FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

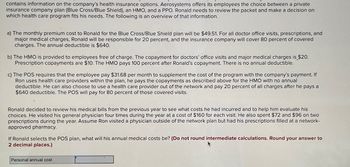

Transcribed Image Text:contains information on the company's health insurance options. Aerosystems offers its employees the choice between a private

insurance company plan (Blue Cross/Blue Shield), an HMO, and a PPO. Ronald needs to review the packet and make a decision on

which health care program fits his needs. The following is an overview of that information.

a) The monthly premium cost to Ronald for the Blue Cross/Blue Shield plan will be $49.51. For all doctor office visits, prescriptions, and

major medical charges, Ronald will be responsible for 20 percent, and the insurance company will cover 80 percent of covered

charges. The annual deductible is $640.

b) The HMO is provided to employees free of charge. The copayment for doctors' office visits and major medical charges is $20.

Prescription copayments are $10. The HMO pays 100 percent after Ronald's copayment. There is no annual deductible.

c) The POS requires that the employee pay $31.68 per month to supplement the cost of the program with the company's payment. If

Ron uses health care providers within the plan, he pays the copayments as described above for the HMO with no annual

deductible. He can also choose to use a health care provider out of the network and pay 20 percent of all charges after he pays a

$640 deductible. The POS will pay for 80 percent of those covered visits.

Ronald decided to review his medical bills from the previous year to see what costs he had incurred and to help him evaluate his

choices. He visited his general physician four times during the year at a cost of $160 for each visit. He also spent $72 and $96 on two

prescriptions during the year. Assume Ron visited a physician outside of the network plan but had his prescriptions filled at a network-

approved pharmacy.

If Ronald selects the POS plan, what will his annual medical costs be? (Do not round intermediate calculations. Round your answer to

2 decimal places.)

Personal annual cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assuming that the cost of medical care rises 7 percent over the next year, what would the actuarially fair premium be for the next year (2019)? Total expected expenditure in 2019 = ?arrow_forwardYou and your spouse are in good health and have reasonably secure careers. Each of you makes about $40,000 annually. You own a home with an $80,000 mortgage, and you owe $15,000 on car loans, $5,000 on personal debts, and $4,000 on credit card loans. You have no other debt. You have no plans to increase the size of your family in the near future. Estimate your insurance needs using the DINK method. Show work!arrow_forward(Click on the into a spreadsheet.) Annuity B C Premium paid today $24.098.32 $22,274.30 $31,240.13 $30,150.95 Annual benefit $3,200 $4100 $4,000 $4,200 Life (years) 20 10 15arrow_forward

- Nonearrow_forwardBhupatbhaiarrow_forwardg. Living Expenses: Assume reasonable values for your living expenses. (You may adjust these numbers to fit your estimated costs, but a good starting point for monthly costs are Utilities: $150, TV: $40, Internet: $30, Cell Phone: $40, Phone: $40) You should also include estimates for food, gas, entertainment, and any other expense you can think of. What is your monthly payment for all of your living expenses?arrow_forward

- Bobbi Hilton, 62, is considering the purchase of a 77-year long-term care policy. If nursing home costs average $7 comma 3907,390 per month in her area, how much could she have to pay out-of-pocket for 77 years without long-term care insurance? What can Bobbi do to reduce the cost of this coverage? Question content area bottom Part 1 The amount Bobbi would have to pay out-of-pocket for 77 years of nursing home costs without long-term care insurance is arrow_forwardSuppose you have just graduated from college and are deciding on a career. Two career options, along with your expected salary in each of three earning periods, are displayed in the table below. Assume that any career will last only three periods before retirement. Occupation Pediatrician Teacher Period 0 Period 1 Period 2 4 5 20 2 4 5 Calculate the net present value (NPV) of your lifetime eamings should you choose to pursue a career in pediatrics if your discount factor 8 = 0.7 Please round your answer to 1 decimal placearrow_forward1. A 40 year old man in the U.S has a 0.242% risk of dying during the next year. An insurance company charges $260 per year for a life-insurance policy that pays a $100,000 death benefit. What is the expected value for the person buying the insurance? Round the answer to the nearest dollar.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education