FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

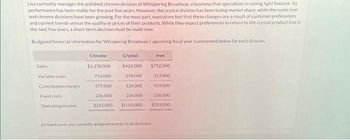

Transcribed Image Text:Lisa currently manages the polished chrome division of Whispering Broadway, a business that specializes in ceiling light fixtures. Its

performance has been stable for the past few years. However, the crystal division has been losing market share, while the rustic iron

and chrome divisions have been growing. For the most part, executives feel that these changes are a result of customer preferences

and current trends versus the quality or prices of their products. While they expect preferences to return to the crystal product line in

the next five years, a short-term decision must be made now.

Budgeted financial information for Whispering Broadway's upcoming fiscal year is presented below for each division

Sales

Variable costs

Contribution margin

Fixed costs

Operating income

Chrome

$1,230,000

753,000

477,000

236.000

Crystal

$424.000

298.000

126.000

236,000

$241.000 $(110,000)

Iron

$752,000

313,000

All foxed costs are currently assigned evenly to all divisions.

439,000

236,000

$203.000

Transcribed Image Text:Lisa currently manages the polished chrome division of Whispering Broadway, a business that specializes in ceiling light fixtures. Its

performance has been stable for the past few years. However, the crystal division has been losing market share, while the rustic iron

and chrome divisions have been growing. For the most part, executives feel that these changes are a result of customer preferences

and current trends versus the quality or prices of their products. While they expect preferences to return to the crystal product line in

the next five years, a short-term decision must be made now.

Budgeted financial information for Whispering Broadway's upcoming fiscal year is presented below for each division

Sales

Variable costs

Contribution margin

Fixed costs

Operating income

Chrome

$1,230,000

753,000

477,000

236.000

Crystal

$424.000

298.000

126.000

236,000

$241.000 $(110,000)

Iron

$752,000

313,000

All foxed costs are currently assigned evenly to all divisions.

439,000

236,000

$203.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 4arrow_forwardV2arrow_forward14. VALUE OFA BUSINESS John Fernandez figures his bike shop is worth $88,000 if sold today and that it will grow in value at 8% per year compounded annually for the next 6 years. If he sells the business, the funds will be invested at 5% compounded semiannually. (a) Find the future value of the shop. (b) What price should he insist on at this time if he sells the business?arrow_forward

- Supposed you are offered to work on a big company, with P20,000 monthly net income. But you are also considering another offer by a smaller firm with P8,000 semi-monthly net income but you can be promoted faster due to its smaller-scaled organization will be receiving a P500.00 salary increased after 2.5 years. At 10% annual interest worth of money, on which offer will you be considering advantageous salary-wise after 5 years? Explain your answer. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardYou have been offered a job with an unusual bonus structure. As long as you stay with the firm, you will get an extra $ 66 comma 000 every 7 years, starting 7 years from now. What is the present value of this incentive if you plan to work for the company for 42 years and the interest rate is 5% (EAR)? (Note : Be careful not to round any intermediate steps less than six decimal places.)arrow_forwardEe 276.arrow_forward

- 8Miller's Hardware plans on saving $40,000, $50,000, and $58,000 at the end of each year for the next three years, respectively. How much will the firm have saved at the end of the three years if it can earn 6% by reinvesting its saving? a. $155,944.00 b. $169,004.13 c. $148,000.00 d. $148,078.15arrow_forwardPlz solve within 30min I vill give definitely upvote and vill give positive feedback thank you sirarrow_forward#49 thoroughly explainarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education