FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:=

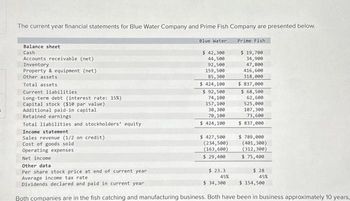

The current year financial statements for Blue Water Company and Prime Fish Company are presented below.

Prime Fish

Balance sheet

Cash

Accounts receivable (net)

Inventory

Property & equipment (net)

Other assets

Total assets

Current liabilities

Long-term debt (interest rate: 15%)

Capital stock ($10 par value)

Additional paid-in capital

Retained earnings

Total liabilities and stockholders' equity

Income statement

Sales revenue (1/2 on credit)

Cost of goods sold

Operating expenses

Net income

Other data

Per share stock price at end of current year

Blue Water

$ 42,300

44,500

92,500

159,500

85,300

$ 424,100

$ 92,500

74,100

157,100

30,300

70,100

$ 424,100

$ 427,500

(234,500)

(163,600)

$ 29,400

$ 23.3

45%

$ 19,700

34,900

47,800

416,600

318,000

$ 34,300

$ 837,000

$ 68,500

62,600

525,000

107,300

73,600

$ 837,000

$ 789,000

(401,300)

(312,300)

$ 75,400

$28

45%

Average income tax rate

Dividends declared and paid in current year

Both companies are in the fish catching and manufacturing business. Both have been in business approximately 10 years,

$ 154,500

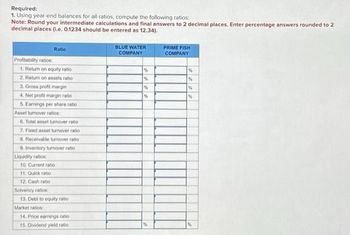

Transcribed Image Text:Required:

1. Using year-end balances for all ratios, compute the following ratios:

Note: Round your intermediate calculations and final answers to 2 decimal places. Enter percentage answers rounded to 2

decimal places (1.e. 0.1234 should be entered as 12.34).

Profitability ratios:

1. Return on equity ratio

2. Return on assets ratio

3. Gross profit margin

Ratio

4. Net profit margin ratio

5. Earnings per share ratio

Asset turnover ratios:

6. Total asset turnover ratio

7. Fixed asset turnover ratio

8. Receivable turnover ratio

9. Inventory turnover ratio

Liquidity ratios:

10. Current ratio

11. Quick ratio

12. Cash ratio

Solvency ratios:

13. Debt to equity ratio

Market ration:

14. Price earnings ratio

15. Dividend yield ratio

BLUE WATER

COMPANY

%

%

%

%

%

PRIME FISH

COMPANY

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable. Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $ 30,800 89,600 110,000 10,400 281,000 $ 521,800 Interest expense Income tax expense Total costs and expenses Net income Earnings per share 1 Year Ago $ 128,800 $ 75,750 99,000 95,500 162,000 135,500 162,000 106,650 $ 521,800 $ 443,400 Current Year $ 36,000 63,000 83,600 9,300 251,500 $ 443,400 $ 421,850 221,650 12,100 9,400 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $ 715,000 665,000 $ 50,000 $3.09 2 Years Ago $ 38,400 49,500 53,500 4,300 235,000 $ 380,700 For both the Current Year and 1 Year Ago, compute the following ratios: $ 51,000 80, 200 162,000 87,500…arrow_forwardThe following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $418,000 $345,600 Marketable securities 484,000 388,800 Accounts and notes receivable (net) 198,000 129,600 Inventories 290,400 87,800 Prepaid expenses 149,600 56,200 Total current assets $1,540,000 $1,008,000 Current liabilities: Accounts and notes payable (short-term) $319,000 $336,000 Accrued liabilities 231,000 144,000 Total current liabilities $550,000 $480,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital 2. Current ratio 3. Quick ratio b. The liquidity of Albertini has from the preceding year to the current year. The working capital, current ratio, and quick ratio have all Most of these changes are the result of an in current assets relative to current liabilities.arrow_forwardRatio AnalysisPresented below are summary financial data from Pompeo’s annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents $1,865 Marketable Securities 19,100 Accounts Receivable (net) 9,367 Total Current Assets 39,088 Total Assets 123,078 Current Liabilities 39,255 Long-Term Debt 7,279 Shareholders’ Equity 68,278 Income Statement Interest Expense 375 Net Income Before Taxes 14,007 Calculate the following ratios:(Round to 2 decimal points) a. Times-interest-earned ratio Answer b. Quick ratio Answer c. Current ratio Answer PreviousSave AnswersNextarrow_forward

- The financial statements for Castile Products, Inc., are given below: Castile Products, Inc.Balance SheetDecember 31 Assets Current assets: Cash $ 19,000 Accounts receivable, net 220,000 Merchandise inventory 370,000 Prepaid expenses 8,000 Total current assets 617,000 Property and equipment, net 810,000 Total assets $ 1,427,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 230,000 Bonds payable, 11% 310,000 Total liabilities 540,000 Stockholders’ equity: Common stock, $5 par value $ 170,000 Retained earnings 717,000 Total stockholders’ equity 887,000 Total liabilities and…arrow_forwardA comparative balance for Shabbon Corporation is presented as follows. Debit Credit Cash $197,000 Sales revenue $8,100,000 Debt Investments (trading) (at cost, $145,000) 153,000 Cost of Goods sold 4,800,000 Debt investments (long-term) 299,000 Equity Investments (long-term) 277,000 Notes Payable (short-term) 90,000 Accounts Payable 455,000 Selling Expenses 2,000,000…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

- Refer to the following selected financial information from a company. Compute the company’s debt-to-equity ratio for Year 2. Year 2 Year 1 Net sales $ 484,500 $ 427,450 Cost of goods sold 277,500 251,320 Interest expense 10,900 11,900 Net income before tax 68,450 53,880 Net income after tax 47,250 41,100 Total assets 319,500 295,200 Total liabilities 175,400 168,500 Total equity 144,100 126,700 Answer: A. 1.22. B. 1.82. C. 3.36. D. 0.82. E. 2.22.arrow_forwardConsider the following company’s balance sheet and income statement. Number of days in inventory. Debt-to-asset ratio. Cash-flow-to-debt ratio.arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $46,900; total assets, $179,400; common stock, $88,000; and retained earnings, $31,286.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement Cost of goods sold Gross profit For Current Year Ended December 31 Sales Operating expenses Interest expense Income before taxes Income tax expense Net income $ 18,000 9,000 33,800 Req 1 and 2 Reg 3 Req 4 Compute the debt-to-equity ratio. Numerator: $ 455,600 298,150 157,450 98,500 4,000 54,950 22,136 $ 32,814 30,150 3,050 154,300 Retained earnings $ 248,300 Total liabilities and equity 1 CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity Accounts payable Accrued wages payable Income taxes payable Complete this question by…arrow_forward

- Uramilabenarrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardRatio Analysis Presented below are summary financial data from Porter's annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents Marketable Securities Accounts Receivable (net) Total Current Assets Total Assets Current Liabilities Long-Term Debt- Shareholders' Equity Income Statement Interest Expense Net Income Before Taxes b. Quick ratio $1,850 19,100 9,367 39,088 123,078 38,450 7,279 68,278 Calculate the following ratios: (Round to 2 decimal points) a. Times-interest-earned ratio c. Current ratio 400 14,007arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education