FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

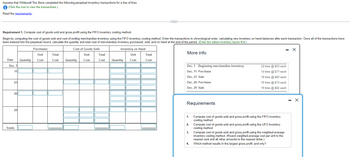

Transcribed Image Text:Assume that Whitewall Tire Store completed the following perpetual inventory transactions for a line of tires:

i (Click the icon to view the transactions.)

Read the requirements.

Requirement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method.

Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have

been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.)

Date Quantity

Dec. 1

11

23

261

29

Totals

Purchases

Unit

Cost

Cost of Goods Sold

Total

Unit

Cost Quantity Cost

Total

Cost

Inventory on Hand

Unit

Quantity Cost

C

Total

Cost

More info

Dec. 1 Beginning merchandise inventory

Dec. 11 Purchase

Dec. 23 Sale

Dec. 26 Purchase

Dec. 29 Sale

Requirements

1.

2.

3.

4.

22 tires @ $53 each

14 tires @ $71 each

18 tires @ $82 each

10 tires @ $74 each

19 tires @ $82 each

Compute cost of goods sold and gross profit using the FIFO inventory

costing method.

Compute cost of goods sold and gross profit using the LIFO inventory

costing method.

- X

Compute cost of goods sold and gross profit using the weighted-average

inventory costing method. (Round weighted-average cost per unit to the

nearest cent and all other amounts to the nearest dollar.)

Which method results in the largest gross profit, and why?

-

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Describe the calculation of the cost of goods sold when using the periodic inventory system.arrow_forwardMake assumptions about amounts for beginning inventory, net purchases, and ending inventory. Then use the pick lists (accessed by clicking in the boxed areas within the Calculation of Cost of Goods Sold section) to select the correct amounts for goods available for sale and cost of goods sold. Correct selections turn applicable boxes green. Enter an amount for beginning inventory >>>> Enter an amount for net purchases >>>> Enter an amount for ending inventory >>>> Beginning inventory Plus: Net purchases Goods available for sale Less: Ending inventory Cost of goods sold Calculation of Cost of Goods Sold 0 0 0 0 0 0 0 0arrow_forwardIf the balance in the inventory account is greater than the physical count, which of the following journal entries is recorded? a.Debit Merchandise Inventory and credit Inventory Short and Over b.Debit Merchandise Inventory and credit Cost of Goods Sold c.Debit Cost of Goods Sold and credit Merchandise Inventory d.Debit Inventory Short and Over and credit Merchandise Inventoryarrow_forward

- Please help me make a perpetual FIFO, perpetual LIFO, Weighted Average, and Specific ID chart. Thank youarrow_forwardIdentify which of the following statement is correct for perpetual inventory system? Under the perpetual Inventory system, on the purchase of Inventory purchase account is debited. When valuing ending Inventory under a perpetual Inventory system, oldest units purchased during the period using FIFO are allocated to the cost of goods sold when units are sold. When valuing ending Inventory under a perpetual Inventory system, weighted average cost method requires that a new weighted average unit cost be calculated after every sale. 09/03/2024 15:01 When valuing ending Inventory under a perpetual inventory system, valuation using weighted average is the same as the valuation using weighted average under the periodic Inventory system.arrow_forwardIdentify each item as describing the FIFO method, LIFO method, or average cost method of inventory valuation. A. Involves calculating the total number of units in the warehouse FIFO LIFO Average cost B. To determine cost of goods sold, begin with the earliest goods acquired FIFO LIFO Average cost C. To determine merchandise inventory balance, begin with the earliest goods acquired FIFO LIFO Average costarrow_forward

- The cost of merchandise sold and merchandise inventory is determined from the inventory cost flow assumption. To illustrate, beginning inventory, purchases and sales of shoes are shown below for Grant Co., using a perpetual inventory system. 1. In the table below, fill in the March 24 quantity, unit cost, and total cost in the spaces provided for determining Cost of Merchandise Sold (COMS) and Merchandise Inventory under the FIFO cost flow assumption, assuming 32 shoes are sold on March 24. Determine the COMS and Merchandise inventory final balances. If units are in inventory or are listed under cost of merchandise sold at two different costs, enter the units that were purchased earliest first. 2. In the table below, fill in the March 24 quantity, unit cost, and total cost in the spaces provided for determining Cost of Merchandise Sold (COMS) and Merchandise Inventory under the LIFO cost flow assumption, assuming 32 shoes are sold on March 24. Determine the COMS and Merchandise…arrow_forwardUnder a perpetual inventory system, acquisition of merchandise for resale is debited to O the Supplies account. O the Cost of Goods Sold account. O the Inventory account. O the Purchases account.arrow_forwardThe cost of goods sold is based on the oldest purchases under which method of calculating inventory cost? O A. weighted average method O B. first in, first out (FIFO) O C. gross profit method O D. last in, first out (LIFO)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education