Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

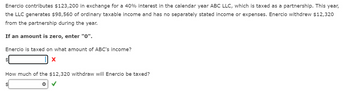

Transcribed Image Text:Enercio contributes $123,200 in exchange for a 40% interest in the calendar year ABC LLC, which is taxed as a partnership. This year,

the LLC generates $98,560 of ordinary taxable income and has no separately stated income or expenses. Enercio withdrew $12,320

from the partnership during the year.

If an amount is zero, enter "0".

Enercio is taxed on what amount of ABC's income?

X

How much of the $12,320 withdraw will Enercio be taxed?

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Sofia (single) is a 50 percent owner in Beehive LLC (taxed as a partnership). Sofia does not do any work for Beehive. Beehive LLC reported $600,000 of taxable business income for the year (2023). Before considering her 50 percent business income allocation from Beehive and the self-employment tax deduction (if any). Sofia's adjusted gross income is $150,000 (all employee salary). Sofia has $35,000 in itemized deductions. Answer the following questions for Sofia. Note: Leave no answer blank. Enter zero if applicable. c. What is Sofia's net investment income tax liability (assume no investment expenses)? Income tax liability $ 0arrow_forwardKaranarrow_forwardPart 'a' of 'a-d' was answered. Damarcus is a 50 percent owner of Hoop (a business entity). In the current year, Hoop reported a $100,000 business loss. Answer the following questions associated with each of the following alternative scenarios. (Leave no answer blank. Enter zero if applicable.) d. Hoop is organized as an LLC taxed as a partnership. Fifty percent of Hoop’s loss is allocated to Damarcus. Damarcus works full-time for Hoop (he is not considered to be a passive investor in Hoop). Damarcus has a $70,000 basis in his Hoop ownership interest and he also has a $70,000 at-risk amount in his investment in Hoop. Damarcus does not report income or loss from any other business activity investments. How much of the $50,000 loss allocated to him by Hoop is Damarcus allowed to deduct this year? Allowable Deduction Loss?arrow_forward

- Frank Pepper, a single taxpayer, has a flow-through of net income from a general partnership of $180,000 for 2022. He also has a flow-through of $12,000 of interest and dividends from an investment partnership. What is the amount of self-employment tax Frank must pay, rounded to the nearest dollar? A) $21,621 B) $21,700 C) $23,049 D) $22,047arrow_forwardLO.2 Enercio contributes $100,000 in exchange for a 40% interest in the calendar year ABC LLC, which is taxed as a partnership. This year, the LLC generates $80,000 of ordinary taxable income. Enercio withdrew $10,000 from the partnership during the year. Enercio is taxed on what amount of ABC’s income? On how much of the $10,000 distribution will Enercio be taxed?arrow_forwardsarrow_forward

- Browne and Red, both C corporations, formed the BR Partnership on January 1, 2020. Neither Browne nor Red is a personal service corporation, and BR is not a tax shelter. BR’s gross receipts were $22,000,000, $28,000,000, $34,000,000, and $36,000,000, respectively, for 2020 to 2023. Describe the methods of accounting available to BR in each tax year.arrow_forwardRequired information [The following information applies to the questions displayed below.] Jacob is a member of WCC (an LLC taxed as a partnership). Jacob was allocated $90,000 of business income from WCC for the year. Jacob's marginal income tax rate is 37 percent. The business allocation is subject to 2.9 percent of self- employment tax (Jacob has salary in excess of the wage base limitation) and 0.9 percent additional Medicare tax. Note: Round your intermediate calculations to the nearest whole dollar amount. b. What is the amount of tax Jacob will owe on the income allocation if the income is qualified business income (QBI) and Jacob qualifies for the full QBI deduction? > Answer is complete but not entirely correct. Tax owed if income is QBI $ 30,060 xarrow_forward(J) Alejandra is a 50% partner in ABC LLC. For the current year, the partnership reported taxable income of $175,00 and it distributed $100,000 to the two partners ($50,000 each) what is the overall tax effect of this transaction? What if ABC LLC was to be taxable as a corporation, what would be the overall tax effect of the this transaction?arrow_forward

- Hw.60.arrow_forwardThe following Data relates to Stephanie Garner, a resident taxpayer. Stephanie derives income from a public relations business and is also a partner in a marketing business Assessable business Income 2019/20 2020/21 2021/22 $93,400. $126,000 $133,400 General Business Deductions Share of Partnership Net Income (Loss). Superannuation and Gifts Net Exempt income 80,000 129,000 119,200 (21,800) 14,900 (5,600) 11,000 8,000 3,000 2,000 4,000 1,500 General Business deductions are separate from personal superannuation, gifts, partnership lossess and losses of previous years. For each year, determine Stephanie's Taxable Income and any losses that may be carried forwardarrow_forwardMr. and Mrs. Poe earned $135, 900 compensation income and $963 interest this year and recognized a $600 short-term capital gain and a $7,200 long-term capital gain on the sale of securities. They incurred $4,400 investment interest expense and $28, 500 other itemized deductions. Use 2023 Individual tax rate schedules and Tax rates for capital gains and qualified dividends. Required: Compute the Poes' income tax on a joint return if they don't elect to treat long-term capital gain as investment income. Compute the Poes' income tax if they elect to treat enough long-term capital gain as investment income to allow them to deduct their investment interest.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education