FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

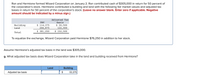

Transcribed Image Text:Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $305,000 in return for 50 percent of

the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax

bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative

amount should be indicated by a minus sign.)

Adjusted Tax

FMV

Basis

Building

$ 114,375

266,875

$ 381,250

$30,500

Land

122,000

$ 152,500

Total

To equalize the exchange, Wizard Corporation paid Hermione $76,250 in addition to her stock.

Assume Hermione's adjusted tax basis in the land was $305,000.

g. What adjusted tax basis does Wizard Corporation take in the land and building received from Hermione?

Land

Building

Adjusted tax basis

$

53,375

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answerarrow_forwardGopher Corporation began the year with a large amount of accumulated earnings and profits and ended the year reporting taxable income of $100,000. Gopher wants to distribute its after-tax earnings to its sole shareholder, Sven Anderson. The dividend would meet the requirements to be a qualified dividend, and Sven is subject to a tax rate of 15 percent on dividend income. What is the amount of the dividend distribution and how much income does Sven realize after taxes? Answer is not complete. Corporate income Corporate tax Dividend distribution to Seven Shareholder tax Total after tax income $100,000 $105,000 x $ 15,000arrow_forwardRiverbend Incorporated received a $200,000 dividend from stock it held in Hobble Corporation. Riverbend's taxable income is $2,100,000 before deducting the dividends-received deduction (DRD) and a $100,000 charitable contribution. Use Exhibit 13-7. Note: Round your tax rates to 2 decimal places. Leave no answer blank. Enter zero if applicable. Required: a. What is Riverbend's deductible DRD assuming it owns 10 percent of Hobble Corporation? b. Assming that it owns 10 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend? c. What is Riverbend's DRD assuming it owns 60 percent of Hobble Corporation? d. Assming that it owns 65 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend? e. What is Riverbend's DRD assuming it owns 85 percent of Hobble Corporation (and is part of the same affiliated group)? f. Assming that it owns 85 percent of Hobble Corporation (and is part of the same affiliated group), what is Riverbend's marginal…arrow_forward

- Nonearrow_forwardTim contributes equipment with a tax basis of $150,000 and a FMV of $170,000 in exchange for 100% of the stock of Blue corporation and $30,000 cash. As a result, Tim will recognize a gain of $30,000 for the cash received. True Falsearrow_forwardHarry, Hermione, and Ron formed an S corporation called Bumblebore. Harry and Hermione both contributed cash of $36,700 to get things started. Ron was a bit short on cash but had a parcel of land valued at $85,700 (basis of $73,400) that he decided to contribute. The land was encumbered by a $49,000 mortgage. What tax bases will each of the three have in his or her stock of Bumblebore?arrow_forward

- Last year, lana purchased a $100,000 account receivable for $90,000. During the current year, Lucy collected $97,000 on the account. What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected. a.$7,000 gain b.$3,000 loss c.$13,000 loss d.$2,000 gainarrow_forward7.Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam will contribute inventory valued at $100,000 in return for 80 percent of the stock in the corporation. Sam’s tax basis in the inventory is $60,000. Devon will receive 20 percent of the stock in return for providing accounting services to the corporation (these qualify as organizational expenditures). The accounting services are valued at $25,000. (Negative amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) What amount of income gain or loss does Sam realize on the formation of the corporation? What amount, if any, does he recognize? Income Gain or loss realizedIncome Gain or loss recognizedarrow_forwardH5.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education