FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Its a standard practice question I am struggling with

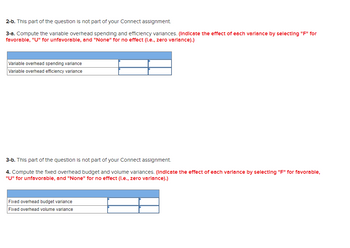

Transcribed Image Text:2-b. This part of the question is not part of your Connect assignment.

3-a. Compute the variable overhead spending and efficiency variances. (Indicate the effect of each varlance by selecting "F" for

favorable, "U" for unfavorable, and "None" for no effect (l.e., zero varlance).)

Variable overhead spending variance

Variable overhead efficiency variance

3-b. This part of the question is not part of your Connect assignment.

4. Compute the fixed overhead budget and volume variances. (Indicate the effect of each varlance by selecting "F" for favorable,

"U" for unfavorable, and "None" for no effect (l.e., zero varlance).)

Fixed overhead budget variance

Fixed overhead volume variance

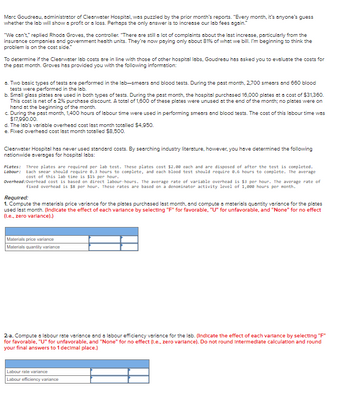

Transcribed Image Text:Marc Goudreau, administrator of Clearwater Hospital, was puzzled by the prior month's reports. "Every month, it's anyone's guess

whether the lab will show a profit or a loss. Perhaps the only answer is to increase our lab fees again."

"We can't," replied Rhoda Groves, the controller. "There are still a lot of complaints about the last increase, particularly from the

insurance companies and government health units. They're now paying only about 81% of what we bill. I'm beginning to think the

problem is on the cost side."

To determine if the Clearwater lab costs are in line with those of other hospital labs, Goudreau has asked you to evaluate the costs for

the past month. Groves has provided you with the following information:

a. Two basic types of tests are performed in the lab-smears and blood tests. During the past month, 2,700 smears and 660 blood

tests were performed in the lab.

b. Small glass plates are used in both types of tests. During the past month, the hospital purchased 16,000 plates at a cost of $31,360.

This cost is net of a 2% purchase discount. A total of 1,600 of these plates were unused at the end of the month; no plates were on

hand at the beginning of the month.

c. During the past month, 1,400 hours of labour time were used in performing smears and blood tests. The cost of this labour time was

$17,990.00.

d. The lab's variable overhead cost last month totalled $4,950.

e. Fixed overhead cost last month totalled $8,500.

Clearwater Hospital has never used standard costs. By searching industry literature, however, you have determined the following

nationwide averages for hospital labs:

Plates: Three plates are required per lab test. These plates cost $2.00 each and are disposed of after the test is completed.

Labour: Each smear should require 8.3 hours to complete, and each blood test should require 0.6 hours to complete. The average

cost of this lab time is $15 per hour.

Overhead: Overhead cost is based on direct labour-hours. The average rate of variable overhead is $3 per hour. The average rate of

fixed overhead is $8 per hour. These rates are based on a denominator activity level of 1,000 hours per month.

Required:

1. Compute the materials price variance for the plates purchased last month, and compute a materials quantity variance for the plates

used last month. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect

(I.e., zero variance).)

Materials price variance

Materials quantity variance

2-a. Compute a labour rate variance and a labour efficiency variance for the lab. (Indicate the effect of each varlance by selecting "F"

for favorable, "U" for unfavorable, and "None" for no effect (I.e., zero varlance). Do not round Intermediate calculation and round

your final answers to 1 decimal place.)

Labour rate variance

Labour efficiency variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education