FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

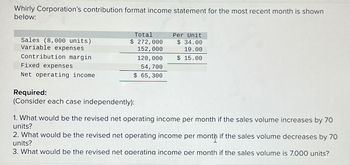

Transcribed Image Text:Whirly Corporation's contribution format income statement for the most recent month is shown

below:

Sales (8,000 units)

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Total

$ 272,000

152, 000

120, 000

54,700

$ 65,300

Required:

(Consider each case independently):

Per Unit

$34.00

19.00

$15.00

1. What would be the revised net operating income per month if the sales volume increases by 70

units?

2. What would be the revised net operating income per montii if the sales volume decreases by 70

units?

3. What would be the revised net operating income per month if the sales volume is 7.000 units?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 30.00 19.00 $11.00 Sales (7,900 units) Variable expenses Contribution margin Fixed expenses Net operating income. Required: (Consider each case independently): Total $ 237,000 150, 100 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 86,900 55,200 $ 31,700 1. What would be the revised net operating income per month if the sales volume increases by 30 units? 2. What would be the revised net operating income per month if the sales volume decreases by 30 units? 3. What would be the revised net operating income per month if the sales volume is 6,900 units?arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Sales (7,600 unita) Variable expenses Total $ 243,200 136, 800 Per Unit $32.00 18.00 Contribution nargin 106,400 $ 14.00 ried expenses 55,000 5 51,400 et operating Lncone Required: (Consider each case independently): 1 What would be the revised net operating income per month if the sales volume increases by 50 units? 2 What would be the revised net operating income per month if the sales volume decreases by 50 units? 3. What would be the revised net operating income per month if the sales volume is 6,600 units? 1. Revined net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $31.00 18.00 $13.00 Sales (7,900 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 244,900 142,200 102,700 55,300 $ 47,400 Required: (Consider each case independently): 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 1. What would be the revised net operating income per month if the sales volume increases by 70 units? 2. What would be the revised net operating income per month if the sales volume decreases by 70 units? 3. What would be the revised net operating income per month if the sales volume is 6,900 units?arrow_forward

- Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $31.00 19.00 $ 12.00 Sales (8,900 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): Total $ 275,900 169,100 106,800 54,200 $ 52,600 1. What would be the revised net operating income per month if the sales volume increases by 100 units? 2. What would be the revised net operating income per month if the sales volume decreases by 100 units? 3. What would be the revised net operating income per month if the sales volume is 7,900 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forwardSubject - account Please help me. Thankyou.arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown be Total $ 254, 200 147,600 Per Unit Sales (8,200 units) Variable expenses $ 31.00 18.00 Contribution margin 106,600 $ 13.00 Fixed expenses 54,200 Net operating income $ 52,400 Required: (Consider each case independently): 1. What would be the revised 2. What would be the revised net operating income per month if the sales volume decreases by 60 units? 3. What would be the revised net operating income per month if the sales volume is 7,200 units? operating income per month if the sales volume increases by 60 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income Pr [O ere to searcharrow_forward

- Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 30.00 18.00 $ 12.00 Sales (7,100 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): Total $ 213,000 127,800 85,200 54,100 $ 31,100 1. What would be the revised net operating income per month if the sales volume increases by 30 units? 2. What would be the revised net operating income per month if the sales volume decreases by 30 units? 3. What would be the revised net operating income per month if the sales volume is 6,100 units?arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Total $ 268,600 150, 100 118,500 54,300 Per Unit $ 34.00 19.00 $ 15.00 $ 64,200 Sales (7,900 units) Variable expenses Contribution margin Fixed expenses Net operating income. Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 30 units? 2. What would be the revised net operating income per month if the sales volume decreases by 30 units? 3. What would be the revised net operating income per month if the sales volume is 6,900 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 33.00 19.00 $ 14.00 Sales (8,500 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 280,500 161,500 119,000 54,700 $ 64,300 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 70 units? 2. What would be the revised net operating income per month if the sales volume decreases by 70 units? 3. What would be the revised net operating income per month if the sales volume is 7,500 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education