Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

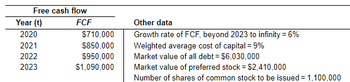

Transcribed Image Text:Using the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an opportunity to buy the stock of CoolTech, Inc., an IPO being offered for $15.96 per share. Although you very much interested in owning the company,

are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm's financial data that you've accumulated from a variety of data sources. The key values you have compiled are

summarized in the following table,

a. Use the free cash flow valuation model to estimate CoolTech's common stock value per share.

b. Judging by your finding in part a and the stock's offering price, should you buy the stock?

c. On further analysis, you find that the growth rate in FCF beyond 2023 will be 7% rather than 6%. What effect would this finding have on your responses in parts a and b?

a. The value of CoolTech's entire company is $. (Round to the nearest dollar.)

C

Transcribed Image Text:Free cash flow

FCF

Year (t)

2020

2021

2022

2023

$710,000

$850,000

$950,000

$1,090,000

Other data

Growth rate of FCF, beyond 2023 to infinity = 6%

Weighted average cost of capital = 9%

Market value of all debt = $6,030,000

Market value of preferred stock = $2,410,000

Number of shares of common stock to be issued = 1,100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- You have some funds that you would like to invest. Do some internet research to find two publicly traded companies in the same industry and compare their earnings per share. Would the earnings per share reported by each company influence your decision in selecting which company to invest in?arrow_forwardTo maximise the wealth of shareholders, a finance manager should _________ Question 20 options: 1) increase the current ratio of the firm 2) decrease the debt ratio of the firm 3) increase the cost of goods sold of the firm 4) increase the share price of the firmarrow_forwardDeciding how much earnings to retain and how much to return to ordinary shareholders is a key partof dividend policy. Drawing on the dividend policy literature critically discuss some of the factors thatneed to be considered by senior managers of a listed company when deciding on:a) the size of the annual dividend to return to its shareholders and the practical issues that needto be considered when deciding on the size of the dividend payment.Squeezeco is currently deciding on the level and form of its next dividend. It is consideringthree options:i. A cash dividend payment of 15p per shareii. A 5% scrip dividendiii. A repurchase of 15 % of ordinary share capital at the current market priceExtracts form the company’s financial statements are given below £m £mOperating profit 24.5Taxation 7.8 Distributable earnings…arrow_forward

- D3)arrow_forwardStock Valuation methods: Free cash now model Suppose you are evaluating SolarHeat Co., a renewable energy startup that does not pay dividends, and you want to determine the value of their shares using a free cash flow model. To do this, you analyze their financial statements for several things: (1) present value of free cash flows, (2) sabilities, and (3) number of outstanding shares. After some analysis, you determine that the present value of SolarHeat Co/s free cash flows, labilities, and number of outstanding shares are $140 million, $35 million, and 30 million, respectively, and that the cash flows will show no growth in the future. Using this information, and the free cash flow model, SolarHeat Co's value per share ist $3.50 $3.82 4.10 Which of the following are limitations to the free cash flows model? Check all that apply It can result in inaccurate valuations when the firm's forecasted earnings are incorrectly estimated. It can result in inaccurate valuations when the firm's…arrow_forwardRatio comparisons Robert Arias recently inherited a stock portfolio from his uncle. Wishing to learn more about the companies in which he is now invested, Robert performs a ratio analysis on each one and decides to compare them to one another. Some of his ratios are listed here. Assuming that his uncle was a wise investor who assembled the portfolio with care, Robert finds the wide differences in these ratios confusing. Help him out. a. What problems might Robert encounter in comparing these companies to one another on the basis of their ratios? b. Why might the current and quick ratios for the electric utility and the fast-food stock be so much lower than the same ratios for the other companies? c. Why might it be all right for the electric utility to carry a large amount of debt, but not the software company? d. Why wouldn't investors invest all of their money in software companies instead of in less profitable companies? (Focus on risk and return.) a. What problems might Robert…arrow_forward

- Pretend for a moment you owned a business but had no cash and your business was about to close because of no operating funds. You approach a Venture Capitalist and an Angel Investor, and both are willing to provide you with the necessary financing; however, you can only go with one. First part of the question is: Who would you choose and why? Second part of the question is: Where does Risk and Return fit in with both Venture Capitalists and Angot Inarrow_forwardYour grandmother calls you up and asks you for advice on where to invest some of her money. What do you think would be an appropriate investment for her. Choose one from the following A. Bitcoin B. An electric vehicle company C. A dividend paying stock D. A mutual fund that invests in risky smaller companies in the biotech industry.arrow_forwardConsider an all-equity firm that is run by a manager who acts in the best interest of existing shareholders. The value of the firm's assets in place is either $50 or $210. The firm has an investment project that requires an investment of $45. The only way to finance this project is by issuing equity to new investors in a competitive stock market. The project generates a sure, risk-free cash flow of $50 next year (i.e. this cash flow does not depend on the value of assets in place). Everyone is risk neutral and there is no discounting. a. Suppose that everyone, including the manager, believes that the assets in place are worth $50 with probability ½ and $210 with probability 2. What fraction a of the firm's equity has to be issued to new investors to raise $45? Does the manager want to issue equity?arrow_forward

- Do not give image formatarrow_forwardHi! I'm having difficulty comparing the choices between raising a large amount of cash in the capitaal market verses the bond market. I have to make a decision as to what is best and why, all while considering ethical implications of financial reporting and how it relates to acquiring additional investors and accessing markets for additional capital. Consider the impact on the following on your choice: The company’s existing capital structure The company’s current market capitalization The company’s weighted average cost of capital The company’s degree of operating, financial and combined leveragearrow_forwardWhen a firm conducts a seasoned equity offering and uses the proceeds to purchase a portion of the firm's outstanding debt, then the firm's Group of answer choices business risk increases. financial risk decreases. financial risk increases. business risk increases.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education