitalwould be released if Leyton could take action that led to on-time payments?arrow_forwardCompany investment says will pay out $64,000 at the end of 3 years. To invest, you'll need to deposit $9,900 to their bank account and keep the information private. What is the average annual return on this investment? Remember to use a TVM function. the answer is provided: 86.29% Please show how to get on EXCEL in one functionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education