FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is answer for this Question?

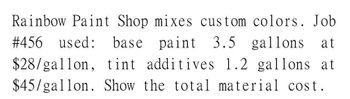

Transcribed Image Text:Rainbow Paint Shop mixes custom colors. Job

#456 used: base paint 3.5 gallons at

$28/gallon, tint additives 1.2 gallons at

$45/gallon. Show the total material cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Want Correct Answerarrow_forwardSnapware Systems produces commercial strength cleansing supplies. Two of its main products are window cleaner that uses ammonia, and floor cleaner that uses bleach. Information for the most recent period follows: Product Names Window Cleaner (ammonia) Floor Cleaner (bleach) Direct materials information: Standard ounces per unit 16 oz. 24 oz. Standard price per ounce $0.75 ? Actual quantity used per unit 20 oz. 22 oz. Actual price paid for material $1.00 $0.90 Actual quantity purchased and used 1,500 oz. 2,800 oz.. Price variance ? $300 U Quantity variance $1,500 U ? Total direct materials variance ? $678 F Number of units produced 500 600 What is the standard price for bleach? Select one: a. $0.88/oz. b. $1.09/oz. c. $1.14/oz. d. $0.79/oz. e. $0.92/oz.arrow_forwardDeporte Company produces single-colored t-shirts. Materials for the shirts are dyed in large vats. After dying the materials for a given color, the vats must be cleaned and prepared for the next batch of materials to be colored. The following standards for changeover for a given batch have been established: Direct materials (2.4 lbs. @ $0.95) $2.28 Direct labor (0.75 hr. @ $7.40) 5.55 Standard prime cost $7.83 During the year, 79,500 pounds of material were purchased and used for the changeover activity. There were 30,000 batches produced, with the following actual prime costs: Direct materials $67,410 Direct labor $182,991 (for 22,450 hrs.) Required: Compute the materials and labor variances associated with the changeover activity, labeling each variance as favorable or unfavorable. Material Variances Price variance $fill in the blank 1 Usage variance $fill in the blank 3 Labor Variances Rate variance $fill in the blank 5 Efficiency…arrow_forward

- Deporte Company produces single-colored t-shirts. Materials for the shirts are dyed in large vats. After dying the materials for a given color, the vats must be cleaned and prepared for the next batch of materials to be colored. The following standards for changeover for a given batch have been established: Direct materials (2.4 lbs. @ $0.95) $2.28 Direct labor (0.75 hr. @ $7.40) 5.55 Standard prime cost $7.83 During the year, 79,500 pounds of material were purchased and used for the changeover activity. There were 30,000 batches produced, with the following actual prime costs: Direct materials $ 63,000 Direct labor $163,385 (for 22,450 hrs.) Required: Compute the materials and labor variances associated with the changeover activity, labeling each variance as favorable or unfavorable.arrow_forwardDeporte Company produces single-colored t-shirts. Materials for the shirts are dyed in large vats. After dying the materials for a given color, the vats must be cleaned and prepared for the next batch of materials to be colored. The following standards for changeover for a given batch have been established: Direct materials (2.4 lbs. @ $0.95) $2.28 Direct labor (0.75 hr. @ $7.40) 5.55 Standard prime cost $7.83 During the year, 79,500 pounds of material were purchased and used for the changeover activity. There were 30,000 batches produced, with the following actual prime costs: Direct materials $73,710 Direct labor $189,527 (for 22,450 hrs.) Required: Compute the materials and labor variances associated with the changeover activity, labeling each variance as favorable or unfavorable. Material Variances Price variance $ Usage variance $ Labor Variances Rate variance $ Efficiency variance $arrow_forwardCoronado, Ltd. manufactures shirts, which it sells to customers for embroidering with various slogans and emblems. The standard cost card for the shirts is as follows. Standard Price Standard Quantity Standard Cost Direct materials $3 per yard 2.00 yards $6.00 Direct labor $14 per DLH 0.75 DLH 10.50 Variable overhead $3.20 per DLH 0.75 DLH 2.40 Fixed overhead $3 per DLH 0.75 DLH 2.25 $21.15 Sandy Robison, operations manager, was reviewing the results for November when he became upset by the unfavorable variances he was seeing. In an attempt to understand what had happened, Sandy asked CFO Suzy Summers for more information. She provided the following overhead budgets, along with the actual results for November.The company purchased 82,400 yards of fabric and used 94,000 yards of fabric during the month. Fabric purchases during the month were made at $2.80 per yard. The direct labor payroll ran…arrow_forward

- Concord, Ltd. manufactures shirts, which it sells to customers for embroidering with various slogans and emblems. The standard cost card for the shirts is as follows. Standard Price Standard Quantity Standard Cost Direct materials $3 per yard 2.00 yards $6.00 Direct labor $14 per DLH 0.75 DLH 10.50 Variable overhead $3.20 per DLH 0.75 DLH 2.40 Fixed overhead $3 per DLH 0.75 DLH 2.25 $21.15 Sandy Robison, operations manager, was reviewing the results for November when he became upset by the unfavorable variances he was seeing. In an attempt to understand what had happened, Sandy asked CFO Suzy Summers for more information. She provided the following overhead budgets, along with the actual results for November.The company purchased 82,100 yards of fabric and used 93,700 yards of fabric during the month. Fabric purchases during the month were made at $2.80 per yard. The direct labor payroll ran…arrow_forwardDesigner Furniture Company manufactures designer home furniture. Designer Furniture uses a standard cost system. The direct labor, direct materials, and factory overhead standards for a finished dining room table are as follows: Line Item Description Classification Value Direct labor: standard rate $24.00 per hr. Direct labor: standard time per unit 3.50 hrs. Direct materials (oak): standard price $8.50 per bd. ft. Direct materials (oak): standard quantity 15 bd. ft. Variable factory overhead: standard rate $3.20 per direct labor hr. Fixed factory overhead: standard rate $0.80 per direct labor hr. a. Determine the standard cost per dining room table. Round to two decimal places.fill in the blank 1 of 1$ per tablearrow_forwardThe question and answer choices are in the photo provided.arrow_forward

- Lally, Inc. produces universal remote controls. Lally uses a JIT costing system. One of the company's products has a standard direct materials cost of $9 per unit and a standard conversion cost of $35 per unit. During January 2018, Lally produced 500 units and sold 495 units on account at $45 each. It purchased $4,800 of direct materials on the account and incurred actual conversion costs totaling $14,000. Requiremets : 1. Prepare summary jounal entries for January. 2. The January 1, 2018, balance of the Raw and In-Process inventory account was $70. Use a T - account to find the January 31 balance. 3. Use a T - account to determine wheither conversion costs are overallocated or unerallocated for the month. By how much? Prepare the journal entry to adjust the Conversion Costs account.arrow_forwardExercise 1) Deporte Company produces single-colored t-shirts. Material for the shirts are dyed in large vats. After dying the materials for a given color, the vats must be cleaned and prepared for the next batch of materials to be colored. The following standards for changeover for a given batch have been established: Direct materials (1.6lbs. @ $0.95) Direct labor (0.75 hr. @ $7.40) Standard prime cost $1.52 5.55 $7.07 During the year, 50,000 pounds of material were purchased and used for the changeover activity. There were 30,300 batches produced, with the following actual prime costs: Direct materials Direct labor $49,500 $169,875 (for 22,500 hrs.) Required: Compute MPV, MUV, LRV, and LEV. Exercise 2) At the beginning of the year, Honey Company had beginning operating assets of $198,000. During the year, Honey Co. had operating income of $25,500 and expenses of $124,500. At the end of the year, they had operating assets of $177,000. Required: Compute profit margin, turnover, and ROI…arrow_forwardSanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay: Line Item Description SupportDepartmentsS1 SupportDepartmentsS2 ProducingDepartmentsAssembly ProducingDepartmentsPainting Direct costs $200,000 $140,000 $115,000 $96,000 Normal activity: Square footage — 500 1,875 625 Machine hours 337 — 3,200 12,800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education