FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

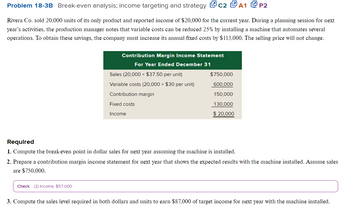

Transcribed Image Text:Problem 18-3B Break-even analysis; income targeting and strategy C2 A1 P2

Rivera Co. sold 20,000 units of its only product and reported income of $20,000 for the current year. During a planning session for next

year's activities, the production manager notes that variable costs can be reduced 25% by installing a machine that automates several

operations. To obtain these savings, the company must increase its annual fixed costs by $113,000. The selling price will not change.

Contribution Margin Income Statement

For Year Ended December 31

Check (2) Income, $57,000

Sales (20,000 × $37.50 per unit)

Variable costs (20,000 × $30 per unit)

Contribution margin

Fixed costs

Income

$750,000

600,000

150,000

130,000

$ 20,000

Required

1. Compute the break-even point in dollar sales for next year assuming the machine is installed.

2. Prepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales

are $750,000.

3. Compute the sales level required in both dollars and units to earn $87,000 of target income for next year with the machine installed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Dhapaarrow_forwardVictoria Company reports the following operating results for the month of April. VICTORIA COMPANY CVP Income Statement For the Month Ended April 30, 2020 Sales (10,000 units) Variable costs Contribution margin Fixed expenses Net income $500,000 300,000 Break-even point Break-even point $ Total Show Transcribed Text Margin of safety $ Break-even point 200,000 Management is considering the following course of action to increase net income: Reduce the selling price by 5%, with no changes to unit variable costs or fixed costs. Management is confident that this change will increase unit sales by 10%. Break-even point 140,000 Using the contribution margin technique, compute the break-even point in units and dollars and margin of safety in dollars: (Round intermediate calculations to 4 decimal places eg. 0.2522 and final answer to 0 decimal places, e.g. 2,510) (a) Assuming no changes to selling price or costs. $60,000 $ Using the contribution margin technique, compute the break-even point in…arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 33.00 19.00 $ 14.00 Sales (8,500 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 280,500 161,500 119,000 54,700 $ 64,300 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 70 units? 2. What would be the revised net operating income per month if the sales volume decreases by 70 units? 3. What would be the revised net operating income per month if the sales volume is 7,500 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forward

- Last year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product variable expense $67.00 per unit with a fixed price expense of $835,500 per year. a. What is the product's net income or loss last year? b. What is the product break-even point in unit sales and dollar sales? c. Assume the company has conducted a market study that estimates it can increase sales by 5,000 units for each $2.00 reduction in its selling price. If the company would only consider increments of $2.00(e.g. $68,$66, etc) What is the maximum annual profit that can be earned on this product? What sales volume and selling price per unit generate the maximum profit? d. What would be the break-even point in unit sales and dollar sales using the selling price that was determined in the required letter c above? Thank you,arrow_forwardThe following is Pacific Limited’s contribution format income statement for January 2022: Sales $1,400,000 Variable expenses 700,000 Contribution margin 700,000 Fixed expenses 400,000 Net operating income $ 300,000 The company has no beginning or ending inventories and produced and sold 25,000 units during the month. Required (show your calculation): a. The company’s top management team is currently investigating how many units they need to sell to reach the break-even point. Also, they want to know how much revenue they need to generate to reach the break-even point. What do you think? d.d. Company’s Marketing Manager is confident that she can increase sales by 28% next year with some effort. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to compute your answerarrow_forwardEngberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 86,000 100% Variable expenses 34,400 40% Contribution margin 51,600 60% Fixed expenses 40, 420 Net operating income $ 11,180 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 7% increase in unit sales.arrow_forward

- Jilk Incorporated's contribution margin ratio is 61% and its fixed monthly expenses are $48,500. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $139,000? $84,790 $5,710 $36,290 $90,500arrow_forwardThe following data are available for the Valentine Corporation for a recent month: Product A Product B Product C Total Selling price $23 $69 $115 Sales $115,000 $172,500 $287,500 |Variable |$91,000 $104,000 $27,000 Expenses Contribution $24,000 $68,500 $260,500 Margin Fixed $55,000 Expenses Net Operating Income What is the sales revenue required from Product C at the break even point?arrow_forwardPlease provide correct solutionarrow_forward

- Subject: accountingarrow_forwardThe following monthly data are available for the Phelps Company: Product A Product B $150,000 $130,000 Variable expenses $91,000 $104,000 Contribution margin $59,000 $26,000 Fixed expenses Operating income The break-even sales for the month for the company are: Sales Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a $203,000 Product C $90,000 $27,000 $63,000 foonnnn. Total $370,000 $222,000 $148,000 $55,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education