FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

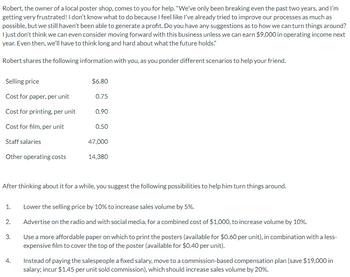

Transcribed Image Text:Robert, the owner of a local poster shop, comes to you for help. "We've only been breaking even the past two years, and I'm

getting very frustrated! I don't know what to do because I feel like I've already tried to improve our processes as much as

possible, but we still haven't been able to generate a profit. Do you have any suggestions as to how we can turn things around?

I just don't think we can even consider moving forward with this business unless we can earn $9,000 in operating income next

year. Even then, we'll have to think long and hard about what the future holds."

Robert shares the following information with you, as you ponder different scenarios to help your friend.

Selling price

Cost for paper, per unit

Cost for printing, per unit

Cost for film, per unit

Staff salaries

Other operating costs

1.

2.

3.

$6.80

4.

0.75

After thinking about it for a while, you suggest the following possibilities to help him turn things around.

0.90

0.50

47,000

14,380

Lower the selling price by 10% to increase sales volume by 5%.

Advertise on the radio and with social media, for a combined cost of $1,000, to increase volume by 10%.

Use a more affordable paper on which to print the posters (available for $0.60 per unit), in combination with a less-

expensive film to cover the top of the poster (available for $0.40 per unit).

Instead of paying the salespeople a fixed salary, move to a commission-based compensation plan (save $19,000 in

salary; incur $1.45 per unit sold commission), which should increase sales volume by 20%.

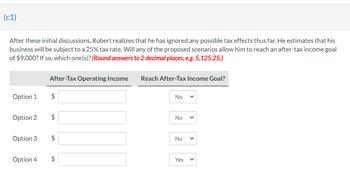

Transcribed Image Text:(c1)

After these initial discussions, Robert realizes that he has ignored any possible tax effects thus far. He estimates that his

business will be subject to a 25% tax rate. Will any of the proposed scenarios allow him to reach an after-tax income goal

of $9,000? If so, which one(s)? (Round answers to 2 decimal places, e.g. 5,125.25.)

Option 1

Option 2

Option 3

After-Tax Operating Income Reach After-Tax Income Goal?

$

LA

LA

$

LA

$

LA

Option 4 $

No

No

No

Yes

<

<

<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- Big Tractor, Inc.'s best salesperson is Misty Hammond. Hammond's largest sales have been to Farmer's Cooperative, a customer she brought to the company. Another salesperson, Bob Blanchette has been told in confidence by his cousin (an employee of Farmer's Cooperative) that Farmer's Cooperative is experiencing financial difficulties and may not be able to pay Big Tractor Inc. what is owed. Both Hammond and Blanchette are being considered for a promotion to a new sales manager position. What are the ethical considerations that Bob Blanchette faces? What alternatives do you think he has?arrow_forwardHow are realized income, gross income and taxable income similar, and how are they different? I am not able to find my textbook here. I am not finding this site useful at all. I will have many more than 30 questions per month as I am really struggling with this class. But I cannot find anyone to help me figure out HOW to use the site successfully.arrow_forwardBecause of a job change, Seth Armstrong has just relocated to the southeastern United States. He sold his furniture before he moved, so he's now shopping for new furnishings. At a local furniture store, he's found an assortment of couches, chairs, tables, and beds that he thinks would look great in his new two-bedroom apartment; the total cost for everything is $6,400. Because of moving costs, Seth is a bit short of cash right now, so he's decided to take out an installment loan for $6,400 to pay for the furniture. The furniture store offers to lend him the money for 48 months at an add-on interest rate of 6.5 percent. The credit union at Seth's firm also offers to lend him the money - they'll give him the loan at an interest rate of 10 percent simple, but only for a term of 24 months. Compute the monthly payments for the loan from the furniture store. Round the answer to the nearest cent. $ per month Compute the monthly payments for the loan from the credit union. Round the…arrow_forward

- 1) Suppose you work for Meijer, a large grocer headquartered in Michigan. 20 years ago, Meijer bought a parcel of land on the outskirts of Lafayette, Indiana. It is currently being rented to a farmer. They intended to build a new store on the lot after a proposed new highway was complete. However, when the new highway was built it went in a different direction and now they must decide whether to build the new store. You ask around and find the following information from the following departments (all numbers are in thousands of dollars): The sales department tells you: Annual Revenue: The operations department tells you: Inventory Required on Shelves: Annual Cost of Goods Sold: Annual Cost of Running Store: Annual Allocated Overhead from HQ: The forecasting department tells you: Loan to fund construction: Interest Rate: Weighted Average Cost of Capital: Depreciation Schedule: Tax Rate: $2400 Current Market Value of Land: Current Pre-Tax Income from renting land out: Cost of…arrow_forwardTerry House, the controller for MicroTech Software Company, is responsible for preparing the company’s financial statements. He learns that sales for the first quarter of the year have dropped so dramatically that the company is in danger of bankruptcy. As a result, he applies for an accounting position with another software company that competes with MicroTech. During his job interview, Terry is asked why he wants to leave MicroTech. He replies truthfully, “The company’s sales are down another 10% this quarter. I fear they will go out of business.” At that time, MicroTech had not released its sales results to the public. Discuss the ethics of this situation.arrow_forwardIts a standard practice question I am struggling witharrow_forward

- Claudia is learning about differential analysis in Chapter 25 this week. She made a goal to try and go one chapter without getting mad. However, there is something that is driving her crazy: She can’t figure out what the purpose of the “differential” column is. She points out the “Lease or Sell” example in the book with total income calculated for each alternative. “Clearly, leasing would provide a higher income than selling, so why do we need that stupid third column?” Claudia asks aloud. “I bet it’s just those dumb old accountants that have nothing better to do than waste our time with extra work.” Please summarize what differential analysis is and explain to Claudia why you think that “third column” might be important. Alternatively, if you totally agree with Claudia on this issue, please support your position.arrow_forwardInfinity Designs, an interior design company,has experienced a drop in business due toan increase in interest rates and acorresponding slowdown in remodelingprojects. To smulate business, thecompany is considering exhibing at theHome and Garden Expo. The exhibit willcost the company $12,000 for space. At theshow, Infinity Designs will present a slideshow on a PC, pass out brochures that areprinted previously, (the company printedmore than needed), and show its porolio ofpreviousjobs.The companyesmates thatrevenue will increaseby $36,000 over thenext year as a resultof the exhibit. For theprevious year, profitwas as follows:Revenue $201,000Less:Design supplies (variable cost) $15,000Salary of Samantha Spade (owner) 80,000Salary of Kim Bridesdale (full meemployee)55,000Rent 18,000Ulies 6,000Depreciaon of office equipment 3,600Prinng of adversing materials 700Adversing in Middleton Journal 2,500Travel expenses other than depreciaonof autos (variable cost)$3,000Depreciaon of company cars…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education