Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

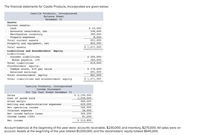

Transcribed Image Text:The financial statements for Castile Products, Incorporated are given below:

Castile Products, Incorporated

Balance Sheet

December 31

Assets

Current assets:

$ 23,000

230,000

390,000

8,000

651,000

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Total current assets

Property and equipment, net

820,000

Total assets

$ 1,471,000

Liabilities and Stockholders' Equity

Liabilities:

$ 250,000

360,000

610,000

Current liabilities

Bonds payable, 10%

Total liabilities

Stockholders' equity:

Common stock, $10 per value

Retained earnings

Total stockholders' equity

$ 170,000

691,000

861,000

Total liabilities and stockholders' equity

$ 1,471,000

Castile Products, Incorporated

Income Statement

For the Year Ended December 31

$ 2,190,000

1,230,000

960,000

620,000

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

Interest expense

340,000

36,000

304,000

91,200

Net income before taxes

Income taxes (30%)

Net income

$ 212,800

Account balances at the beginning of the year were: accounts receivable, $230,000; and inventory, $270,000. All sales were on

account. Assets at the beginning of the year totaled $1,000,000, and the stockholders' equity totaled $645,000.

Transcribed Image Text:Required:

Compute the following: (For Requirements 1 to 4, enter your percentage answers rounded to 2 decimal places (i.e., 0.1234 should

be entered as 12.34).)

1. Gross margin percentage.

2. Net profit margin percentage.

3. Return on total assets.

4. Return on equity.

5. Was financial leverage positive or negative for the year?

1. Gross margin percentage

%

2. Net profit margin percentage

%

3. Return on total assets

%

4. Return on equity

%

5. Financial Leverage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Hi there, could I have some help in this statement please? thank you so mucharrow_forwardwhat is recasting of the income statement, and give three examples of items that are recasted?arrow_forwardYour Task… Using your assigned financial statements calculate the required ratios below Indicate if the change from year to year is favorable or unfavorable. All values should be accurate to at least two decimal places. The expectation is to submit a professional report free of grammar and spelling errors and easy to read. Think of this as a menu you would be handing to a customer. All calculations are to be represented. Analysis of Profitability Gross Profit Ratio Operating Profit Ratio Net Profit Ratio Sales to Total Assets Ratio Return on Total Assets Return on Equity Earnings Per Sharearrow_forward

- Sargassum Caribbean Incorporated Balance Sheet as at December 31, 2020 Assets Liabilities Current Assets: Current Liabilities: Cash Accounts Payable 600,000 300,000 200,000 400,000 Notes Payable 900,000 1,500,000 Total Current Liabilities Accounts Receivable Inventory Total Current Assets 900,000 Fixed Assets: Long-Term Liabilities: Property, Plant & Equipment Less: Accumulated Depreciation 1,200,000 Long-Term Debt 1,000,000 Total Long Term Liabilities 200,000 300,000 300,000 Net Fixed Assets Owners' Equity: Common Stock ($1 Par) Capital Surplus Retained Earnings Total Owners' Equity 100,000 300,000 100,000 500,000 Total Assets 1,700,000 Total Liabilities & Owners' Equity 1,700,000 Sargassum Caribbean Incorporated Income Statement for Year Ending December 31, 2020 Sales 2,500,000 800,000 100,000 104,000 1,496,000 Less: Cost of Goods Sold Less: Administrative Expenses Less Depreciation Earnings Before Interest and Тахes Less: Interest Expense 20.000 1,476,000 663,000 813,000 417,000…arrow_forwardStatement 1: Profit is any amount over and above that required to maintain the capital at the beginning of the period. Statement 2: Profit is equal to income minus expenses. Statement 3: Profit is the equivalent of net income under IFRS. * Choices: True, True, True False, False, False True, True, False True, False, Truearrow_forwardPlease answer the questions I need it asaparrow_forward

- Suppose that you are doing a financial statement analysis. Assume you took a financial statement and divided every entry amount in the statement by the amount of total assets. The resulting statement is commonly called a? current ratio common base year income statement common size balance sheet common size income statement common base year balance sheet .DO NOT GIVE PLAGRIZED ANSWERarrow_forwardPerform the following: a. horizontal analysis b. vertical analysis c. ratio analysis d. interpret the resultsarrow_forwardIdentify how each of the following separate transactions 1 through 10 affects financial statements. For increases, place a “+” and the dollar amount in the column or columns. For decreases, place a “−” and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (−) along with dollar amounts. The first transaction is completed as an example.arrow_forward

- I need help to determine the following; 5. For P & B Manufacturing to assess its profitability I need help to calculate the net profit margin percentage AND the return on equity. Include calculations and round answers to 2 decimal places.arrow_forwardChapter 24 discusses various methods of analyzing financial statements in terms of calculating ratios. Specifically, Return on Assets (ROA) is a very simple calculation: ROA= Net Income/Average Total Assets. Another method at arriving at this ratio is the DuPont Equation that was discussed in your textbook. In looking at the DuPont Equation, what benefits are derived by using this method rather than the most typical method that I have described above?arrow_forward5. Current assets LESS current liabilities is the * a. Current Ratio b. Net Worth Ratio c. Working Capital d. Quick Assetsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education