Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

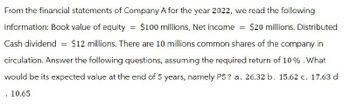

Transcribed Image Text:From the financial statements of Company A for the year 2022, we read the following

information: Book value of equity = $100 millions, Net income = $20 millions. Distributed

Cash dividend = $12 millions. There are 10 millions common shares of the company in

circulation. Answer the following questions, assuming the required return of 10%. What

would be its expected value at the end of 5 years, namely P5? a. 26.32 b. 15.62 c. 17.63 d

. 10.65

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company plans to pay an annual dividend of $.30 a share for four years commencing two years from today. After that time, a constant $1 a share annual dividend is planned indefinitely. Given a required return of 14 percent, what is the current value of this stock? O $5.46 None of these is correct O $5.25 O $5.39arrow_forwardam.106.arrow_forwardFranktown Meats has just paid annual dividend of $2 per share. In the meantime, the company establishes a policy whereby the dividend will increase by 3% annually thereafter. How much will one share of this stock be worth three years (P3) from now if the required rate of return is 14.5% based on DGM model? Select one: O a. $20.21 O b. $19.57 OC $17.00 O d. $16.08 O e. $19.00 Marrow_forward

- Suppose you bought a stock for $45 on January 1st. Thirty days later you received a dividend of $2.2 and you sold the stock for $44.30. Given this information, annualized return is ______________. (Assume 360 days in a year.) answer is 40%arrow_forwardPlease show detailed steps and correct.arrow_forwardSuppose you have $10,000 in cash to invest. You decide to sell short $5000 worth of Kinston stock and invest the proceeds from your short sale, plus your $10,000 into one-year U.S. treasury bills earning 5%. At the end of the year, you decide to liquidate your portfolio. Kinston Industries has the following realized returns: PO Div1 P1 Kinston $25.00$1.00$29.00 What is the return on your portfolio?arrow_forward

- Now or Later, Inc. recently paid $2.10 as an annual dividend. Future dividends are projected at $2.5, $3 and $4 over the next three years, respectively. At the end of the third year, you expect to sell the stock for $34. The stock of the company is selling for $34 today. How much added wealth is expected from your investment in the stock given that the expected return is 6%arrow_forwardhelp pleasearrow_forwardA company is expected to pay out 40% of its expected earnings per share of €0.5 next year as dividends. The earnings are expected to grow 2% per year in perpetuity and the cost of equity is 7%. Supposing that the company is a stable growth dividend paying, calculate the expected PE ratio. P/E=Payout ratio*(1+g)/(r-g) A. 4 B. 8 C. 10 D. 20 E. 25arrow_forward

- Jia's Fashions recently paid a R2 annual dividend. The company is projecting that its dividends will grow by 20 percent next year, 12 percent annually for the two years after that, and then at 6 percent annually thereafter. Based on this information, how much should Jia's Fashions common stock sell for today if her required return is 10.5%? Which answer is correct? A. R54.90 B. R60.80 C. R66.60 D. R69.30arrow_forwardTed McKay has just bought the common stock of Sunland Corp. Management of Sunland expects the company expects to grow at the following rates for the next three years: 40 percent, 35 percent, and 25 percent. Last year the company paid a dividend of $2.20. Assume a required rate of return of 12 percent. Compute the expected dividend for the first year. D1 $enter a dollar amount of the dividend for the first year rounded to 2 decimal placesarrow_forwardMicrosoft Co. has the following projected sales, costs, net investment, and free cash flow in millions. The anticipated growth rate in free cash flows after year 6 is 5% per year forever. There are 7.43 billion shares outstanding, and investors require a return of 8% on the company's stock and a comparable P/E ratio of 21. Calculate the company stock price using the P/E comparable approach to find the terminal value. (Round to 2 decimals) 1 5 232 282 120 146 40 48 72 88 50 61 22 27 ($ in Billions) Sales Costs Taxes OCF (net income) Net investment FCF 2 244 126 42 76 53 23 3 256 132 44 80 55 25 4 269 139 46 84 58 26 6 296 153 50 92 64 28arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education