Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

answer should be $___.

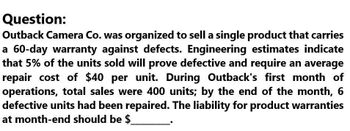

Transcribed Image Text:Question:

Outback Camera Co. was organized to sell a single product that carries

a 60-day warranty against defects. Engineering estimates indicate

that 5% of the units sold will prove defective and require an average

repair cost of $40 per unit. During Outback's first month of

operations, total sales were 400 units; by the end of the month, 6

defective units had been repaired. The liability for product warranties

at month-end should be $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please answer the accounting question not use aiarrow_forwardModem Appliances, Inc. sells food processors for $150 with a 120-day warranty against defects. Past experience indicates that 5% of the processors will have some defect during the warranty period and that the necessary repairs and adjustments will cost $25 per defective unit. Sales for August are $225,000. What is the estimated liability for product warranties for units sold in August? Select one: a. $3,000 b. $1,800 C. $11,250 d. $1,875 e. None of the abovearrow_forwardSea Port Company sells a product that carries a 60-day unconditional warranty against product failure. Based on statistical analysis, Sea Port knows that between the time of sale and the lapse of the warranty, 4% of the units sold will fail and require repair at an avenge cost of $40 per unit. The following data reflect the first three months during which the product was sold. October November December Units sold 30,000 36,000 60,000 Known units of product failure From sales of October 480 600 120 November 300 960 December 900 Prepare the general journal entry to record Sea Port’s estimated liability for product warranties at December 31. Assume that warranty costs of known failures have already been reflected in the records.arrow_forward

- Hopewell sells a line of goods under a six-month warranty. Any defect arising during that period is repaired free of charge. Hopewell has calculated that if all the goods sold in the last six months of the year required repairs the cost would be $2 million. If all of these goods had more serious faults and had to be replaced the cost would be $6 million. The normal pattern is that 80% of goods sold will be fault-free, 15% will require repairs and 5% will have to be replaced. What is the amount of the provision required?arrow_forwardAn entity sells goods with a warranty covering customers for the cost of repairs of any defects that are discovered within the first two months after purchase. Experience suggests that 60% of the goods sold will have no defects, 25% will have minor defects and 15% will have major defects. If minor defects were detected in all products sold the cost of repairs would be OMR 40,000; if major defects were detected in all products sold, the cost would be RO 200,000. What amount of provision should be made? a.OMR 30,000 b.None of the options c.OMR 40,000 d.OMR 35,000arrow_forwardHollingsworth Industries introduced a new line of ceiling fans in 20x1 that carry a two-year warranty against manufacturer's defects. Management estimated that warranty costs were expected to approximate 6% of sales revenue. First-year sales of the fans were $370,000. An evaluation of the company's claims experience in late 20x2 indicated that actual claims were less than expected-5% of sales rather than 6%. Sales of the fans were $420,000 in 20x2. What is the 20x2 warranty expense? Warranty expensearrow_forward

- Warranty CostsMilford Company sells a motor that carries a three-month unconditional warranty against product failure. Based on a reliable statistical analysis, Milford knows that between the sale and the end of the product warranty period, four percent of the units sold will require repair at an average cost of $60 per unit. The following data reflect Milford’s recent experience: October November December Dec. 31 Total Units sold 23,000 22,000 25,000 70,000 Known product failures from sales in: October 120 180 160 460 November 130 220 350 December 210 210 Calculate, and prepare a journal entry to record, the estimated liability for product warranties at December 31. Assume that warranty costs of known failures have already been reflected in the records. General Journal Date Description Debit Credit Dec.31 AnswerProduct Warranty ExpenseEstimated Liability for Product Warranty Answer Answer AnswerProduct Warranty ExpenseEstimated…arrow_forwardOn December 1, XYZ Limited introduces a new product that includes a one-year warranty on parts. In November, 1000 units are sold. Management believes that 15% of the units will be defective and that the average warranty costs will be $50 per unit. Prepare the adjusting entry at November 30 to accrue the estimated warranty cost.arrow_forwardDuring April, koduck cameras sold answer general andarrow_forward

- Coronado Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience, Coronado estimates that 3% of the units sold will become defective during the warranty period. Management estimates that the average cost of replacing or repairing a defective unit is $25. The units sold and units defective that occurred during the last 2 months of 2022 are as follows. Month November December (a) Units Sold 31,600 33,600 Units Defective Prior to December 31 632 Account Titles and Explanation 420 Prepare the journal entry to record the costs incurred in honoring 1,052 warranty claims. (Assume actual costs of $26,300.) (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Creditarrow_forwardEcco Company sold $158,000 of kitchen appliances with six-month warranties during September. The cost to repair defects under the warranty is estimated at 5% of the sales price. On October 15, a customer required a $140 part replacement, plus $86 labor under the warranty. a. Provide the journal entry for the estimated expense on September 30. b. Provide the journal entry for the October 15 warranty work. If an amount box does not require an entry, leave it blank. Cash Product Warranty Expense Product Warranty Payable Repairs Expense Wages Payablearrow_forwardExcom sells radios and each unit carries a two-year replacement warranty. The cost of repair defects under the warranty is estimated at 5% of the sales price. During September, Excom sells 110 radios for $40 each. One radio is actually replaced during September. For what amount in September would Excom debit Product Warranty Expense? Оа. S40 Оb. $21 Oc. $220 Od. $2,310 Previousarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College