Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

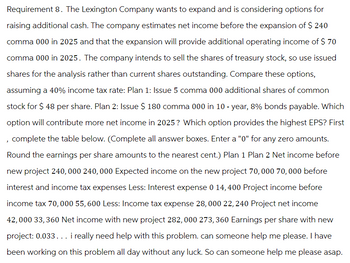

Transcribed Image Text:Requirement 8. The Lexington Company wants to expand and is considering options for

raising additional cash. The company estimates net income before the expansion of $ 240

comma 000 in 2025 and that the expansion will provide additional operating income of $ 70

comma 000 in 2025. The company intends to sell the shares of treasury stock, so use issued

shares for the analysis rather than current shares outstanding. Compare these options,

assuming a 40% income tax rate: Plan 1: Issue 5 comma 000 additional shares of common

stock for $ 48 per share. Plan 2: Issue $ 180 comma 000 in 10-year, 8% bonds payable. Which

option will contribute more net income in 2025? Which option provides the highest EPS? First

, complete the table below. (Complete all answer boxes. Enter a "0" for any zero amounts.

Round the earnings per share amounts to the nearest cent.) Plan 1 Plan 2 Net income before

new project 240,000 240, 000 Expected income on the new project 70, 000 70, 000 before

interest and income tax expenses Less: Interest expense 0 14, 400 Project income before

income tax 70,000 55, 600 Less: Income tax expense 28,000 22, 240 Project net income

42,000 33, 360 Net income with new project 282, 000 273, 360 Earnings per share with new

project: 0.033... i really need help with this problem. can someone help me please. I have

been working on this problem all day without any luck. So can someone help me please asap.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Begin with the partial model in the file Ch02 P21 Build a Model.xlsx on the textbooks Web site. a. Using the financial statements shown here for Lan Chen Technologies, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and return on invested capital for 2020. The federal-plus-state tax rate is 25%. b. Assume there were 15 million shares outstanding at the end of 2019, the year-end closing stock price was 65 per share, and the after-tax cost of capital was 10%. Calculate EVA and MVA for 2020. Lan Chen Technologies: Income Statements for Year Ending December 31 (Millions of Dollars) Lan Chen Technologies: December 31 Balance Sheets (Thousands of Dollars)arrow_forwardAssume that today is December 31, 2021. Use the following information that applies to Harrison Corporation to calculate what should be the company’s stock price today. After-tax operating income [EBIT (1 – T)] for 2022 is expected to be $850 million The depreciation expense for 2022 is expected to be $110 million The capital expenditures for 2022 are expected to be $650 million No change is expected in net working capital The free cash flow is expected to grow at a constant rate of 5.5% per year The required return on equity is 10% The WACC is 8% The firm has $150 million of non-operating assets The market value of the company’s debt is $3.25 billion 250 million shares of stock are outstanding Using the corporate valuation model approach, what should be the company’s stock price today?arrow_forwardsub : Finance Please type the solutionarrow_forward

- Please answer option A and Barrow_forwardFree cash flow FCF Year (t) 2020 2021 2022 2023 $710,000 $850,000 $950,000 $1,090,000 Other data Growth rate of FCF, beyond 2023 to infinity = 6% Weighted average cost of capital = 9% Market value of all debt = $6,030,000 Market value of preferred stock = $2,410,000 Number of shares of common stock to be issued = 1,100,000arrow_forwardQuantitative Problem 1: Assume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income [EBIT(1 – T)] will be $430 million and its 2020 depreciation expense will be $65 million. Barrington's 2020 gross capital expenditures are expected to be $110 million and the change in its net operating working capital for 2020 will be $30 million. The firm's free cash flow is expected to grow at a constant rate of 4.5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 8.1%; the market value of the company's debt is $2.95 billion; and the company has 170 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Also, the firm has zero non-operating assets. Using the corporate valuation model, what should be the company's stock price today (December 31, 2019)? Do not round intermediate…arrow_forward

- 10 Net income, currents assets and current liabilities for 2020 are expected to vary with sales. The projected sales in 2020 is ₱210M. The company plans to pay ₱0.05 cash dividends per share in 2020. What is the projected current liabilities for 2020?arrow_forwardUse the same CMO as in the previous question and suppose that in month 10, the beginning balance on tranche A is $2,733,990.91 and the beginning balance on tranche B is X$3,000,000. How much cash flow do investors in tranche A receive in month 10? 4 Selected Answer: 191,554 BE O ENG 40 11:36 PM 11/15/2023arrow_forwardQuantitative Problem 1: Assume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income [EBIT(1 - T)] will be $450 million and its 2020 depreciation expense will be $70 million. Barrington's 2020 gross capital expenditures are expected to be $100 million and the change in its net operating working capital for 2020 will be $30 million. The firm's free cash flow is expected to grow at a constant rate of 6% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 8.9%; the market value of the company's debt is $2.6 billion; and the company has 170 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Also, the firm has zero non-operating assets. Using the corporate valuation model, what should be the company's stock price today (December 31, 2019)? Do not round intermediate…arrow_forward

- Suppose C Manufacturings sales increase 20% over the next year. Assuming all asset accounts change proportionately to sales, there is no change in dividend or tax rate and that new growth is financed by equity, what will company be paying out in dividends for 2021? 1. $14,400 2. $12,960 3. $2,160 4. $3,600 5. $31,250arrow_forwardHello tutor please provide answer the accounting questionarrow_forwardQuestion1: Cybernauts, Ltd., is a new firm that wishes to finance an expansion program and determine its capital structure. It can issue 20 percent debt or 18 percent preferred stock. The total capitalization of the firm will be $6 million, and common stock can be sold at $25 per share. The company is expected to have a 50 percent tax rate. Four possible capital structures being considered are as follows: Plan Debt Preferred Common 1 20% 20% 60% 2 35 25 40 3 50 0 50 4 40 25 25 What would be the earnings per share for the four alternatives if earnings before interest and taxes are at $1.5 million?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning