FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

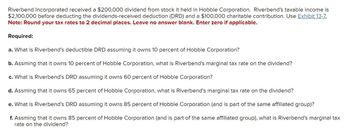

Transcribed Image Text:Riverbend Incorporated received a $200,000 dividend from stock it held in Hobble Corporation. Riverbend's taxable income is

$2,100,000 before deducting the dividends-received deduction (DRD) and a $100,000 charitable contribution. Use Exhibit 13-7.

Note: Round your tax rates to 2 decimal places. Leave no answer blank. Enter zero if applicable.

Required:

a. What is Riverbend's deductible DRD assuming it owns 10 percent of Hobble Corporation?

b. Assming that it owns 10 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend?

c. What is Riverbend's DRD assuming it owns 60 percent of Hobble Corporation?

d. Assming that it owns 65 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend?

e. What is Riverbend's DRD assuming it owns 85 percent of Hobble Corporation (and is part of the same affiliated group)?

f. Assming that it owns 85 percent of Hobble Corporation (and is part of the same affiliated group), what is Riverbend's marginal tax

rate on the dividend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Carter Corporation reports the following for the current taxable year: Gross income from operations $660,000 Dividends from 25%-owned corporation $300,000 Operating expenses $700,000 What is Carter’s taxable income?arrow_forwardM.18.arrow_forwardDuring the current year, Swallow Corporation, a calendar year C corporation, has the following transactions: Income from operations $660,000 Expenses from operations 760,000 Dividends received from Brown Corporation 240,000 Click here to view the dividend received deduction table. Question Content Area a. Swallow Corporation owns 12% of Brown Corporation's stock. How much is Swallow's taxable income or NOL for the year? Swallow's taxable income after deducting the dividends received deduction is $fill in the blank fd6fd0f8303e049_2 . Feedback Area Feedback The purpose of the dividends received deduction is to mitigate multiple taxation of corporate income. Without the deduction, income paid to a corporation in the form of a dividend would be taxed to the recipient corporation with no corresponding deduction to the distributing corporation. Later, when the recipient corporation paid the income to its shareholders, the income would again be subject to taxation with no corresponding…arrow_forward

- X Corp has $200,000 of gross receipts from sales, $300,000 of operating expenses, and $150,000 of dividends received from a 10% owned corporation. What is X Corp's dividends-received deduction? 25,000arrow_forwardX Corporation was formed in Year 1. In Year 1, X Corporation: (i) received $100,000 of revenue, (ii) a $20,000 dividend distribution from Y Corporation (X owned less than 1% of Y and received a $10,000 DRD) (iii) purchased a Section 179 asset for $10,000, (iv) paid $21,000 of federal tax and (v) distributed $10,000 cash to each of its two shareholders A and B. In Year 2, X received $50,000 of revenue and contributed $12,000 to cash to a qualified charity. X made no distributions in Year 2. a. What is X' Accumulated E&P at the beginning of Year 2? (Write your answer as a number only, i.e. $5,000) b. What is X' Accumulated E&P at the beginning of Year 3? (Write your answer as a number only, i.e. $12,000)arrow_forwardWasatch Corporation (WC) received a $200,000 dividend from Tager Corporation (TC). WC owns 15 percent of the TC stock. Compute WC's deductible DRD in each of the following situations: e. WC's taxable income (loss) without the dividend income or the DRD is $(500,000). Deductible DRDarrow_forward

- Garrison holds a controlling interest in Robertson’s outstanding stock. For the current year, the following information has been gathered about these two companies: Garrison RobertsonSeparate $300,000 $200,000operating income (includes $50,000 intra-entity gross profit in ending inventory)Dividends paid ...32,000 50,000Tax rate . . . . . . . . . 40% 40% Garrison uses the initial value method to account for the investment in Robertson. Garrison’s separate operating income figure does not include dividend income for the current year.a. Assume that Garrison owns 80 percent of Robertson’s voting stock. On a consolidated tax return, what amount of income tax is paid?b. Assume that Garrison owns 80 percent of Robertson’s voting stock. On separate tax returns, what total amount of income tax is paid?c. Assume that Garrison owns 70 percent of Robertson’s voting stock. What total amount of income…arrow_forwardOdom Ltd purchased a 30% shareholding in Bryant Ltd on 1 Jan 20X7 for $60 000. This purchase resulted in Odom Ltd having significant influence over Bryant Ltd. Bryant's assets were recorded at fair values and its owners' equity, totalling $180 000, was: Share capital $80 000 Reserves $60 000 Retained profits $40 000 During 20X7 Bryant Ltd reported profit of $100 000, from which a dividend of $60 000 was paid. Also, during the year, Bryant revalued its assets upwards by $50 000, and sold inventories to Willams Ltd which is the subsidiary of Odom. Bryant made a profit of $4,000. Half of the inventories were still held by Willams by the year-end. Odom Ltd has an 80% equity interest in Willams Ltd. Required: Prepare journal entries for Odom Ltd to account for its investment in Bryant Ltd using the Equity Method. Use the Reclassification Method to account for the profit and dividends that Odom shares from Bryant. (Using the provided journal entry template to enter your answer;…arrow_forwardMozart Co. owns 35% of Melody Inc. Melody pays $50,000 in cash dividends to its shareholders for the period. Mozart's entry to record the Melody dividend includes a? O Debit to Cash for $50,000 O Credit to Cash for $17,500 Credit to Investment Revenue for $50,000 O Credit to Equity Method Investments for $17,500arrow_forward

- Bethel Corporation distributed $125,000 to its shareholders on December 31, 1997, the end of its taxable year. Bethel's capital structure was as follows: Capital stock--5,000 shares issued and outstanding $500,000 Current earnings and profits 1/1/97 - 12/31/97 $ 15,000 Accumulated earnings and profits 3/1/93 - 12/31/96 $ 75,000 Mr. Rutland held 200 shares of Bethel Corporation's stock. His basis in the stock was $100 per share. How much of the Bethel Corporation distribution is a dividend to Mr. Rutland? Which answer is correct to this question? A)$1400; B)3,000; C)3,600; D)$5,000arrow_forwardMartin Corporation's accumulated E\&P Was($500,000)at the beginning of the year and Martin Corporation reported current E\&P of$200,000this year. Martin distributed$400,000cash to its sole shareholder, Craig, on the last day of the tax year. Craig's basis in his Martin Corporation stock before the distribution is$60,000. 1. How much of the distribution is a dividend to Craig? 2. What is Craig's stock basis in Martin after the distribution? 3. How much of the distribution is a capital gain to Craig? If any of the answers are−0-, do not leave blank. Put−0-arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education