FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

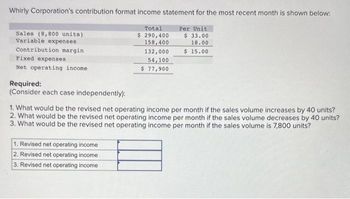

Transcribed Image Text:Whirly Corporation's contribution format income statement for the most recent month is shown below:

Per Unit

$ 33.00

18.00

$ 15.00

Sales (8,800 units)

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Required:

(Consider each case independently):

Total

$ 290,400

158,400

132,000

54,100

$ 77,900

1. What would be the revised net operating income per month if the sales volume increases by 40 units?

2. What would be the revised net operating income per month if the sales volume decreases by 40 units?

3. What would be the revised net operating income per month if the sales volume is 7,800 units?

1. Revised net operating income

2. Revised net operating income

3. Revised net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Similar questions

- shobhaarrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Sales (7,800 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 265,200 148, 200 117,000 55,700 $ 61,300 Required: (Consider each case independently): Per Unit $ 34.00 19.00 $15.00 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is 6,800 units?arrow_forwardMiller Company's contribution format income statement for the most recent month is shown below: Per Unit $ 7.00 4.00 $3.00 Sales (45,000 units) Variable expenses Contribution margin Fixed expenses Net operating income. Total $ 315,000 180,000 135,000 44,000 $91,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 14%? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 15%? 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 8%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 40 cents per unit, and the number of units sold decreases by 5%? > Answer is complete but not entirely correct. 1. Net operating income $ 109,900 2. Net operating income $…arrow_forward

- iller Company's contribution format income statement for the most recent month is shown below: Total Per Unit Sales (32,000 units) $ 160,000 $5.00 Variable expenses 64,000 2.00 Contribution margin 96,000 $ 3.00 Fixed expenses 50,000 Net operating income $ 46,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 12% ? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 22% ? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 4% ? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 40 cents per unit, and the number of units sold decreases by 12% ?arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $31.00 18.00 $ 13.00 Sales (8,600 units) Variable expenses Contribution, margin Fixed expenses Net operating income Total $ 266,600 154,800 111,800 Required: (Consider each case independently): 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 56,000 $ 55,800 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is.7,600 units?arrow_forwardMiller Company's contribution format income statement for the most recent month is shown below: Per Unit $ 9.00 6.00 $ 3.00 Sales (41,000 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): Total $ 369,000 246,000 123,000 42,000 $ 81,000 1. What is the revised net operating income if unit sales increase by 13%? 2. What is the revised net operating income if the selling price decreases by $1.20 per unit and the number of units sold increases by 21%? 3. What is the revised net operating income if the selling price increases by $1.20 per unit, fixed expenses increase by $8,000, and the number of units sold decreases by 5%? 4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 11%? X Answer is complete but not entirely correct. 1. Net operating income $ 96,990 2. Net operating income $…arrow_forward

- Solve the incorrectarrow_forwardDarrow_forwardMiller Company’s contribution format income statement for the most recent month is shown below: Total Per Unit Sales (36,000 units) $ 180,000 $ 5.00 Variable expenses 72,000 2.00 Contribution margin 108,000 $ 3.00 Fixed expenses 43,000 Net operating income $ 65,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 17%? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 24%? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 3%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 13%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education